Sterling slides further driving UK grain higher: Market Commentary

Thursday, 19 March 2020

Market Commentary

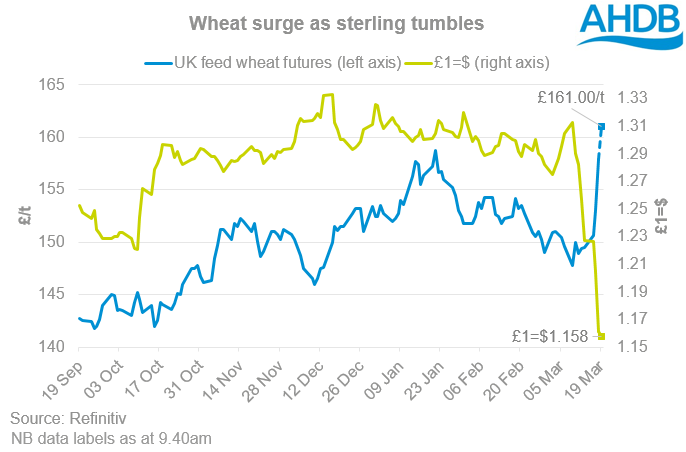

- The pound continued to fall yesterday against the dollar, reaching lows not recorded since 1985, finishing the day at £1=$1.1613. At 9:30 this morning, the pound had fallen to £1=$1.1563.

- Relative to the Euro the pound fell to £1=€1.0641 at yesterday’s close, lower than at any time post the EU referendum to lows recorded during 2009.

- As the pound has fallen, domestic prices have moved dramatically upward. May-20 UK feed wheat futures closed at £157.90/t, up £4.90 yesterday and moved up a further £2.10/t by 10:00 this morning, reaching £160.00/t. The highest point for the contract so far this season.

- The Nov-20 contract also surged in value as the pound fell. Closing at £168.40/t, up £4.40/t yesterday and extending these gains to £171.00/t by 10:00, up a further £2.60/t.

The fast devaluation of the pound yesterday comes as demand for the dollar surges, as value is removed from equities and commodities and holding cash is the safe haven during financial market downturns. The continued direction of the pound will now be very much dependent upon the short and medium term impact of the Covid-19 pandemic and ensuing global financial market repercussions, not just in the UK, but on a global scale. Should further measures need to be taken in order to protect people at the expense of global economies then there could well be a further weakening of the pound.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.