Is the weather dampening wheat prospects? Grain market daily

Wednesday, 22 December 2021

Market commentary

- May-22 UK feed wheat futures gained another £3.50/t yesterday to close at £227.50/t. That brings it back in line with the previous Tuesdays close. The new crop contract (Nov-22) also closed higher yesterday, up £3.40/t to £200.90/t.

- Movements in UK futures follow US and French May-22 contracts, which closed $7.81/t and €4.25/t higher yesterday.

- German rapeseed and wheat areas are estimated up year-on-year, according to Germany’s national statistics agency. The rapeseed area is estimated at 1.08Mha, up 8.7% from last year, on the back of strong prices. Rapeseed is important for edible oil and biodiesel markets in Europe and Germany is one of the biggest rapeseed producers.

Is the weather dampening wheat prospects?

Old crop

Australia

Australian harvest is well underway. Although wet weather decimated some crops in the East, Western Australia’s harvest (the biggest producing state) is progressing well, anticipating record crops. According to the Grain Industry Association of Western Australia, all grain crop yields have exceeded pre-harvest estimates. Negative quality impacts due to weather are isolated, as is low protein from lack of nitrogen. The usual effects of high yields diluting protein is apparent though.

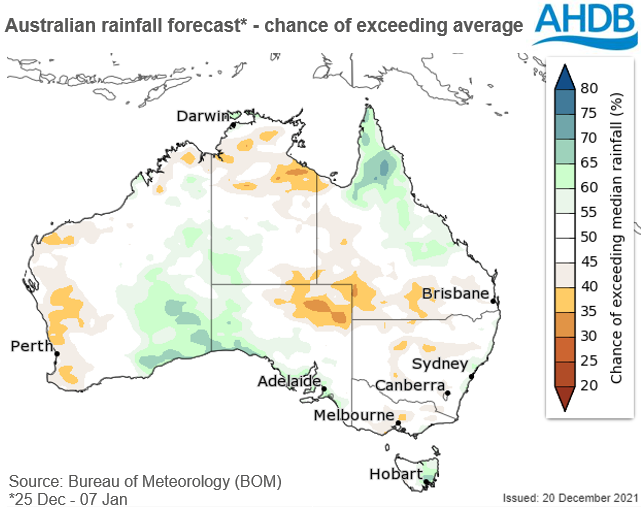

The Bureau of Meteorology (BOM) forecast average rainfall for the period 25 December – 7 January across Australia, which should allow harvest to continue strong.

Argentina

South America dryness has been a watch point for some time, as a second La Niña is present. Dryness now predominantly affects the currently developing maize and soyabean crops. Argentine wheat crops are already 65% harvested (an update is due out tomorrow). The country is forecast to achieve record wheat production, at 20Mt (USDA) and 21Mt (Bolsa de Cereales).

New crop

Black Sea

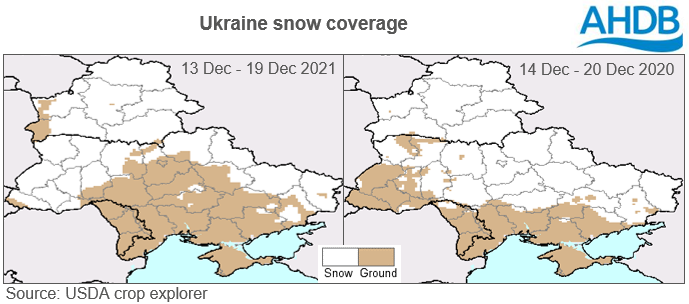

As crop development lags, there is frost tolerance concerns in the Black Sea region. Ukrainian snow coverage is behind last year, although well ahead of December 2019. Snow coverage is important as it provides a blanket to protect crops from hard frosts. According to some weather forecasts, Ukrainian temperatures are anticipated to reach -10°C in the next few days. This could result in winter kill. This will be something to keep an eye on over the next few weeks considering current snow coverage.

US

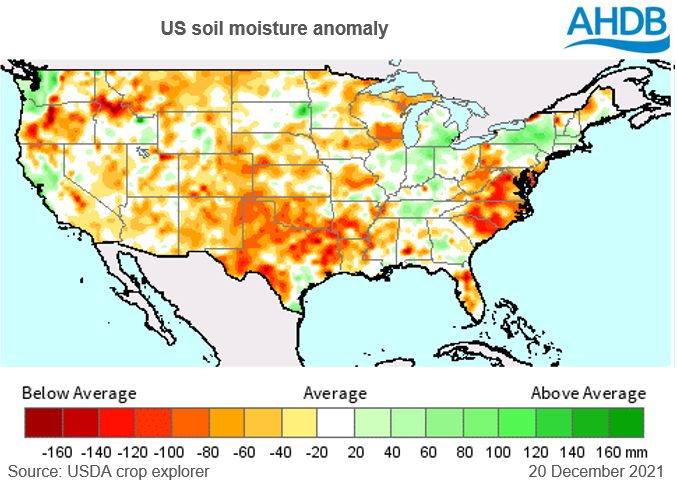

In the US, recent weather events have been compared to those experienced in the drought years of the 1930’s. A freak storm last Wednesday (15 December) brought 100mph winds across the US Plains. Young plants were uprooted, but the effect on more established plants is yet to be quantified. Conditions in the US are drier than usual causing stress to developing plants. Moisture replenishment is required for crop development, but also to reduce the risk of more dust storms. Some rainfall is forecast in the coming fortnight, but anticipated to be lower than “normal”.

Conclusion

As always at this time of year, weather will continue to aid sentiment in markets. Old crop supply is almost confirmed, with decent crops coming from the southern hemisphere. Now, the focus moves to the new crop. We anticipate entering the new marketing year (Jul-22) with tight global opening stocks. If new crop prospects deteriorate, it will likely add a bullish sentiment to markets. Although the northern hemisphere harvest is a long way off, crop development drives production prospects.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.