Analyst Insight: How does crude oil affect your rapeseed price?

Thursday, 19 March 2020

Market Commentary

- Yesterday the value of sterling continued to fall amid COVID-19 uncertainty, closing yesterday at £1=$1.161 and £=1.064. Sterling has recovered marginally from yesterday’s close, to reach £1=$1.162 and £1=€1.077 at midday today.

- May-20 UK feed wheat futures closed yesterday at £157.90/t, up £4.90 on the previous close. May futures have continued to be supported so far today, reaching £161.00/t at midday.

- The Nov-20 contract also surged in value as the pound fell. Closing at £168.40/t yesterday, up £4.40/t. This contract at midday was trading at £171.25/t.

- Paris milling wheat futures (May-20) closed yesterday at €184.00/t, up €4.75/t on the day before. The May-20 contract had gained a further €4.00/t to €188.00/t at midday, on euro weakness.

How does crude oil affect your rapeseed price?

As vegetable oils compete for their market share, they have been pressured in line with crude oil going into the New Year. This has had a knock-on effect on domestic rapeseed prices, as last weeks delivered rapeseed price (Erith, May-20) reduced by £17.00, to be quoted at £318.50/t. The weakening of sterling has helped shelter the UK’s domestic price momentarily.

Going forward the direction of crude oil, vegetable oils and currency will be pivotal to movements in rapeseed prices. Whilst we have seen pressure for rapeseed prices of late, weakness in both the euro and sterling relative to the dollar has offered some price support.

What is happening with crude oil prices?

Since the World Health Organisation has labelled COVID-19 as a pandemic there has been mounting pressure on global commodities, with global anxieties exacerbating day on day.

As aviation grinds to a halt, and shipping is drastically declined the demand for crude oil is reducing. COVID-19 is expected to end the decade-long run of successive increased oil demand. Heading into the second quarter demand for oil could see the biggest reduction on record.

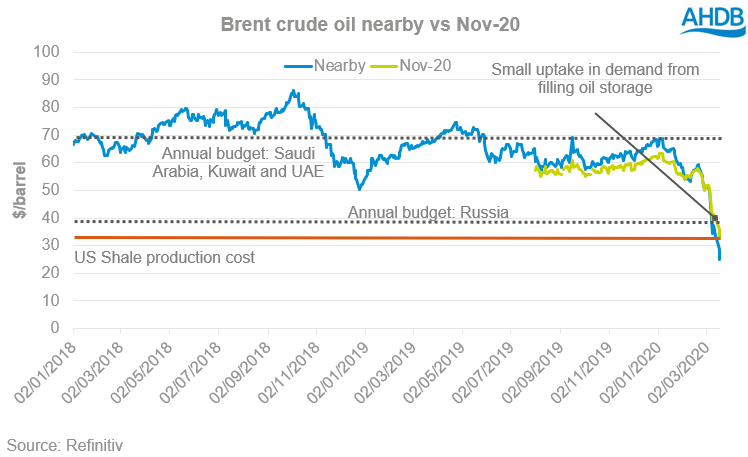

This pandemic has posed threats of a global recession and pushed money managers to intensify the selling-off of crude oil futures contracts. Currently demand will not increase in the futures market as global economic activity decreases drastically, although there has been a small uptick in demand from bargain buying.

The selling off has only intensified as Brent crude oil closed yesterday (18 March) trading at $24.88/barrel, this is down 45% since Russia refused to adjust oil outputs on the 6 March to support oil prices. This subsequently led to a price war with Saudi Arabia as they have intensified production.

Russia’s refusal was to not allow US oil exports to increase their market share, a lot of US shale production costs exceed $35/barrel, meaning production is currently being reduced.

What have the movements in crude oil done to veg oil prices?

Since the New Year the pressure on Brent crude was driven the national outbreak of the COVID-19 in China. This exposed OPEC’s reliance on China, as crude oil was pressured from a lack of consumption from China.

We have now seen this pressure on crude oil filter into agricultural commodities, notably oilseeds such as rapeseed. Although agricultural commodities have categorical links with crude oil, how long will this last until their relationship diverges apart, with technical purchasing and currency supporting markets?

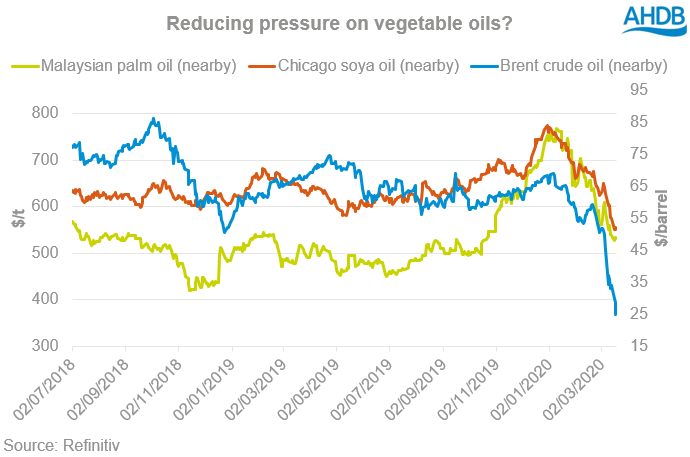

Pressure in vegetable oil markets at the start of the year was from external macro factors such as global equities and crude oil. However, in the last couple of weeks fundamentals around the notion of demand have limited the falls in the edible oil market.

For example, since the start of January Brent crude oil (nearby) has reduced by 63%, throughout this month it has reduced by 50%. In turn, Chicago soy oil (nearby) has reduced by 28% since the start of January, throughout this month it has only reduced by 12%.

This reduction is similar with palm oil, as there is a disparity in the pressure that the commodity has taken on the futures market relative to that seen in crude oil. Therefore, advocating that crude oil isn’t the only parameter that can control these commodities and outside the bearish notion of crude oil, these vegetable oils react autonomously to demand.

A recovery in demand

Before the coronavirus outbreak vegetable oils were in high demand.

Furthermore, there was a huge demand for vegetable oils for blending in fuel as a biodiesel feedstock, as the global economy attempts to reduce reliance on fossil fuels. Malaysia and Indonesia pledged to increase their biodiesel mandates with palm oil and Brazil will increase theirs with soya oil.

At the moment with current pressures on crude oil there are questions around the feasibility and cost benefit of blending fuels.

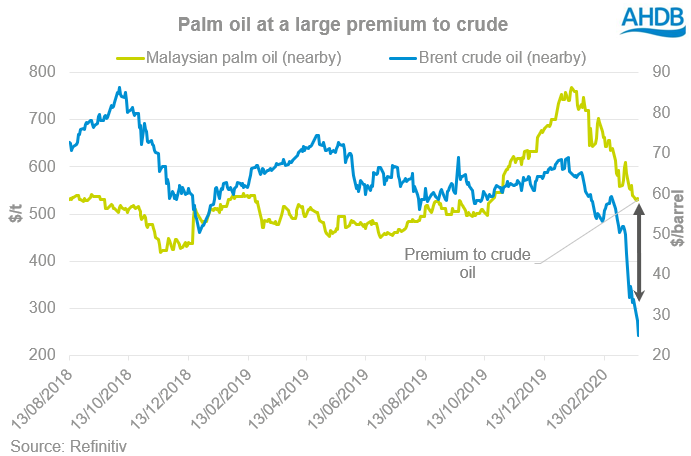

As of yesterday’s close, nearby Malaysian palm oil futures were are at a $346.76/t premium to Brent crude. However, last July palm oil was at a $40.90/t discount to Brent crude.

Current pressure on vegetable oils is linked with COVID-19, it’s speculated that once issues around health and well-being going forward are clarified, there will be renewed support for vegetable oil prices.

The current demand for vegetable oils will be met with a plentiful supply in the medium term with increased outputs of oilseeds from the Black Sea Region, the Americas and Australia.

Global demand going forward

Global oil demand is expected to decline in 2020, as COVID-19 affects the whole world. However, currently the impacts of this virus are unknown in the medium to longer term.

The International Energy Agency predicts crude oil demand will be at 99.9 million barrels a day for 2020, down from around 90,000 barrels a day on the year. Before the coronavirus outbreak this prediction was forecast to increase by 825,000 barrels a day in 2020.

However, despite current lacklustre demand for crude oil, demand into the decade is still forecast to increase. In the short-term crude oil markets will react to how global government intervention curbs economic implications of the COVID-19 outbreak.

There is still little known around the notion of longer-term health impacts of this pandemic outbreak. Once clarity is given, we could see markets supported again.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.