Analyst insight: Final 2025 UK harvest estimates are out

Thursday, 11 December 2025

Market commentary

- UK feed wheat futures (May-26) closed at £170.10/t yesterday, down £0.25/t (0.2%) on the previous day and hitting a new contract low

- Global wheat markets were pressured yesterday, following the release of the latest USDA World Agricultural Supply and Demand Estimates (WASDE) on Tuesday. The USDA have pegged 2025/26 global wheat production at a record high of 837.8 Mt. Consumption is also expected to increase this season, although that rise does not outweigh the increase in supply, leading to a rise in global ending stocks of wheat. This has put pressure on global grain markets. Chicago wheat futures (May-26) lost 0.8% on the day yesterday

- Currency movements also added pressure to domestic grain markets. In line with expectations, the US Federal Reserve cut interest rates by 0.25 percentage points to a range of 3.5% to 3.75%. This caused sterling to rise against the dollar to the highest level since October, £1 = $1.3382 (LSEG)

- Paris rapeseed futures (May-26) gained €3.50/t (0.8%) on the day to close at €469.75/t, yesterday

- The European market found support as the German government approved the transposition of the third European directive on renewable energies, known as RED III. RED III is the EU’s 2023 directive requiring at least 42.5% energy use by 2030, boosting prospects for biodiesel

- The wider global oilseed complex also found some momentum form the US market which announced 467Kt of new soyabean sales, with 136Kt of this set for China. US soyabean crushings were also up 9.9% in October compared to October 2024, according to latest data from the USDA

Analyst insight: Final 2025 UK harvest estimates are out

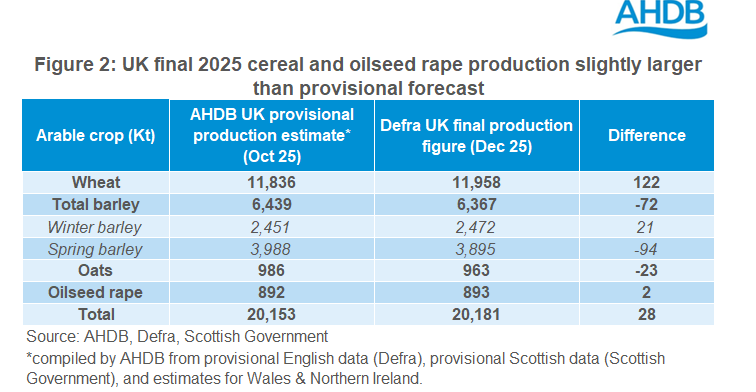

This morning, Defra released its estimates for 2025 UK cereal and oilseed production. These are the first ‘official’ numbers; AHDB published provisional UK cereal and oilseed rape production estimates back in October, using Defra England and Scottish Government provisional data, with estimates for Wales and Northen Ireland.

So how do the final official estimates, compare to our provisional forecasts and what does this mean for UK supply and demand this season?

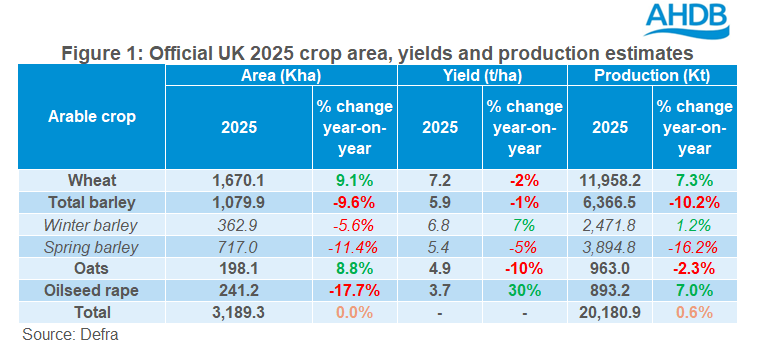

Unsurprisingly, and as has been well reported since the summer, the adverse conditions in the spring and summer, have led to yields coming in lower on the year for most crops in the UK.

However, winter barley yields are reportedly 7% up from 2024’s four-year low. The shining light from harvest 2025, was oilseed rape (OSR), with OSR yields climbing 30% on the year to 3.7 t/ha.

A rise in area planted outweighed a drop in yields, leading to a 7.3% increase in UK wheat production in 2025. At 11.958 Mt, UK wheat production is 122 Kt (1%) higher than AHDB’s provisional UK estimate, with final estimates for wheat production across all four devolved nations coming in slightly higher than initially estimated. At just short of 12 Mt, UK wheat production is probably closer to what those in the trade were expecting, if not still on the slightly low side.

The final estimate for total UK barley production has come in 72 Kt lower (-1%) than the provisional estimate, driven by further reductions in spring barley production outweighing a slight rise in winter barley output. At 6.366 Mt, 2025 total UK barley production is at the lowest level since 2012.

The final figure for 2025 oat production has come in 23 Kt lower than the provisional figure, with downward revisions to yields leading to the decline.

The final OSR figure comes in at 893 Kt, relatively unchanged from the provisional estimate of 892 Kt. Despite a smaller planted area, the relative triumph for national yields has led to UK OSR production rising 7% on the year.

What does this mean for UK S&D?

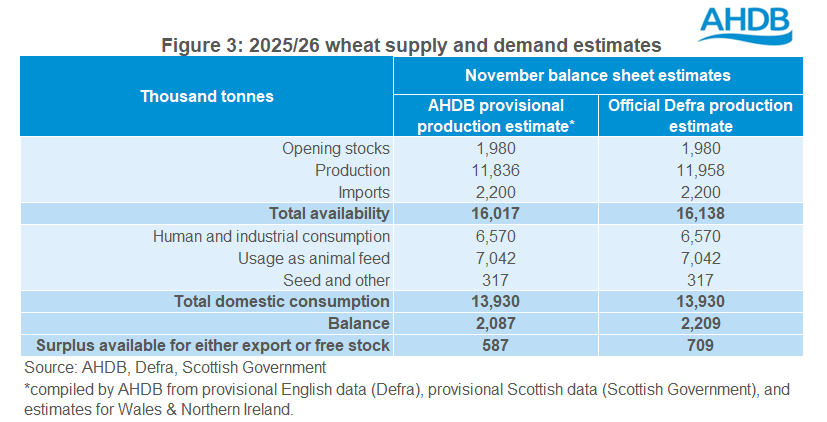

The slight increase in Defra’s final wheat production estimate leads to a slight increase in wheat availability for the season (2025/26). Applying this to the November UK supply and demand estimates, would lead to a slightly larger balance and surplus for export or free stock.

However, even with the rise in production, the wheat balance (when applied to the current estimates), remains the tightest since 2020/21.

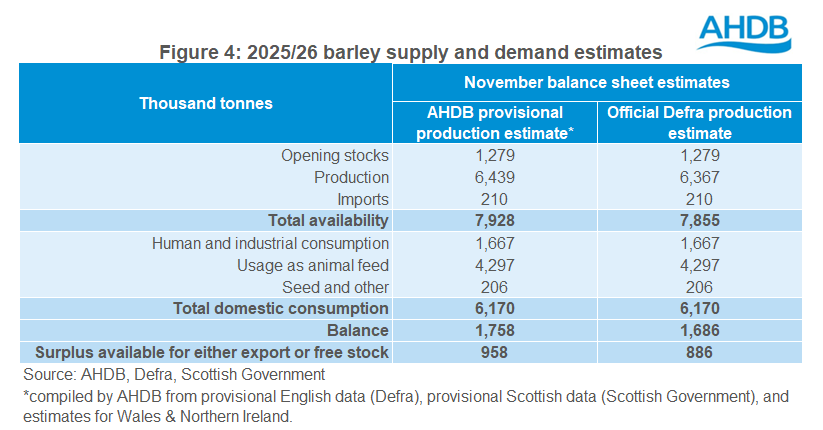

For barley the slight drop from the provisional estimates to the final Defra release, leads to less availability, an even tighter balance and surplus available for either export or free stock.

Applying Defra’s final production estimate to the latest S&D estimates would lead to a balance of 1.686 Mt which would remain the tightest since 2012/13.

The slight decrease in oat production from the provisional estimate could lead to a reduction in closing stocks, back down to more typical levels. Although ending stock levels will very much depend on a number of factors, not discounting the pace of exports.

Conclusion

The official and final Defra production figures released this morning for harvest 2025 were not too dissimilar to the provisional estimates AHDB made in October.

Focus has now shifted to what we can expect for harvest 2026. Released in November, the provisional results of the Early Bird Survey (EBS) of planting intentions, suggested a slight rise in wheat area, further falls for barley, but a somewhat significant rise in OSR (albeit not back to the area we once had five or so years ago).

The final results of the EBS will be released within the next week or so, giving us a clearer picture of what could be in the ground for harvest 2026.

The next UK cereal supply and demand estimated are scheduled for release at the end of January. These will not only include the latest Defra production figures released today but also updated usage and trade information.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.