GB milk markets at risk of disruption

Thursday, 26 November 2020

By Patty Clayton

Dairy markets look set for some disruption in the new year, regardless of what type of trade deal is agreed with the EU. Once the UK becomes a third country in terms of trade, all dairy exports to the continent will face additional administrative requirements. These will include customs declarations, border checks, and, for any product of animal origin such as dairy, an export health certificate (EHC)[1].

This will particularly affect fresh dairy products, and could lead to pressure on prices of bulk cream and skim concentrate.

The GB dairy market currently balances the supply of excess products through exports to the continent. Bulk cream and skim milk concentrate are exported to the EU when:

- there is a lack of processing capacity to convert into butter or powder, or

- when prices on the EU market are more attractive than they are in the UK, or

- when prices on the EU market are more attractive than processing into butter or powders.

This trade allows the GB market to balance domestic demand to supply, and helps keep domestic pricing in line with EU markets.

From 1 January, 2021, the need to have an EHC for each load destined for the EU could disrupt this trade, due to added cost and time needed.

The very nature of these trades, selling fresh product, which is surplus to immediate requirements, means they are done on short notice and require a quick turnaround. The likelihood of having access to a qualified vet to sign off the EHC in time, could make the process untenable.

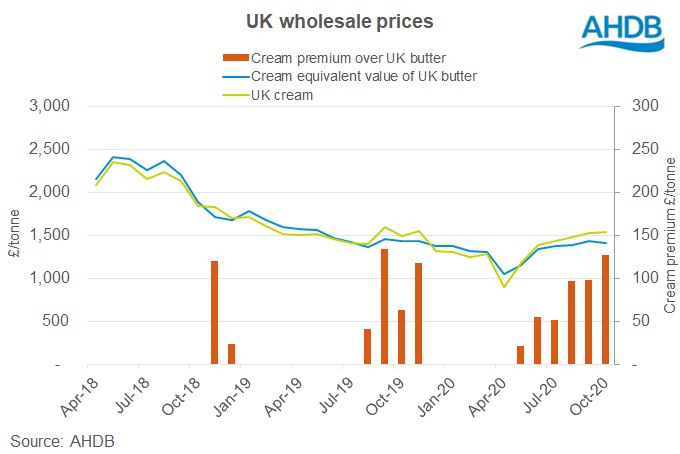

Without the ability to balance the domestic market, any surplus volumes would need to be diverted to alternative uses. For bulk cream, surpluses could go into butter, and prices would align with the equivalent value of butter. Currently, bulk cream is attracting a premium due to higher prices available on the EU export market.

For skim concentrate, the surplus product would be more difficult to place as there is less capacity for processing this within GB. Capacity is particularly tight over the Christmas period and the spring flush. Without the ability to export surplus volumes due to time delays, there is a risk that some skim concentrate may need to be diverted into AD plants during these periods, reducing net returns for sellers.

[1] An export health certificate (EHC) is needed for exports of live animals, products of animal origin (POAO) and germplasm. Dairy products are classified as POAO

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.