2022 dairy trade review: exports up, with a slight fall in imports

Tuesday, 28 February 2023

Dairy product trading volumes for the UK have overall risen from 2021 levels, however, this should be considered in the context of reduced volumes in the first quarter of 2021 with the EU exit coming into effect from January 2021. The EU remains an important market for dairy imports and exports, for countries such as Ireland, France, the Netherlands, and Germany.

Exports

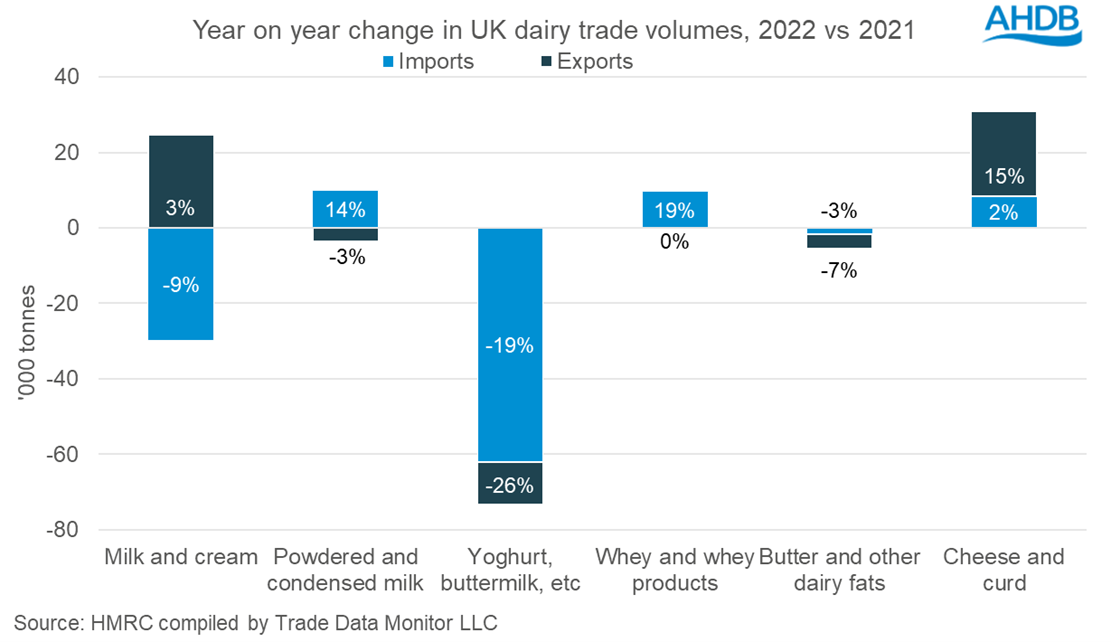

Total export volume for 2022 was 1.2m tonnes, an increase of 28,300t (2%) from 2021. Whilst levels of EU exports increased by 45,000t, there was a fall in exports from non-EU destinations by 16,350t (-15%). This is especially noticeable for exports to China, which fell 7,800t compared to 2021.

Milk and cream products saw the largest increase in export volumes from 2021 levels, up 24,650t. This was driven by a rise in total milk and cream exports to EU destinations, such as Ireland and the Netherlands. However, Poland and France saw falls in milk and cream export volumes by 2,500t and 3,400t respectively. Breaking it down, milk saw a fall of 13,000t exported mainly to Ireland. Cream exports increased 481t overall, with a 5,300t rise to Ireland. Cheese also saw a large uptick in exports, with an increase of 22,400t from 2021 levels.

Milk powders, yoghurts, and butter exports all saw varying declines in export volumes from 2021. Yoghurt saw an overall fall of 11,400t (-26%), with a -33% (12,600t) fall to the EU. Butter exports were down 3,800t, with an overall 64% (4,400t) fall in exports to non-EU destinations, shipments to the EU did increase by 658t during this time. Milk powder exports fell by 3,500t, driven by a fall to non-EU destinations by 8,600t (-20%). This was compensated by an uptick of 5,100t to EU markets.

There were minor changes to whey product volumes, a total fall of 54t from 2021 as non-EU destination exports fell 3,100t (-21%), but EU destination exports rose by 9%.

Imports

Total import volumes are down just over 65,000t (-5%) from 2021 levels to 1.17m tonnes. This was driven by a fall of 68,150t (-6%) from EU sources, and a 2,800t increase from non-EU sources. Imports mainly fell from Ireland, France, and Belgium.

Milk powder and whey product import volumes increased 10,000t and 9,700t respectively. This marked a 14% and 19% increase in volumes. Milk powder imports rose from Belgium (4,000t), France (3,600t), and the Netherlands (3,500t). Cheese and curd import volumes rose too, up 2% (8,500t) from EU sources.

Yoghurt and buttermilk import volumes saw a 62,000t (-19%) fall, all from EU destinations. These included Poland (-24,000t), France (-17,400t), and Germany (-11,400t). Raw milk and cream imports fell by just under 30,000t (-9%) from 2021 levels, again from EU sources.

Butter imports saw a minimal change from 2021 levels, down 1,740t (-3%), coming from a fall in EU-sourced butter.

For more detailed data, check out our dairy trade dashboard.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.