Analyst Insight: How could the coronavirus impact oilseed markets?

Friday, 3 April 2020

As crop calendars reach crucial stages for many countries, it is important to examine the potential effect coronavirus related lockdowns could have.

For many countries, manual labour forms a large part of the agricultural workforce, and so country lockdowns could have potentially long delays on farm operations and logistical outputs. Despite coronavirus affecting the global supply chain, there remains opportunities for oilseed markets to see support.

India's upcoming harvest

One developing area of support for oilseed markets is the unfolding situation in India. India is forecast to produce 7.8Mt of rapeseed this season with the bulk of the harvest being completed in April. With the country currently on lockdown, many seasonal workers have returned to home regions, away from key producing areas.

As over 60% of India’s farm activities are completed by manual labour, there is a very real risk that harvests will see long delays with yields affected. April is also a key period for vegetable oil demand with the religious festival of Ramadan taking place.

India is currently the largest importer of vegetable oils, importing over 12.93Mt of palm and soyabean oil (crude and refined) in 2019. Over 11.29Mt of those imports originated from Indonesia, Malaysia and Argentina. Recently, coronavirus linked delays to Argentine agricultural exports have been reported with around 50% less trucks arriving at ports in the last week of March compared to the first.

Malaysia, palm oil and the coronavirus

Earlier this week, Malaysia closed palm oil plantations amidst outbreaks of coronavirus.

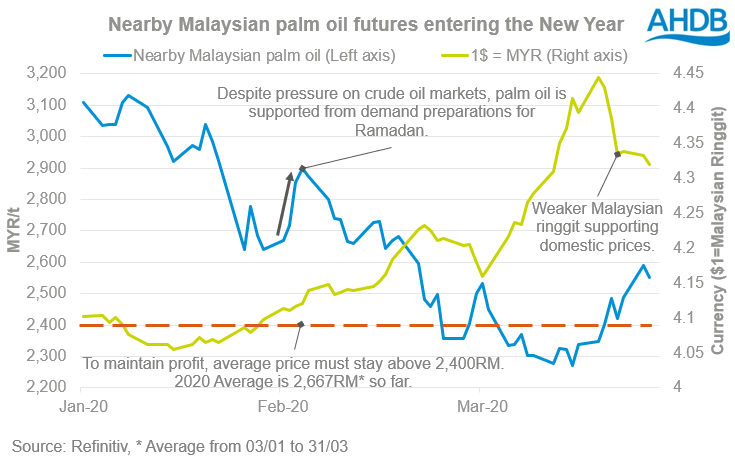

There has been recent support for palm oil as there has been concerns over the distribution and supply as the Malaysian government imposed a national lockdown, shutting their borders to travellers, restrict internal movement, closing school, and order most businesses to shut.

This has caused some palm oil plantations and processing factories to close as workers tested positive for the coronavirus, initially plantation closure was to last until 31st March, however this week that was extended until 14th April.

Initially the edible oil complex was severally pressured in line with crude oil. However, over successive weeks we have seen fundamentals such as demand limit the falls in the edible oil market, for more information be sure to read How does crude oil affect your rapeseed price?

One of the worse affected areas in Malaysia from the lockdowns is the Sabah region, where output has been reduced by 75%, and they account for 25% of the countries palm oil output.

A decrease in production of Malaysian palm oil?

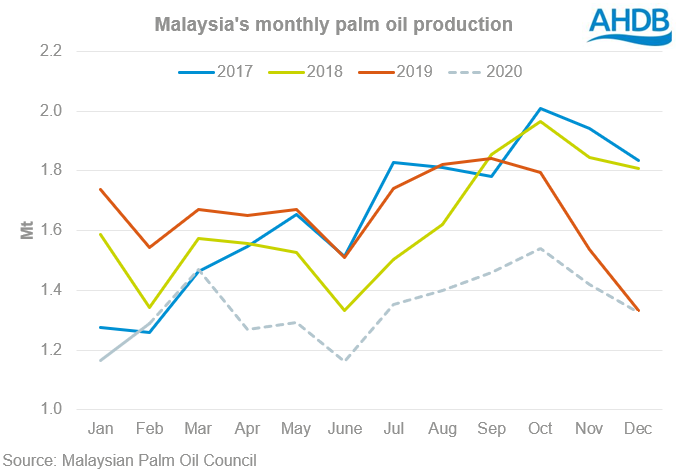

With the Sabah region drastically slowing production it’s advocated that the crude palm oil output is to reduce by up to 20% per month and a loss of 2% for total crude oil production for 2020.

With February palm oil inventories at their lowest since June 2017, there is overwhelming anxieties of a lack of production as we enter Ramadan.

Further to that, although palm oil production has been suspended until mid-April, that date could be extended further again. Internationally, we are all to a degree in the unknown of the impacts of the coronavirus as we look into the medium to long term.

In the graph above, a 3-year-average has been used to calculate the average monthly palm-oil production with a 20% reduction throughout the rest of 2020.

This reduction is applied from April as there is speculation that March has increased on February’s output and that is why the market is currently trading in a bearish manner. Therefore, the March 2020 figure is based on the 3-year-average without the 20% reduction applied.

Analysing the long-term for palm oil

At this current time if exemptions are granted for the Sabah region to continue business as usual with palm oil production, we could see ever increasing pressure on palm oil prices.

However, there are concerns that if the industry completely slows, many workers within the region will be made redundant and when coronavirus lockdowns are relaxed the demand for palm-oil will not be able to be fulfilled.

Global soymeal trade

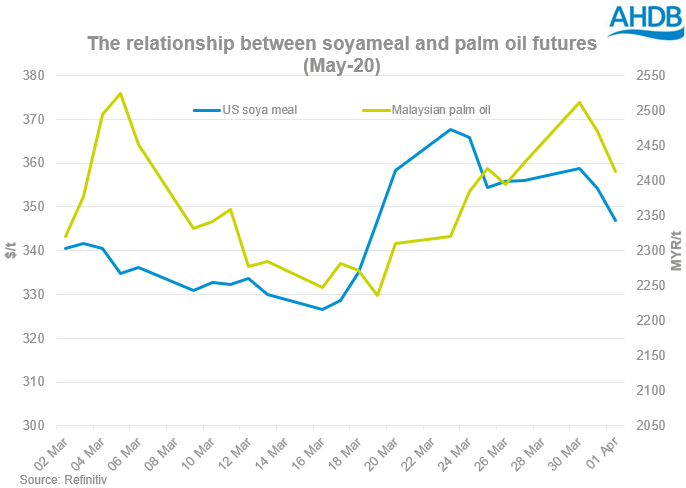

In Argentina, logistical delays owing to coronavirus have also affected crushing’s of soyabeans. Argentina is the world’s top supplier of soyameal and with the country in the middle of an anticipated 51.5Mt soyabean harvest, the reported delays at crushers and ports could have a knock-on effect on global soyabean meal supply. US soyabean meal futures increased $13.88/t over the course of March to close at $354.29/t on Tuesday.

As we begin to see China ‘open up’ again to world markets, news of the country’s decision to partially revert a year-long ban on imports of Canadian rapeseed will look to support markets. Previously it was anticipated that Canadian rapeseed stocks would build up and begin to overhang markets in a similar way to US soyabean supplies. However, with China experiencing its lowest soyabean stocks since 2010, it seems the country is desperate to replenish oilseed stocks for its processors.

It is clear that coronavirus will have a deep impact on the global supply chain with long-term ramifications likely. Food prices have already seen effects, with the March FAO food price index falling 4.3% from February. For oilseed markets, the FAO Vegetable oil prices index fell 12% in March, owing to pressures following stark declines in crude oil prices. Amidst the ongoing uncertainty, domestic rapeseed prices will likely see a continuing degree of volatility in the shorter term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.