Oilseeds Sector Outlook: Grain Market Daily

Friday, 16 October 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £182.70/t, gaining £1.20/t on Wednesday’s close.

- Global wheat markets rallied yesterday when Argentina’s Rosario Grains Exchange lowered its estimate of its wheat crop from 18Mt to 17Mt, which brought around questions of global supplies. Chicago wheat (Dec-20) closed up (+$7.90/t) at $227.17/t, while Paris milling wheat (Dec-20) closed up (+€3.25/t) at €206.75/t.

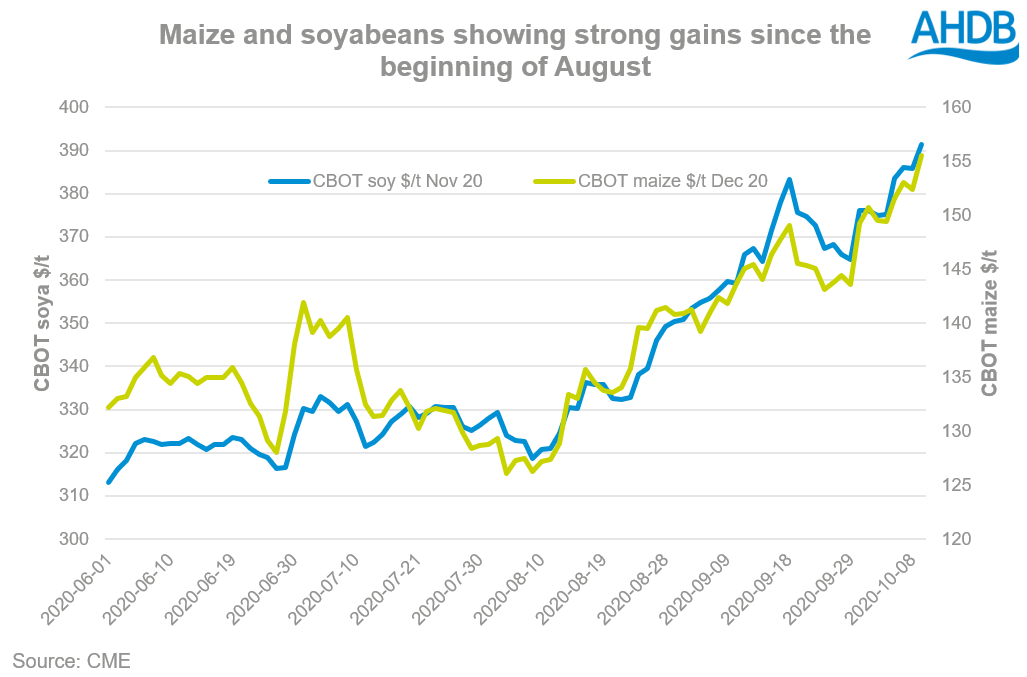

- Despite rains in South America improving conditions for newly planted crops Chicago soyabeans (Nov-20) closed up (+$2.21/t) at $390.31/t. Continued export demand from China is still providing support. Despite this, Paris rapeseed (Nov-20) closed down (-€1.25/t) at €389.00/t.

- Our latest podcast is out now! David Eudall, Head of AHDB’s Arable Market Specialists, talks to grain experts from around the globe. Tune in to hear about markets in the USA, South America, Australia and Russia.

Oilseeds Sector Outlook

Following the wheat and barley round ups yesterday and Wednesday, today we turn our attention to oilseeds. Below, the fundamentals explained in Tuesday’s Grain Market Outlook conference are focussed on. What could affect the oilseed complex and price direction over the coming weeks and months?

Chinese purchasing has been supporting the price of global soyabeans and maize over recent weeks, but the question on many lips is; how long can this support be felt?

China has been rebuilding its pig herd following the African Swine Fever outbreak, which reportedly reduced the pig herd from 430 million to under 200 million by the end of 2019 (Rabobank).

In its recent three-year plan, China committed to returning pork production to 95% self-sufficiency. To put this into some context, prior to the ASF outbreak, China was operating at c.98% self-sufficiency.

While Chinese officials point to a growing pig herd, there are concerns over the efficiency and productivity of this, with many producers choosing to rebuild their breeding herd rather than finishing herd. With this, comes the inference that the herd growth looks set to continue.

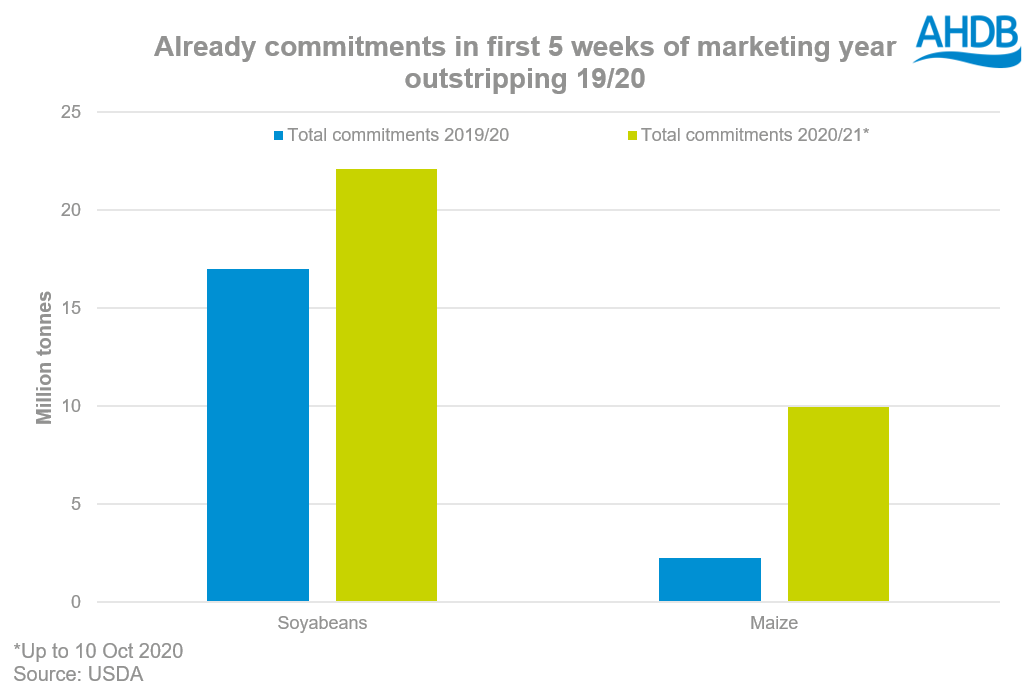

What we do know is that while pork productivity has fallen, imports of soyabeans are on the rise to support the growing breeding herd. Brazil has been exporting a record amount of soyabeans to China over the past 12 months, to both supply extra demand and plug the gap created earlier in the season from the US/China dispute. In addition, the implementation of the Phase 1 trade deal between the US and China has seen record exports leave US shores. China has committed to purchase $12.5bn above the 2017 baseline in 2020, and $19.5bn above the 2017 baseline in 2021. Total commitments for this season have already outstripped last seasons’.

In addition to this, Brazilian growers have reportedly also forward sold c.70% of this year’s crop.

Given the Chinese pledge of self-sufficiency, and pork production still to return to pre-ASF levels, this Chinese buying could be on the table for a while to come. This will provide continued support for soyabean prices.

Potential supply concerns

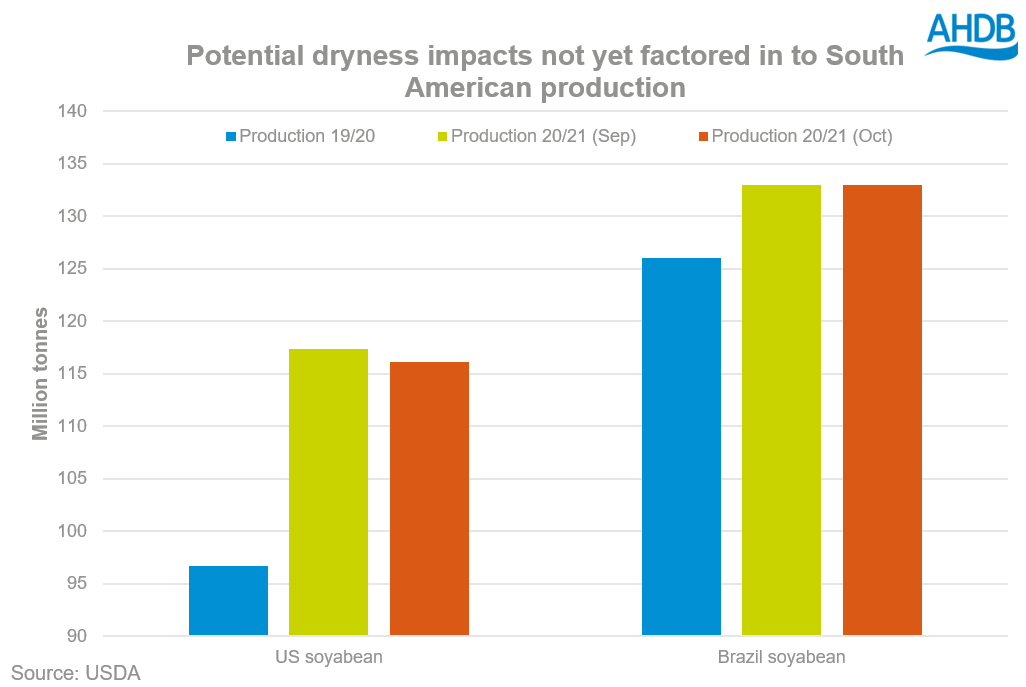

The latest USDA WASDE report downgraded US soyabean production for 2020/21 by 1.2Mt, factoring in a reduction in the harvested area this season from the August storms. It also pegged the US opening stocks back by 1.4Mt, reflecting the increase in Chinese exports last season. However, production figures for Brazil remained static from the September report, at 133Mt.

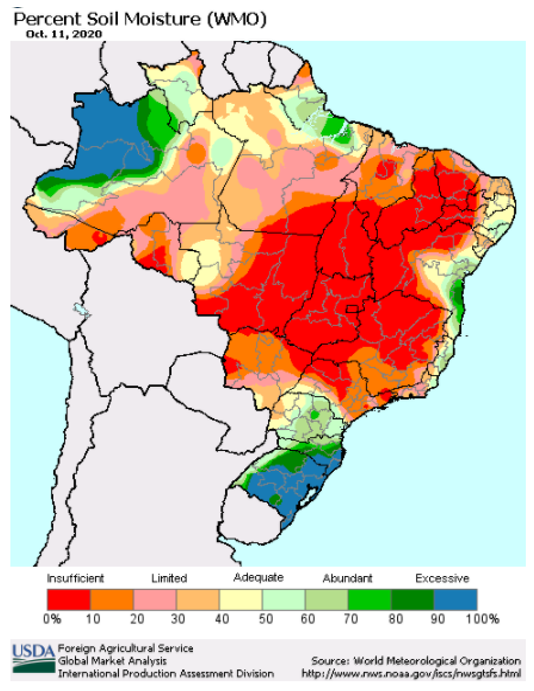

This represents an area of uncertainty. Brazilian producers are looking to plant a record area, CONAB citing 37.8Mha, 2.5% more than last year, buoyed by strong export demand and the weak Brazilian real. However, dryness across the key growing regions has the potential to significantly hamper progress.

The La Nina phenomenon is currently the cause of this dryness across Brazil. This dryness has slowed planting progress of the early sown crop in Mato Grosso and is continuing to pressure advancement. According to AgRural, Brazilian planting progress is at its slowest pace in 10 years.

Forecast rains over the previous weekend were light and patchy at best, doing little to improve the soil moisture level recorded across the main growing regions.

While there is still time yet to catch up and planting rates can increase significantly if conditions are right, this time window is getting narrower. This brings increasing nervousness to markets, especially with the belief by many in the industry that China will shortly look to turn to Brazil once more as a chief soyabean origin. The longer the dryness continues, the longer we can expect to see prices supported.

Ukraine is also experiencing prolonged periods of dryness. Soils are still extremely dry, particularly in Southern and Eastern regions, delaying rapeseed planting. UkrAgroConsult report that, as at 5 October, 721Kha had been planted versus 1,025Kha last season. With the EU rapeseed supply already tight, and questions over the area for 2021 harvest both in the UK and mainland EU, any concerns about future EU supply could well support the market further.

The initial lockdown, imposed largely globally, had a seismic effect on energy demand. This affected both the bio-ethanol and the bio-diesel markets. However, the reduction in demand for biodiesel has not been as significant as for bio-ethanol, with 2020 EU production only forecast slightly back from 2019 levels.

While consumption is forecast back 6% from 2019, due to coronavirus and the economic challenge, this decline is expected to be less than the entire diesel and renewable pool as some increases in overall blending are expected.

Any increase in blending mandates while not fully offsetting the reduction in diesel consumption could help soften the overall demand reduction and limit any pressuring effect this may have imposed. However, given that we are seeing further lockdown restrictions in the west, subsequent demand loss could exceed any upwards revisions to blending mandates.

Conclusion

In conclusion, there is a bullish outlook ahead for oilseeds. Increased Chinese buying, La Nina concerns potentially impacting supply and limited loss of demand from the biodiesel industry would infer that prices could stay supported for the short term.

Given the driving force soyabean prices command for the entire oilseeds complex, plus potential nervousness over EU rapeseed supply, UK producers could well feel this support in their domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.