A mountain side playing field for oilseed rape: Grain Market Daily

Tuesday, 25 February 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £150.90/t, down £1.85/t on Fridays close. The November contract closed at £160.00/t, down £1.25/t on Fridays close.

- US soyabean futures (May-20) closed yesterday at $324.26/t, down $6.06/t on Fridays close.

- A lot of global commodities closed Monday significantly down from Friday. This was from fears that the coronavirus outbreak had spread beyond China, causing a stalled global economic growth, and then technical selling of commodities ensued.

A mountain side playing field for oilseed rape

Recently released Early Bird Survey (EBS) figures do not look promising for oilseed rape in the UK. At the end of last week Alex analysed a scenario outlook from the EBS data.

With the best-case scenario meaning our 2020/21 production figure for OSR will be 1.26Mt. This means we are possibly going to have the worst OSR production since 2001.

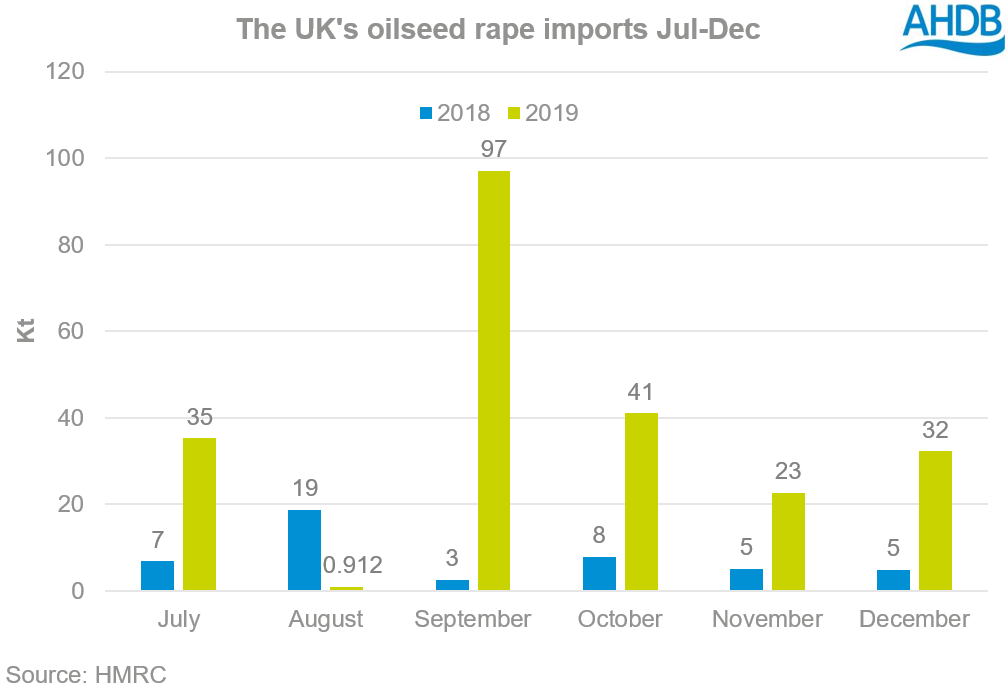

With the EU banning the neonicotinoid dressing on seeds we are seeing OSR production drop off a cliff edge. To compensate for this shortage imports have increased at a staggering rate. We can see that 2019/20 Jul-Dec imports are up nearly 103% year-on-year.

A lot of rapeseed is being imported from Baltic states and the Black sea region, notably the Ukraine, who grow rapeseed mainly as an exportable cash crop. As of Jan 2020, 95% of the Ukraine harvested rapeseed had been exported to the EU, up from 88.5% on last year’s figure.

With a reduction in planted acreage in the UK, Romania and France. Coupled with an unoptimistic 2020 production estimate at 17.1Mt from Coceral. It’s inevitable that the EU will be importing a significant amount of OSR for the MY2020/21.

Conveniently, oilseed planting in the Ukraine has increased for the MY2020/21, with OSR up 1.48% at 1.37Mha. There are no current concerns of the condition of the oilseed rape crop in the Ukraine.

There are three key drivers of what will determine the OSR price coming out of the Black Sea region.

Firstly, crude oil will be a driving parameter. As I have discussed before how fluctuations in rapeseed coincide with crude oil. As lately we have seen crude oil pressured from the coronavirus outbreak, which in-turn has made global commodities decline.

Secondly, the fluctuation in the EUR/USD exchange rate will be key to observe, as this will demine if the Black Sea is competitive on global markets.

Finally, the trend in soyabean markets will be a defining parameter in OSR pricing. At the moment we are seeing soyabean markets pressured significantly. This is from South America forecasting a large soyabean crop, especially in Brazil. Furthermore, the coronavirus outbreak has meant China’s demand in soyabeans has been reduced, projecting a bearish medium-term outlook.

So from a UK point of view, despite a smaller crop in 2020/21, there are still risks to oilseed rape prices as we move further into the spring as global markets react to bearish soyabean fundamentals and uncertainty over coronavirus.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.