Engaging with crude oil to gain perspective on arable markets: Grain Market Daily

Friday, 7 February 2020

Market Commentary

- UK wheat futures (May-20) closed yesterday at £153.25/t, down £0.50/t on the day before. In contrast, Nov-20 fell £0.90/t to close at £160.95/t. Additionally, there have been improved drilling conditions this week.

- Nearby Brent crude oil has lost $11.32/barrel since the start of January. Closing yesterday at $54.93/barrel. Read more below to find out how this can affect you.

- The EU plan to impose new limits on contaminants allowed in palm oil. Top palm oil exporters Indonesia and Malaysia have accused the EU of using this as a trade barrier to protect their own oil industries.

Engaging with crude oil to gain perspective on arable markets

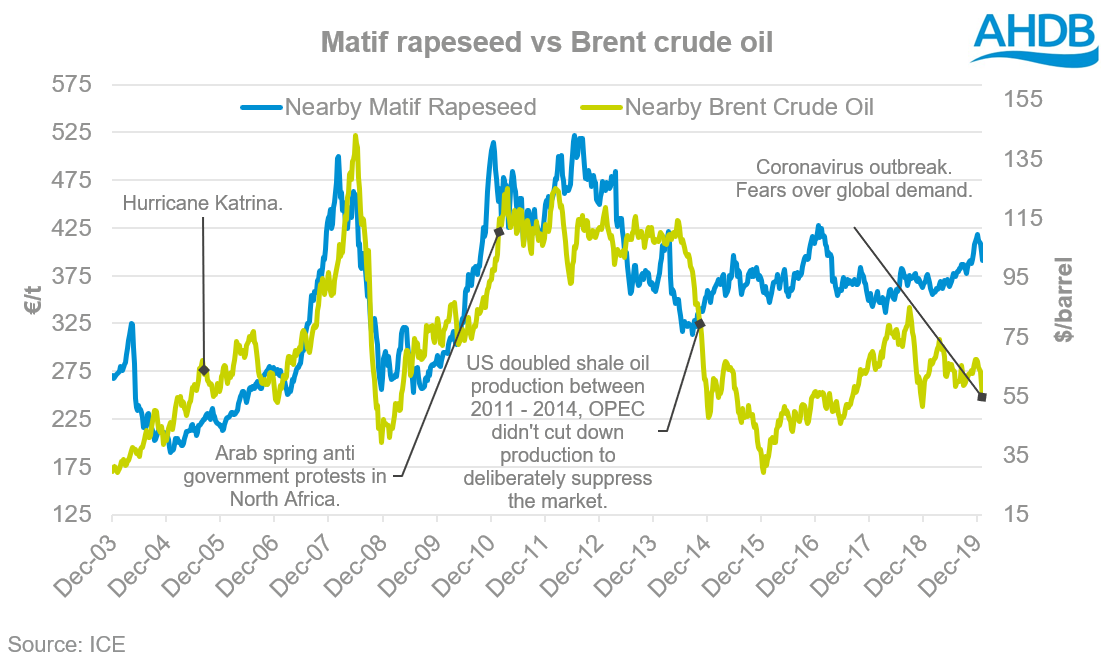

Although we saw support for oil markets from 20th Jan after the shutting down of Libya’s oil pipeline, since then oil has reduced by 15.75% after the coronavirus outbreak in China. There has also been a downturn in Paris matif rapeseed (May-20) futures which have reduced by 3.49% since that date too.

Although it has been discussed how weather and politics can be a driver of global markets. It’s key to engage how crude oil can have a significant economic impact and support or supress markets.

What is the outlook for oil?

For the short-term, oil markets will remain reactive to the coronavirus outbreak in China and the impact on economic growth. Economic data from China reported this week that the Manufacturing Purchasing Manager Index fell to 51.1 in January from 51.5 in the previous month, partially on coronavirus fears. The index was below market expectations of 51.3.

The next index released in early March will be a key indicator for longer-term economic impacts. But for the next few weeks, sentiment of good/bad news from China will be a key driver.

Why is oil important?

Currently, our consumption habits are fairly inelastic towards oil meaning that demand will be high regardless of the price, as currently there isn’t a suitable full-time substitute.

Similar to grains and oilseeds, crude oil is traded on a futures market made up of hedgers and speculators. Speculation of what could happen in the future around supply, demand and sentiment will determine today’s price.

A large influencer of oil prices is The Organisation of the Petroleum Exporting Countries (OPEC). Although not explicitly expressed, this organisation was created to manage oil prices by controlling production. However, OPEC’s influence is reducing as other key players such as Canada, China and the US increase their outputs into export markets.

How will this affect me?

Arable commodities have correlative links with crude oil. As shown in the graph below.

Both weather and political events can also have an impact on oil prices. Therefore, a connection can be created around oil, weather and politics as a tool for analysing arable commodities markets.

Although on a macro scale it’s key to engage with these three parameters as they will in turn affect your input costs and your ex-farm price.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.