An uncertain end to 2021: Grain market daily

Thursday, 23 December 2021

Market commentary

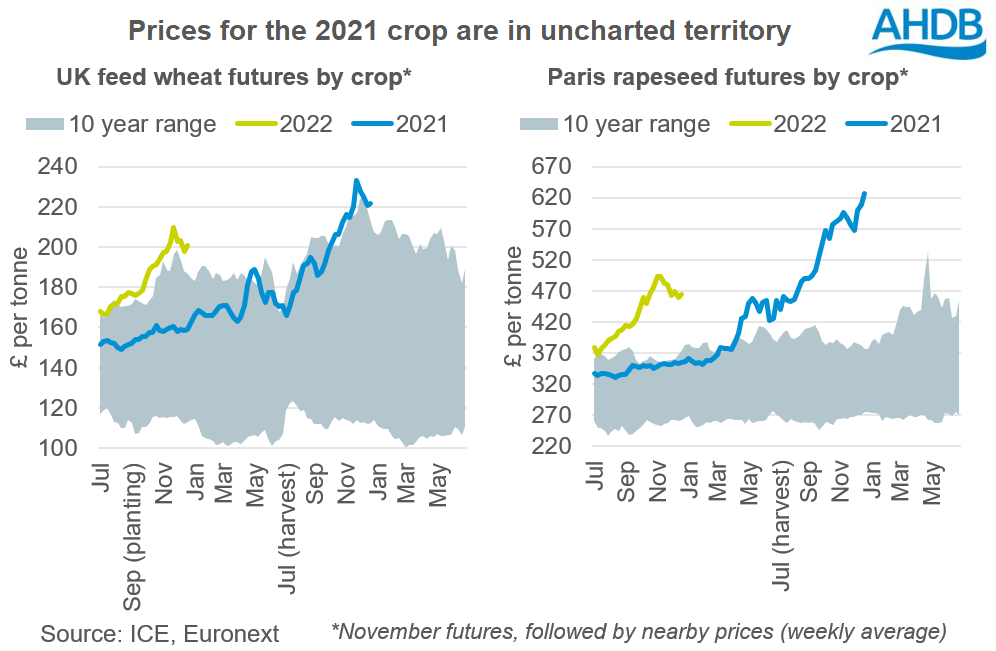

- May-22 UK feed wheat futures gained £4.50/t yesterday to close at £232.00/t. This is the highest price since 2 December. Meanwhile, May-22 Paris rapeseed futures rose €9.75/t to €687.50/t, approximately £583.50/t.

- Weather worries, especially for South American maize and soyabean crops, have pushed global grain and oilseed prices higher in the last couple of days. Heavy rain in Malaysia could also dent palm oil production this month.

- There was also support for wheat prices from reports that Ukraine is considering export restrictions for milling wheat in 2022 (Refintiv). Ukraine has exported rapidly this season, partly due to the export tax imposed by neighbour Russia, and domestic prices are rising.

- This is the last Grain Market Daily of 2021. We wish you a very happy Christmas and a safe and prosperous 2022. Grain Market Daily will resume on Wednesday 5 January.

An uncertain end to 2021

The story of the 2021/22 marketing year so far is one of tightly supplied grain and oilseed markets, both globally and at home. This has pushed both wheat and rapeseed prices to record levels.

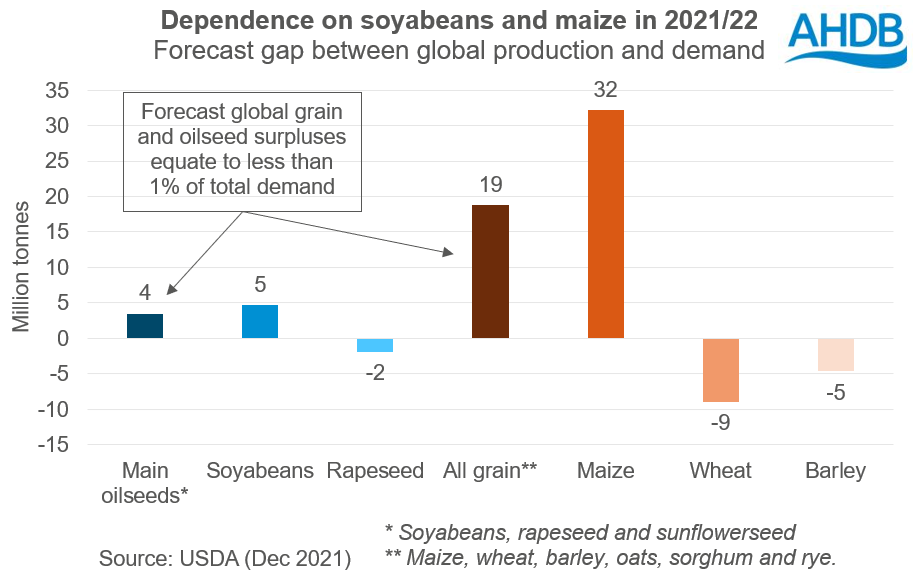

The latest forecasts show very little room for error in terms of supply and demand. Only small surpluses are projected at a total global level, equating to less than 1% of global demand for both grains and oilseeds. These surpluses depend on maize and soyabeans, as wheat, barley and rapeseed are all in deficit.

However, there’s an uncertain outlook as we approach the halfway point of the 2021/22 marketing season. We’ve seen two conflicting drivers for markets over the past week:

- First, there is a threat to demand from rising COVID-19 cases due to the Omicron variant, with increasing social and travel restrictions. As we’ve seen before, the effects of restrictions are felt in our markets through lower fuel demand, plus changes to food and beer consumption.

In mid-December, the USDA held its projections for global demand relatively stable. However, this was before some of the COVID restrictions were introduced. Cuts to demand would reduce the size of the crops needed to secure surpluses.

- Meanwhile, the weather in South America remains a threat to supply. South American crops are forecast to account for 55% of global soyabean supply this season and 15% of global maize supply. So, the world is now banking on record South American maize and soyabean crops to meet demand. Smaller crops in the region could shrink or even wipe out the small global surpluses.

Soyabean crops and early maize crops are at growth stages when dry or hot conditions can significantly reduce yields. Recent weather has not been ideal, especially in Argentina. The largest maize crop, Brazil’s Safrinha crop won’t be planted until after the soyabean harvest. But, the recent weather is still enough to make markets nervous.

The upshot

Smaller than expected South American crops would further tighten supplies and could push prices up again. However, cuts to demand due to COVID could offset a smaller crop and cause prices to weaken. It all boils down to the extent of any changes, leading to an uncertain outlook.

Meanwhile, the influence of new crop information is growing as it always does. With low stocks expected at the end of 2021/22, any threats will also have a bigger impact.

Against this backdrop, prices are likely to be volatile during the next few weeks as new information on both the Omicron situation and global weather emerges. But also, we often see lower traded volumes during the holiday period, and speculative traders often re-position ahead of presenting year-end results to clients.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.