- Home

- News

- Predicted OSR plantings down 18% for 2021/22 could see further support for domestic prices : Grain market daily

Predicted OSR plantings down 18% for 2021/22 could see further support for domestic prices : Grain market daily

Wednesday, 2 December 2020

Market Commentary

- May-21 UK wheat futures closed yesterday at £191.25/t, a fall of £3.25/t from Friday’s close. Nov-21 UK wheat futures also fell further yesterday to £158.60/t; from Friday’s close the Nov-21 contract has fallen by £2.60/t, closing in on the 3-year moving average of £157.58/t.

- Nearby Chicago wheat futures fell to close at $207.76/t yesterday, the lowest level since September. This is following pressure from increased Australian production of 31.17Mt from 28.91Mt.

- Despite increased Australian production to the second largest on record, strong Asian demand is supporting Australian wheat prices. Australian Premium White wheat is quoted around $275/t, Australian Prime Hard wheat quoted around $290-295/t and Australian Standard White wheat quoted as $270/t, all including freight.

Predicted OSR plantings down 18% for 2021/22 could see further support for domestic prices

As my colleague Alex discussed last Wednesday, in the longer term, rapeseed markets have support from anticipated planted area declines. For the third consecutive season, Stratégie Grains estimate a low overall EU and UK rapeseed area for 2021/22; France and the UK are forecasted the largest area declines due to inconsistent rainfall and risk aversion to issues of cabbage stem flea beetle (CSFB). Alex also mentioned how Ukraine’s intended planted area declined by 340Kha to 1.01Mha.

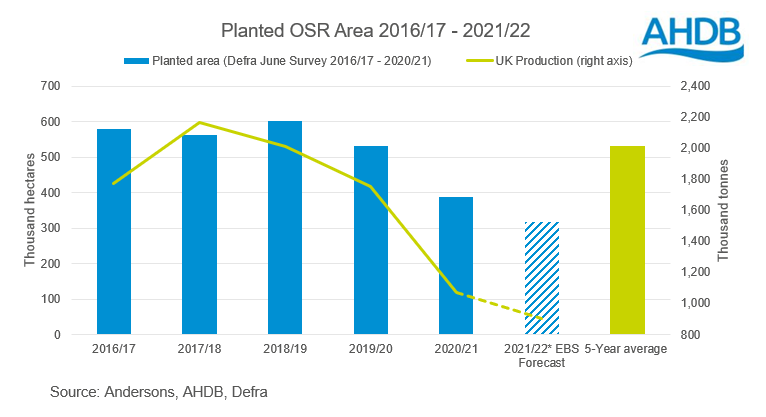

Friday saw the release of the Early Bird Survey which forecasted a reduction of UK OSR area by 18.1% to 318Kha, with some of this area loss utilised by other break crops. This signifies the third consecutive year-on-year fall in planted area. Planted area will have seen reductions of 283Kha in total since 2018/19’s high of 601Kha.

Production in the past 3 years (2018/19-2020/21) is predicted by Defra to have fallen by 942Kt. This further anticipated fall in planted area for 2021/22 could result in a continued production fall by as much as 164Kt from 2020/21, should average yield remain at the 2020/21 figure of 2.85t/ha (ADAS yield).

How is this impacting on delivered prices?

In the short term, rapeseed prices have seen a large amount of support from high oilseed demand. Chinese soyabean purchasing for their recovering pig herd has boosted prices across the oilseed complex, allowing futures prices for CBOT soyabeans and MATIF rapeseed to rally.

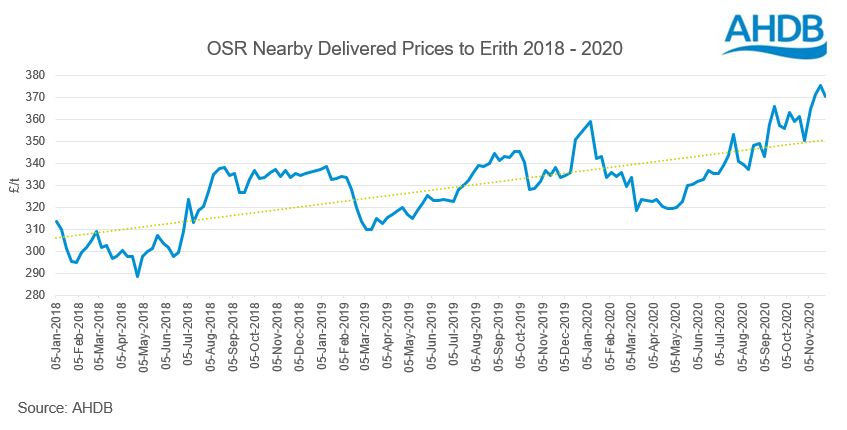

Long-term price support can be seen through a series of year-on-year falls in planted area and domestic production alike, causing an overall upward price trend. From the beginning of marketing year (June) 2018 to last week, nearby delivered Erith prices increased by 22% (£67/t). From the beginning of this marketing year (June 2020) to last week’s quoted prices, nearby delivered Erith prices gained 12% (£39/t).

What does this mean for prices heading into 2021/22?

With this in upward price trend in mind and forecasted OSR planted area reductions, we could see some further support for OSR delivered prices into 2021 should demand remain stable. Though 2021/22 predicted planted area fall is a smaller percentage of -18% as opposed to -27% seen in 2020/21, price may still see some support but perhaps not to the same pace seen in this marketing year so far.

More information may be available upon the release of the final UK production estimates in December.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.