- Home

- Beef Market Outlook 2022

Beef market outlook

January 2022

Summary

- Beef production forecast +1% in 2022, as more prime cattle become available

- Overall beef consumption forecast -1%, as easing retail demand offsets rising foodservice demand

- Beef imports forecast to grow slightly (+1%), as foodservice demand increases

- Exports of beef forecast to increase by over 10%, helped by higher domestic production and increased import demand on the continent

2021 overview

Before we look forward into 2022, let’s take a moment to reflect on how the UK beef market performed in 2021.

2021 saw some of the highest prices for finished cattle and cull cows on record. From a supply point of view, cattle population data suggested that fewer slaughter age cattle would be available in 2021, stemming from a poor calving season in 2018 and likely exacerbated by an elevated prime kill in 2020. From the demand side, continuing disruption to the eating out market meant that domestic demand for beef via retail remained robust, driving competition for home-grown cattle.

The UK’s international trade of beef stumbled in the first quarter following EU exit, but as the new UK-EU trading relationship was navigated and foodservice began to reopen in both the UK and on the continent, import demand grew and volumes grew.

Despite the strong returns for British cattle recorded in 2021, profitability continues to be squeezed by more expensive input costs, including feed, fertiliser and fuel.

Forecasts

Production

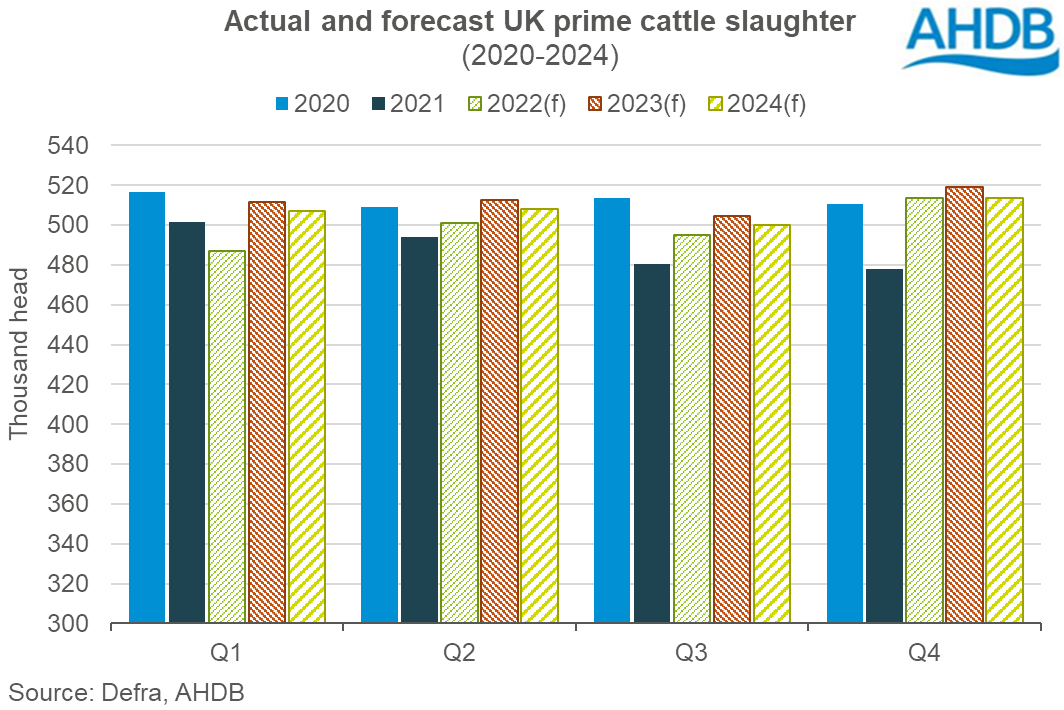

UK prime cattle slaughter is expected to show slight recovery in 2022 compared to 2021, with forecast growth of 2%. This is largely based on cattle supply data from the British Cattle Movement Service, which shows an increased number of younger cattle that would be available for processing later in the year. Indeed, the number of older prime animals still looks tight compared to a year ago, which may limit kill in the first half of the year.

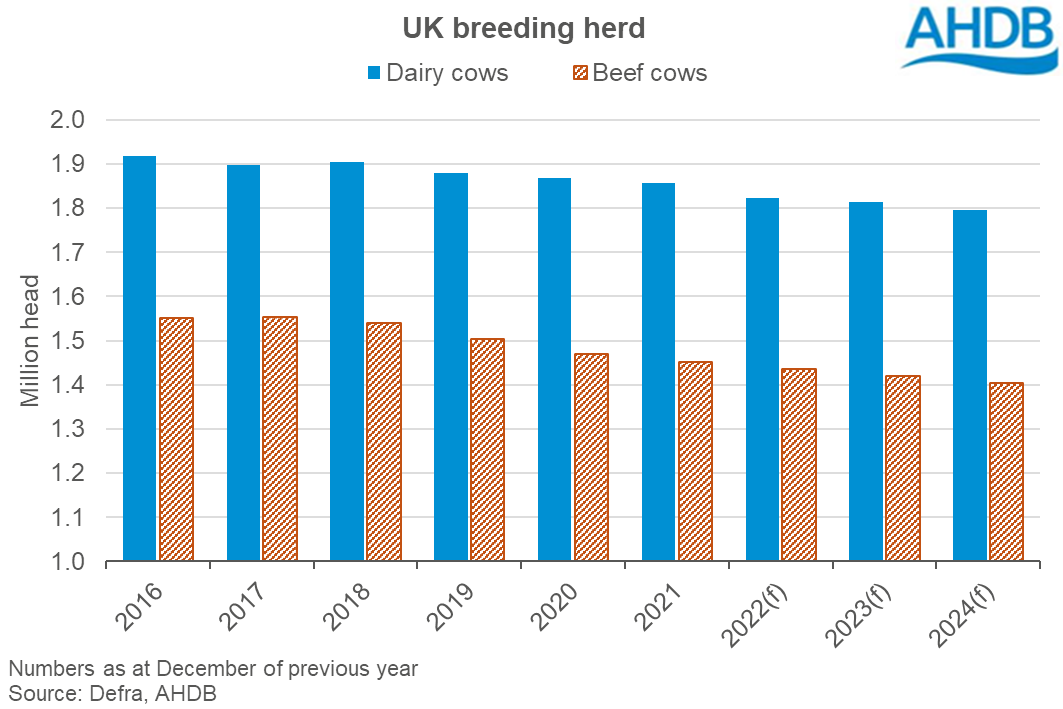

Slaughter of cull cows is forecast to fall by around 1% in 2022. With both the dairy and suckler breeding herds expected to remain in a state of contraction, fewer animals are expected to be available to kill overall.

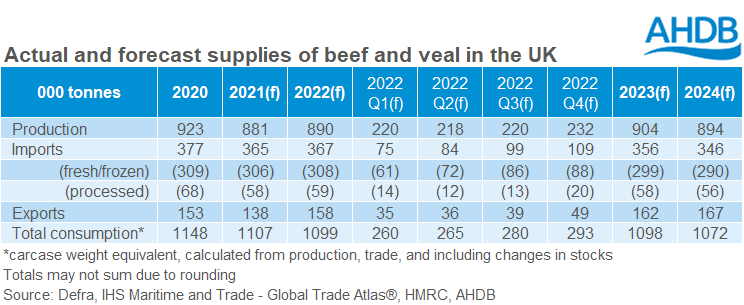

These slaughter forecasts are expected to contribute to a 1% increase in total beef production for 2022, compared to 2021.

Data on calf registrations and calf slaughter suggests that UK beef production in 2023 could see further moderate growth, as changes in dairy bull calf management are implemented. More calves are expected to be made available for prime slaughter during the year as a result of these changes.

Increased use of beef semen on dairy cows will mean that more beef-type cattle with increasing meat quality will come from the dairy herd, contributing to overall production. However, countering this is the expectation of ongoing contraction of both the dairy and suckler herds, due to issues including loss of direct subsidy, increased input costs and associated effects on profitability. This could act as a limiter for further growth in beef production.

Consumption

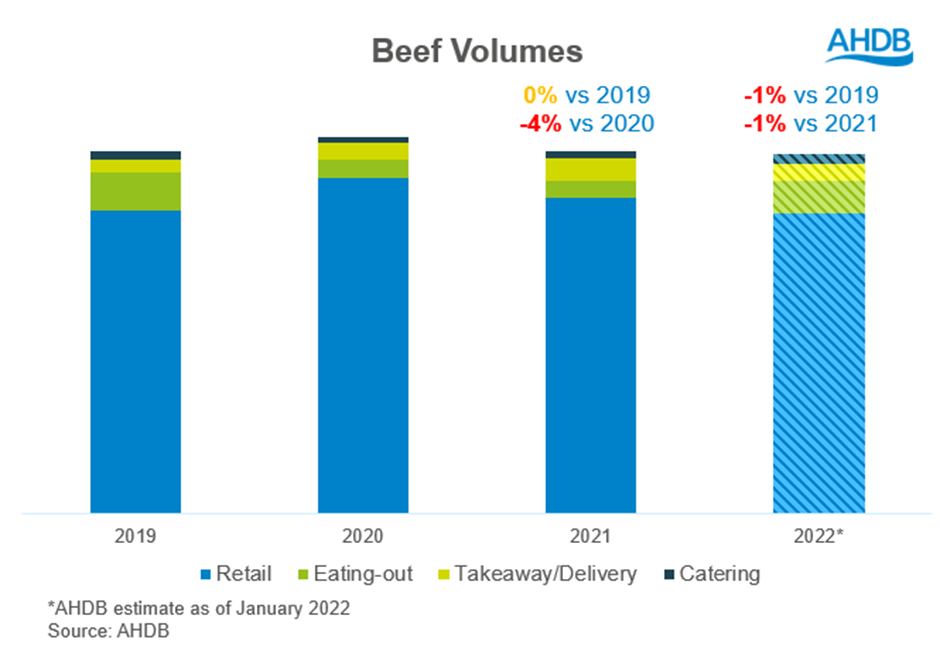

Beef proved to be a staple for consumers in-home at the start of COVID-19, seeing the fastest volume increase in retail of all the meat proteins in the 52 w/e 14 June 20. 2021, however, marked a return to slightly more ‘normal’ buying behaviour, with retail unable to maintain the stellar performance of 2020 as some returned to eating out. This saw beef volumes in retail reducing by 6% year-on-year in the 52 w/e 26 Dec 21, meaning that beef lagged behind both pork and lamb performance. However, when compared back to pre-pandemic levels (2019), beef remains significantly elevated at +4%.

Decline was across all cuts but the worst offender was mince, down by -11.7%. Mince was one of the star performers early in the pandemic as panic-buying and severe lockdowns were in place. Compared to 2019, mince volumes remain slightly elevated at +0.7%. Steaks have been down -5.2% year-on-year across all steak cuts but fillet, which remains in growth. Versus pre-pandemic, steak volumes remain significantly higher at +14.1%. Roasting has seen less decline year-on-year at only -2.6% and is up versus 2019 by +5.3%. The exception to the rule has been marinades, which are up by 16.7% year-on-year as consumers are seeking more convenient options.

The difficult foodservice conditions continued throughout 2021, with lockdowns only easing gradually during the first half of the year. The new variant, omicron, caused consumer caution in the pre-Christmas period, with some additional restrictions in Scotland, Northern Ireland and Wales. We estimate the eating-out market for beef in the 52 w/e 26 Dec 21 saw volume declines of -5% year-on-year. Considering that 2020 had already seen a contraction in eating-out performance of -54%, this was a weak performance in 2021. Eating-out dynamics shifted in 2021, with less cheap, on-the-go eating and more emphasis on treating. For beef this meant declines in sandwiches (-14%) and savoury pastries (-35%) but growth of 2% for meat-centred meals such as steaks and roasts. Burgers were flat from 2020 to 2021 in dine in and on the go.

Deliveries and takeaways continued to offer a lifeline for the foodservice market in 2021. We estimate that beef volumes in this market rose by a further 40% versus 2020meaning a total volume increase of 87% compared to 2019. Growth was across the board but among the biggest contributors were burgers and beef-based Chinese dishes, as well as Mexican, Indian and meat-centred meals (AHDB estimates based on Kantar Out-of-Home, 52 w/e 26 Dec 21).

In the past year, we believe growth in takeaway and delivery was not enough to balance out eating-out and retail losses. We estimate total beef consumption ended the year down 4% on 2020 but flat versus 2019.

Consumption: what next?

Trading conditions are likely to remain tough for some time as omicron continues to wreak havoc on COVID recovery. This will cause some caution in returning to foodservice (eating out) venues and a continuation in some working from home well into the new year and beyond. Moreover, the market will not fully recover to pre-COVID levels due to business closures, the economic backdrop and continuing uncertainty.

Coupled with this, attitudes to meat-eating look to be starting to return to the pre-COVID norm with signs people are again intending to manage their consumption levels. We therefore expect to see further decline for beef in retail this year, resulting in it being slightly down versus 2019 levels.

However, if the omicron wave fades, more people are fully vaccinated and confidence begins to return, we should see foodservice begin to recover through the back half of 2022, providing no further variants emerge. The sector will, however, still be down compared to 2019 levels due to a continuation of some working from home accompanied by a squeeze on household finances due to the energy crisis. Takeaway and delivery growth will slow as people venture back out but will remain elevated versus pre-COVID.

Overall total beef consumption for the full year 2022 is expected to be down -1% year-on-year. Similarly, when we compare back to 2019, being a more typical year, volumes are expected to be down -1%.

The beef outlook might be mitigated, if the industry:

- Encourages consumers back out-of-home. Opportunities in the eating-out market include personalisation, indulgence, quality cues and pushing reputational factors such as health, sustainability and backing Britis. Takeaway/delivery is also an important trend for beef to capitalise

- Encourages shoppers in-store by improving the experience of the meat aisle

- Utilises the “K-shaped” recovery – where some consumers have more disposable income while others have less: provide recipe inspiration for cheaper cuts of meat such as mince and the forequarter to emphasise more affordable options for those on a budget and at the same time target more indulgent options, such as steaks and roasting joints, towards those still cautious about returning to foodservice but who would still like a treat

- BBQ inspiration is key during the summer months and then as we head into winter inspire warming stews/casseroles, playing on affordability and health

- Addresses health concerns by communicating the health benefits of beef, such as B12 and iron

- In the longer term, looks to maintain and build consumer trust, demonstrating where farming values (animal welfare, environmental stewardship and expertise) are shared with consumers. See our consumer reputation landscape hub for more information

Visit the retail and consumer page for more insight

Trade

Taking into account the slight increase forecast in production, and lower forecast consumption, we now turn to imports and exports.

Imports are expected to show slight growth of around 1% compared to 2021 levels overall. Volumes are expected to show stronger year-on-year growth in the first quarter, compared to Q1 2021 when trade volumes were severely reduced following Brexit. Foodservice demand is expected to show some recovery in 2022, but still not to levels seen pre-pandemic (2019).

Ireland, the UK’s main supplier of beef, is forecast to have increased cattle availability in the second half of the year, meaning that total cattle slaughter there could increase by 3% for the year overall. With Irish cattle currently at an increased discount to UK animals, imports are likely to become more attractive, especially if domestic foodservice demand increases.

Exports of British beef on the other hand are forecast to grow by over 10% in 2022, again with a strong year-on-year growth expected in the first quarter. Just like the UK, foodservice demand is expected to continue to grow on the continent as the pandemic is overcome. This is set against a backdrop of lower production, as forecast by the European Commission. Supplies on the global market are also forecast to remain on the tight side in 2022 according to industry reports. Lower production is forecast in North America and New Zealand, and export restrictions remain on some Brazilian and Argentinian product. Chinese beef demand is forecast to remain firm, especially as COVID restrictions are lifted and foodservice demand increases.

Tightness in global supplies coupled with lower EU production is expected to support prices on the continent, which could in turn be favourable for the UK. However, increased imports for the foodservice market and comparatively cheaper, more plentiful Irish supplies could exert some price pressure. It will be important that foodservice outlets source British product wherever possible to support producer returns.

Sign up for our newsletter

Complete the form to receive our monthly newsletter for the latest analysis and forecasts.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.