Analyst Insight: Pulse market brief

Thursday, 22 October 2020

Market commentary

- May-21 feed wheat futures eased marginally yesterday, having hit £191.00/t on Tuesday, closing £0.25/t lower at £190.75/t. Domestic markets are continuing to ride the wave of global uncertainty, caused by dryness in South America, the Black Sea and the US.

- Rainfall is expected in parts of Russia in the next week, which may alleviate some dryness concerns. That said, rainfall continues to be well below normal levels for the time of year. Rainfall in Southern Russia is notably still lacking.

- Paris milling wheat futures (May-21) gained €0.50/t yesterday, to close at a new contract high of €208.00/t. Despite increasing yesterday, since the beginning of October the premium of Paris milling wheat over May-21 UK feed wheat futures had narrowed considerably in sterling terms.

Pulse market brief

Understanding your rotation as a whole is increasingly important. With that in mind my attention today turns to a part of the rotation that we wouldn’t typically cover, the market for pulses. Information for pulses is limited but recent data from Defra and information from PGRO and Pulses UK allows us to build a picture for harvest 2020.

Area, yield and estimated production

Field beans

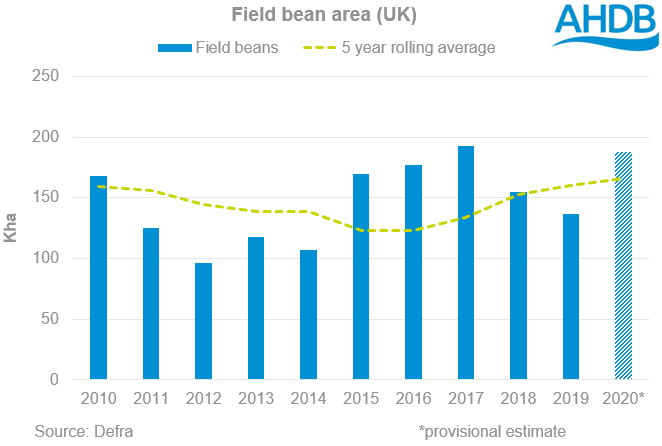

Owing to the challenges seen in the winter planting window, the area planted to pulses, in particular field beans, was up considerably year-on-year in 2020. Field bean acreage in the UK was reportedly the second highest in the past 20 years at 188Kha (up 38% y-o-y), second only to 193Kha in 2017.

Despite this, the likely increased proportion of spring beans versus winter, and the challenging growing season has led to the suggestion that yields will be significantly lower year-on-year. Applying a five-year average yield of 3.7t/ha to the provisional area would suggest a production level of around 700Kt. Given current market prices and anecdotal information from PGRO, this level of output is highly unlikely. Using a five-year low yield would give production levels of around 490Kt, which is in line with the PGRO estimate from October’s market update of between 450Kt and 550Kt.

Combinable peas

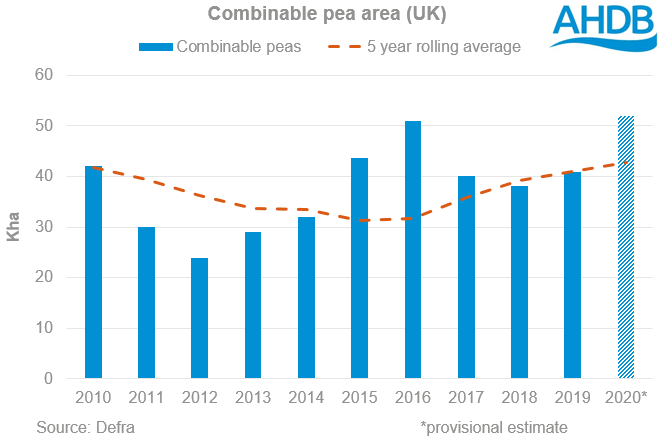

The area planted to combinable peas for harvest 2020 is provisionally given by Defra as 52Kha, a 27% rise year on year. If confirmed, this would represent the highest area planted to the crop since 2005.

From a yield perspective, a five-year average yield (3.67t/ha) would suggest production of around 190Kt. Again taking a steer from PGRO publications, an average yield for 2020 of 3.0t/ha is suggested which would lead to an output of nearer 155Kt, compared with 160Kt in 2019.

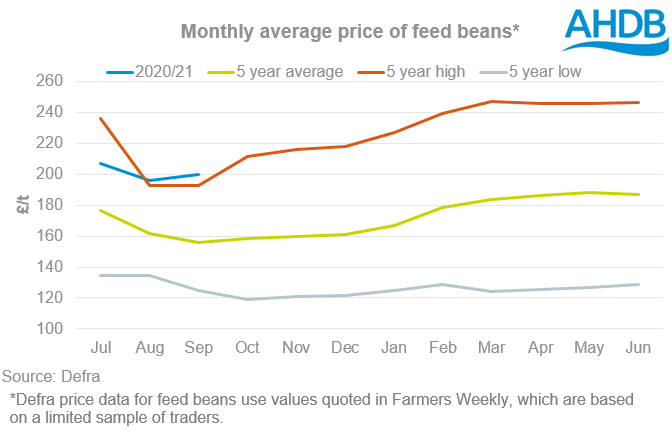

Animal feed Demand

Domestic demand for feed beans was limited in production of compound feed last season, with other proteins remaining more attractive on both price and nutritional benefit (typically higher crude protein). Data for the first two months of the new marketing season shows demand for feed beans and peas is once more limited. This is likely a reflection of the timing of harvest, but also a reflection of the relative prices and lower desirability in animal feed.

In July and August, the price of imported soyameal was significantly lower than it is at present. In July, Hi Pro soyameal (spot, Ex-store East Coast) was quoted at £295.00/t, the most recent data shows spot prices at £375.00/t.

Price data published by Defra, although based on very limited data, shows that monthly average feed bean and pea values increased just 2% from August to September. With soyameal values rampantly higher we could see increased incentive to include beans and peas in compound feed in the coming months, this may offer more support for prices although demand will also be heavily dependent on nutritional benefit.

Export demand

A key part of UK trade in feed beans is exports. Over the last five seasons UK exports of beans have averaged 156Kt, with 84% of this non-EU trade. With production of beans this season still likely to be large, even in spite of lower yields, exports will likely be important again.

The volume the UK exports will largely depend on quality. Egypt is the primary consumer of UK beans, with human consumption demand high.

With a lot of agriculture markets at present we have been highlighting the risk of tariffs. The situation is less significant for beans. The tariffs imposed by Egypt, Sudan and Norway, the three biggest non-EU importers of UK beans, are the same for both the EU and under MFN status. The UK would face a tariff to export to the EU, but this is just 3.2% of value, at £200/t this would equate to £6.40/t.

Pea exports have been more limited in recent years, averaging 21.7Kt between 2015/16 and 2019/20. Outside of the EU the primary market for pea exports is Asia, with imports from China, Japan and Malaysia. The UK would appear to be at no disadvantage trading with China and Malaysia after 31 December, compared to the current situation. The EU does pay a lower tariff on exports to Japan than the MFN rate but with the UK and Japan agreeing a trade deal in principal, this may change.

Where next for production?

In September we published our latest set of Gross Margin data, which showed pulses performing favourably from a return on capital invested perspective. Pulses represent a comparatively low input cropping option. With challenges present for the growing of rapeseed and limited alternative break crops, a return to increased bean acreage seems a possibility.

One potential cap on area is the anticipated rebound in winter wheat planting for harvest 2021. With the total UK wheat area down 22% in 2020, a rebound is very likely, which will undoubtedly restrict acreage planted to spring crops this season.

Following the challenging year for wheat in 2013/14, the area recovered by 20% in the following season. Subsequently the area planted to other crops declined, with barley falling 11%, oats 22% and peas for harvesting dry and field beans falling 6%.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.