2022 wheat crop prices historically high: Analyst's Insight

Thursday, 20 May 2021

Market commentary

- Most grain and oilseed futures prices fell yesterday. Speculative traders reportedly sold due to technical trading signals. There were also some improved wheat crop prospects and spill-over pressure from financial markets.

- The first day of a US crop tour reported good yield potential for wheat crops in Kansas. Meanwhile, Coceral raised its forecast for the EU-27 wheat crop.

- UK feed wheat futures Nov-21 contract lost £2.75/t to £176.00/t. Nov-21 Paris rapeseed futures fell €13.75/t to €518.50/t, roughly £447.19/t (Refinitiv).

- Private consultancy Agroconsult sharply cut its forecast for the Brazilian maize crop from 103.3Mt to 91.1Mt yesterday, due to the impact of recent dry weather. The latest USDA forecast is 102.0Mt.

2022 wheat crop prices historically high

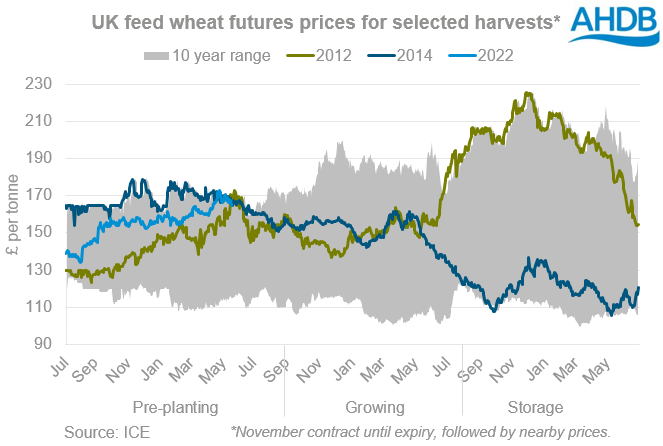

UK feed wheat futures prices for Nov-22 have dropped back in the last week in line with wider grain markets. On 19 May, the contract closed at £164.50/t. This is £8.25/t below the contract’s peak price to date of £172.75/t, set on 26 April.

But, the current price is still the third highest for any crop, this far ahead of harvest. The only higher prices were for the 2014 and 2012 crops. On 20 May 2013, 15 months before the 2014 crop was harvested, the Nov-14 contract closed at £166.15/t. On 19 May 2011, 15 months before the 2012 crop was harvested, the Nov-12 contract closed at £170.50/t.

Uncertain outlook

Many people are making their decisions about what to plant for harvest 2022. The current high prices for the 2022 wheat crop look attractive. But, there’s no guarantee about where values for that crop will be when it’s eventually harvested.

The prices for the 2012 and 2014 wheat crops were both high before planting due to tight global supplies. But, the prices for these crops followed very different paths.

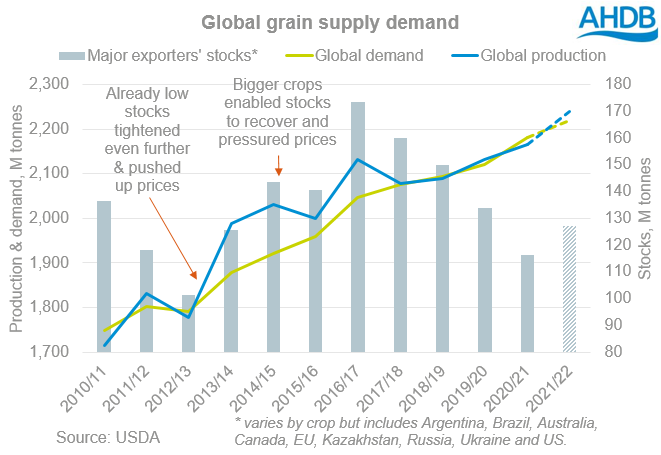

- 2012: Prices for the 2012 crop eased while it was growing (during the 2011/12 marketing year) as global wheat supply concerns lessened. In particular, Russia resumed exporting wheat after being absent for much of the 2010/11 season. But, global wheat stocks were still relatively low. Adverse weather resulted in a much smaller than expected US maize crop in 2012/13. This pushed global grain prices to new highs. For the first time in many years, the UK also became a net-importer of grain, pushing our prices to a premium over world levels.

- 2014: Prices for the 2014 crop also eased slightly while it was growing (during the 2013/14 marketing season). But, they fell considerably in the run-up to the 2014 harvest, as the market became confident of global supplies. E.g. the May 2014 USDA supply and demand report showed surpluses of both wheat and maize, while US farmers planted a record acreage of maize. The UK also returned to being an exporter of grain in 2014/15, after two seasons as a net-importer, adding extra pressure to our prices.

The world currently has tight grain supplies and low accessible stocks, similar to when the 2012 and 2014 crops were planted. But, there’s a long way to go before we know how the 2022 crop prices will unfold.

So, what options are there?

Alex looked at strategies for the 2021 crop here, including forward sales, futures, and options a couple of weeks ago. All these would be relevant for the 2022 crop too, though there’s a couple of extra things to bear in mind:

- Proportion sold. Before a crop is planted, it’s important to sell a smaller proportion of any potential crop than a growing crop. You might not plant all the acres you intend.

- Ability to trade. There’s currently limited open interest on Nov-22 futures and prices are falling. This could impact the willingness or ability of some merchants or end-users to hedge. You may not be able to sell the volume you want at the price you want, so be pragmatic and flexible when making decisions.

- Option cost. Option costs for the 2022 crop will be higher than those for the 2021 crop as they offer protection for a longer time. To mitigate, perhaps consider taking partial protection using an ‘out of the money’ put option? E.g. buying an option below current price levels for a cheaper premium.

If you’re interested it’s worth talking to your merchant(s) about what avenues may be available. Ultimately, what if a forward sale made in this climate was the worst sale you made for the 2022 crop? This is food for thought given that fertiliser and fuel costs have risen recently.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.