Analyst insight: UK barley area to fall to 15-year low

Thursday, 18 December 2025

Market commentary

- UK feed wheat futures rose yesterday, partly supported by a weaker sterling. The May-26 contract closed at £169.00/t, up £0.75/t from Tuesday, while the new-crop (Nov-26) contract gained £0.65/t to settle at £171.90/t

- Sterling weakened against both the US dollar and the euro, closing at £1=$1.3375 and £1=€1.1385 respectively (LSEG). The move followed the release of latest data from the Office for National Statistics, showing a sharper-than-expected fall in Consumer Price Inflation (CPI) to 3.2% in November. This comes ahead of the Bank of England’s monetary policy decision today (18 Dec), where markets are pricing in an interest rate cut

- In contrast, Chicago wheat and Paris milling wheat futures (May-26) both fell by 0.4% to new contract lows yesterday, pressured by ample global supply and ongoing Ukraine-Russia peace talks

- Paris rapeseed futures (May-26) closed at €461.25/t yesterday, down €1.25/t (0.3%) on the day, following declines in Chicago soyabean and Winnipeg canola futures (May-26), which fell by 0.3% and 0.4%, respectively

- The USDA reported export sales of 198 Kt of US soyabeans to China, as the market continues to track Chinese purchases ahead of the 12 Mt target for the end of February 2026

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK barley area to fall to 15-year low

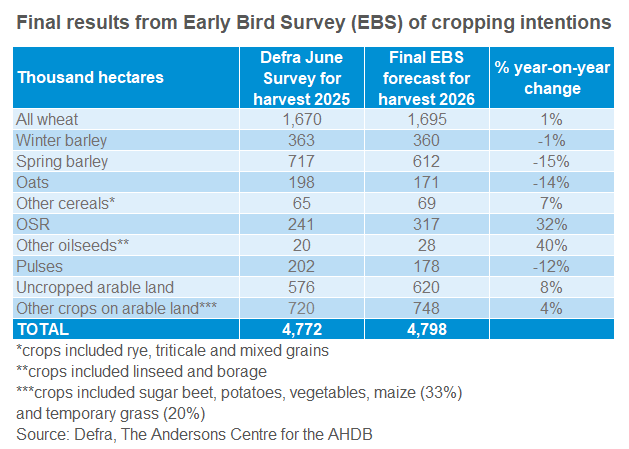

The final UK area forecasts for 2026 from AHDB’s Early Bird Survey (EBS) show only small changes from the provisional figures for wheat, barley, oats and oilseed rape.

The small changes mainly reflect those between provisional and final UK area figures for 2025.

There are also small adjustments to allow for any weighting differences (crop mix or regions) between the survey area and the final official data, reverting back to the methodology used in 2023.

The final forecasts are shown below, with rises for wheat and oilseed rape, but falls for barley, oats and pulses. A large rise in the area of uncropped arable land is also predicted.

Barley area forecast to fall to 15-year low

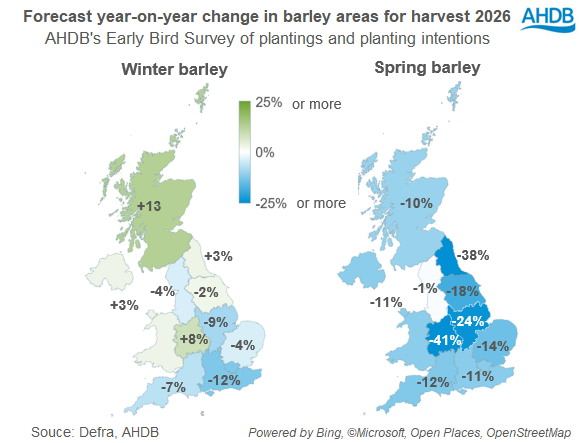

The largest change in terms of the planned hectarage for harvest 2026 is for spring barley, with falls for all countries of the UK and all of the English regions.

This reflects the tough market environment currently for barley, with lower prices, especially for malting barley, and sharp declines in demand from the brewing, malting and distilling sector.

In Scotland, the spring barley area is forecast to decline 10% to 227 Kha, the lowest level since 2007. Within England, the East Midlands expects the largest decline in hectare terms, followed by the East of England.

While there are variations across the UK, the total winter barley area is expected to decline slightly as well.

The forecast changes for winter and spring barley would put the total UK barley area for harvest 2026 at 972 Kha, down 10% year-on-year and the lowest level since 2011.

Even if yields returned to average levels in 2016, a fall in area of this size would limit UK barley production in 2026.

EU-27 prospects may also add to a reduced global barley output picture in 2026/27. Coceral forecasts a broadly stable barley area for harvest 2026, though production could shrink if yields return to more typical levels after the good results in 2025.

However, any potential for price impacts would also depend on domestic and global demand levels, plus the quality of the 2026 crops and price changes for other crops.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.