Analyst Insight: A look towards “new” new crop pricing

Thursday, 21 April 2022

Market commentary

- May-22 UK feed wheat prices softened again yesterday, back £0.25/t to close at £317.25/t. Nov-22 futures fell further, down £3.80/t and closing at £285.10/t. UK prices followed global price movements, which all took a breath after Monday’s increases off the back of latest US crop conditions.

- Paris rapeseed futures continued climbing, with May-22 up €26.25/t, closing at €1044.25/t and Nov-22 closing at €831.00/t, €2.25/t more than the previous day.

- The Ukrainian Agricultural Ministry announced this morning that spring sowing is now 20% complete, with 2.5Mha seeded to date. However, they added that total spring area may reduce by 20% due to the war, and this reduction may be as much as 70% in areas experiencing intense conflict.

A look towards “new” new crop pricing

Much attention has (rightly) been given to the price increases in old crop and new crop wheat values, especially since the outbreak of war in Ukraine. But with record high input costs, how have markets reacted when pricing in for “new” new crop?

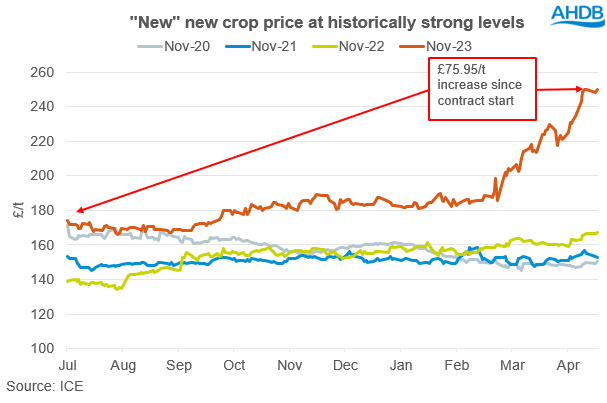

Since the contract started in July 2021, UK feed wheat (Nov-23) prices have risen £75.95/t, closing yesterday (20 April) at £250.00/t. The contract is trading at record highs at this point in its lifecycle, supported by the surging prices in current old and new crop prices.

But, there are increasing concerns surrounding margins and production volumes for the crop that will enter the 2023/24 marketing year. Indeed, we have already seen the US reduce their maize area this season in favour of soyabeans, high input prices cited as one of the reasons.

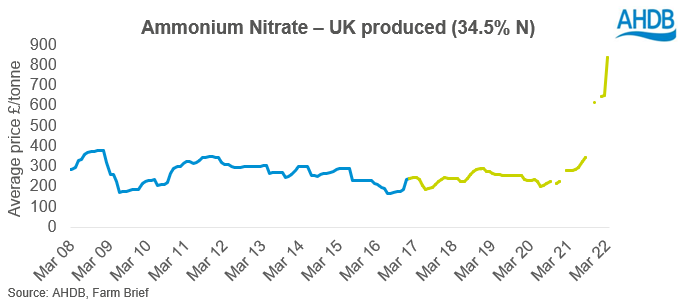

Input price increases, particularly fertiliser costs, have been well documented since they started to move northwards last September. The conflict in Ukraine has surged these movements upwards. This led many to have concerns over yields for harvest 2022.

However, our latest crop condition report suggests that many UK arable growers are largely covered for the current season. Growers who purchased in May/June 2021 last year were largely planning to apply fertilisers according to schedule. Reportedly, some growers were considering keeping some back to use for the following year, but for many, wheat prices are at such a level to incentivise yield.

Given the fundamentals that are supporting both fertiliser price and availability now, and the concern that the war in Ukraine may turn in to a drawn out affair, we may well see fertiliser prices at strong levels for some time to come. With many growers purchasing their requirements for the season ahead in the summer, this will impact margins more for the crop harvested in 2023.

As such, it is essential to watch the “new” new crop price, to ensure the best possible return in an era of rising input costs. Currently, there is market support for new crop (MY 22/23), with weather worries in the US, and the Ukrainian war providing underlying support. This, along with continued concerns for a tight balance sheet into the 23/24 marketing year, are providing support to the Nov-23 contract. However, if the weather becomes more favourable in the US and Russia manages to step up its export activity (having already been successful in the latest Egyptian (GASC) tender), markets could soften as a result.

With supported input costs looking likely for the near future, this movement could bite into margins for the 23/24 marketing year. AHDB provide a range of tools to help monitor and manage some of these prices and inputs, including our GB Fertiliser Price Survey, the nitrogen fertiliser adjustment calculator tool and the latest nutrient management guide (RB209).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.