- Home

- Stacking options for SFI 2023: Beef and lamb

Stacking options for SFI 2023: Beef and lamb

Main findings

- The SFI alone is not going to be enough to mitigate the loss of Direct Payments – this is an intentional feature of the scheme. But the right combination of actions could make up a considerable amount of the shortfall

- Taking part in the SFI can provide extra income for beef and sheep farm businesses

- If farmers select SFI actions that are right for their farm, they can considerably boost the farm’s net profit level

- The farm’s net profit will benefit more if SFI actions requiring land are carried out on less productive or unproductive areas of grassland

- It is likely that actions carried out on unproductive grassland will regenerate the land and make it more productive in the long term

- Farmers have the opportunity to maximise the potential of every hectare of land on their farm

- Looking ahead, the SFI can play a role in stabilising farm business incomes

AHDB virtual farms used for beef and sheep analysis

We used two AHDB virtual beef and sheep farms in this analysis:

- 150 ha beef and sheep farm, South West (jump to the 150 ha farm analysis)

- 220 ha mixed farm, Yorkshire and the Humber (jump to the 220 ha farm analysis)

Methodology

The AHDB virtual farms are theoretical farms that exist on a spreadsheet and are designed to be representative of ‘typical farms’. They have been created as middle 50%-performing businesses: this means that their performance is comparable to actual national or regional averages. Costs associated with middle-performing farms tend to be higher than farms in the top 25%, and these costs have been cross-referenced to Farm Business Survey average results.

Detailed descriptions of the AHDB virtual 150 ha beef and sheep farm and virtual 220 ha mixed farm

The main analysis used 2022 as the baseline year, as this is the most recent year for which there is a full set of annual data. However, we note that market prices were higher than in the previous three years, and this has a big effect on the farm's net profit.

We allocated different areas of the farm to the individual actions under each option and calculated:

• The cost of carrying out the SFI actions on that area

• The net payment by subtracting the cost from the payment rate published by Defra

Net payments were calculated for each of the selected actions over the three years of the SFI agreement, taking into account that there are one-off costs and annual costs incurred, depending on the action.

To examine the effect on the farm of taking part in the SFI, all other variables – such as input and output prices – were assumed to be constant over the three-year duration of the SFI agreement. The net payments were incorporated into the virtual farm’s balance sheets to calculate the net profit (total revenue minus total costs) for a given year. The change in the farm’s net profit as a result of taking part in the SFI compared with not taking part in the SFI was then calculated.

Analysis of the 150 ha beef and sheep farm

Two stacking combinations have been analysed

Our analysis using the 150 ha beef and sheep farm considers two ways of stacking actions:

- Option A: SFI ‘lite’ – combination of SFI actions which do not require additional land

- Option B: SFI ‘ambitious’ – option A plus a combination of SFI actions which require additional land

The 150 ha beef and sheep farm already has farmland entered into the Countryside Stewardship (CS) scheme (Table 1). As a result, the equivalent SFI actions listed in Table 2 could not be carried out on the same land area because farmers will not be paid to carry out equivalent CS and SFI actions on the same land.

Updated 9 January 2024 to reflect changes in payment rates.

A further update is planned by Spring 2024 to add 2023 data.

Table 1. CS actions undertaken by the 150 ha virtual beef and sheep farm

| CS action code | CS action description | Payment | Area or length |

|---|---|---|---|

| GS4 | Legume and herb-rich swards | £382/ha | 10 ha |

| SW2 | 4 m to 6 m buffer strip on intensive grassland | £235/ha | 0.8 ha |

| GS2 | Permanent grassland with very low inputs (outside SDAs) | £151/ha | 10 ha |

| GS17 | Lenient grazing supplement | £28/ha | 10 ha |

| BE3 | Management of hedgerows | £13/100 m (one side of hedge) | 8,000 m |

SDA: Severely disadvantaged area

Source: Defra, AHDB

Where there are similar SFI and CS actions to choose from, it’s important to read the details as requirements may differ. For example, for GS4, there are specific requirements about the species composition of the legume and herb-rich swards, whereas for SAM3, there are no such criteria.

Details on SFI and CS actions can be found on GOV.UK:

Table 2. SFI actions which the 150 ha beef and sheep farm cannot carry out because these are already being undertaken under CS (see Table 1)

| SFI action code | SFI action description | Payment |

|---|---|---|

| SAM3 | Herbal leys | £382/ha |

| IGL3 | 4 m to 12 m grass buffer strip on improved grassland | £235/ha |

| LIG1 | Manage grassland with very low nutrient inputs (outside SDAs) | £151/ha |

| HRW2 | Manage hedgerows | £13/100 m (one side of hedge) |

SDA: Severely disadvantaged area

Source: Defra

Table 3 shows which SFI actions were included in options A and B, along with payment rate and the area of the farm selected for each action.

Note: Tables 2 and 3 show current SFI actions available – more will be funded as the scheme progresses.

Table 3. SFI actions under options A and B with payment rates and area of land in 150 ha beef and sheep farm

| Code | Action | Payment | Area or length | |

|---|---|---|---|---|

| Option A | SAM1 | Assess soil, test SOM, produce soil management plan | £6.00/ha plus £97 per agreement | 50 ha |

| HRW1 | Assess and record hedgerow condition | £5 per 100 m – one side | 8,000 m | |

| HRW3 | Maintain or establish hedgerow trees | £10 per 100 m – both sides | 8,000 m | |

| IPM1 | Assess integrated pest management and make a plan | £1,129 per year | n/a | |

| NUM1 | Assess nutrient management and produce a plan | £652 per year | n/a | |

| NUM2 | Legumes on improved grassland | £102/ha | 10 ha | |

| Option B All actions listed for option A, plus: |

IGL1 | Take improved grassland field corners or blocks out of management | £333/ha | 10 ha |

| IGL2 | Winter bird food on improved grassland | £515/ha | 10 ha |

SOM: Soil organic matter

Source: Defra, AHDB

An SFI management payment is also available, which is £20/ha up to the first 50 hectares of land entered into the relevant SFI actions. This has been factored into the analysis: the 150 ha beef and sheep farm receives the maximum SFI management payment of £1,000 per year.

What’s the overall impact of option A on the 150 ha beef and sheep farm’s net profit?

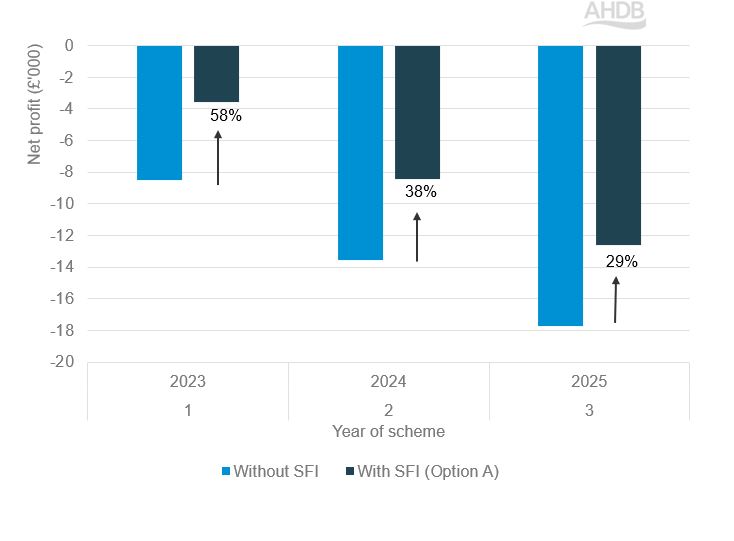

Figure 1 shows that the 150 ha beef and sheep farm makes a loss regardless of participation in the SFI. The additional income from SFI option A reduces the overall loss made by the farm by 58% in year 1, 38% in year 2 and 29% in year 3.

Figure 1. Effect on 150 ha beef and sheep farm’s net profit level – option A

Source: AHDB

How much money can the 150 ha beef and sheep farm make from option A (SFI ‘lite’)?

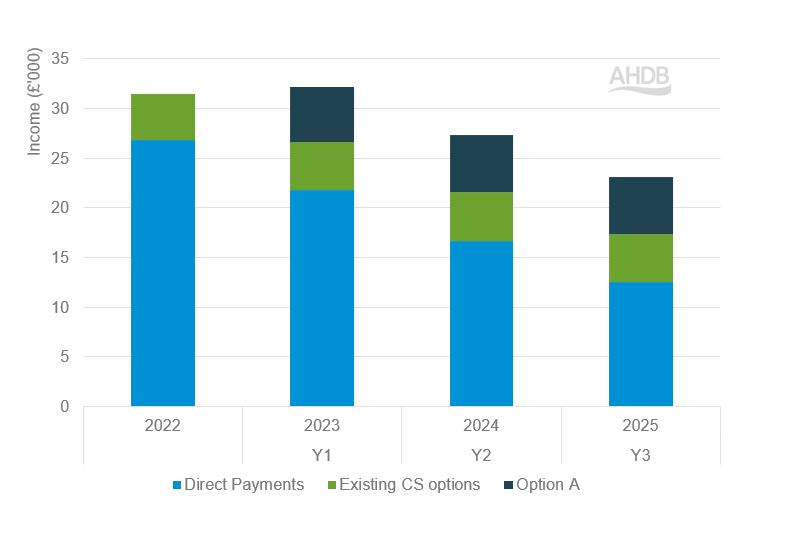

Figure 2 shows the income that would be received by AHDB’s 150 ha beef and sheep virtual farm if option A was selected.

Figure 2. Three-year projection of income received by a 150 ha beef and sheep farm from Direct Payments, CS and SFI actions – option A

Source: AHDB

See a breakdown of ‘With SFI (Option A)’ actions.

Assumptions:

- The two hedgerow actions (HRW1 and HRW3), integrated pest management plan (IPM1) and nutrient management plan (NUM1) incur no additional cost as the farm already carries out these actions

- No additional cost is attributed to NUM2 (legumes on improved grassland) as clover is already present in the farm’s grassland

As a result of carrying out the actions under option A, the farm receives an extra £5,700 on average per year over the three-year duration of the SFI agreement. While this does not fill the gap left by reduction of Direct Payments, it is still providing the farm with more income and does not require any major changes to the farm’s set-up.

What’s the overall impact of option B on the 150 ha beef and sheep farm’s net profit?

The more ambitious SFI grassland actions require land. Because of this, there is a cost to farmers of forage such as silage, which may need to be compensated for. To carry out the ambitious actions in option B, 20 ha of land was selected, which equates to 14% of the farmland available. It is worth noting that the farm also has grassland allocated to the CS options described in Table 1.

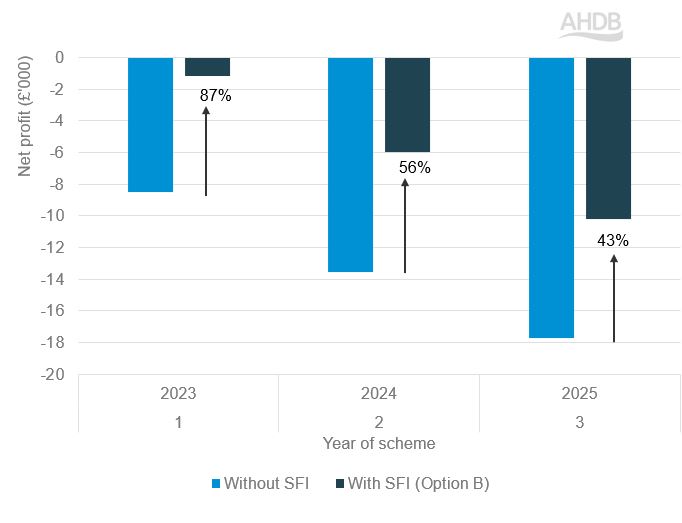

If the farm selects the actions under option B, the overall loss made by the farm reduces by 43–87% over the three-year SFI agreement, as shown in Figure 3.

Figure 3. Effect on 150 ha beef and sheep farm’s net profit level after implementing option B

Source: AHDB

While the more environmentally ambitious SFI actions are likely in the short term to incur a higher opportunity cost if carried out on areas used for pasture, they are likely to benefit the productivity of the grassland in the long term.

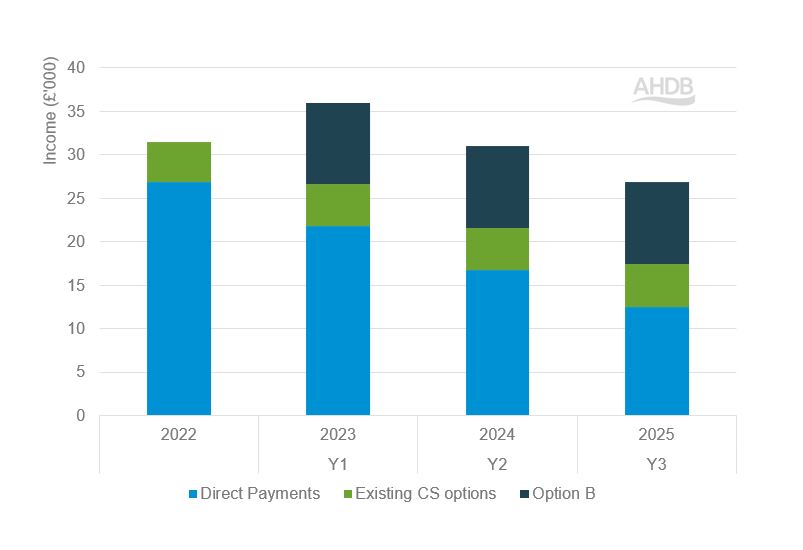

How much money can the 150 ha beef and sheep farm make from option B (SFI ‘ambitious’)?

The additional income the farm receives if it selects actions listed for option B is an average of £8,100 per year. For IGL1 (take improved grassland field corners or blocks out of management), the farm is able to apply for a Countryside Stewardship capital grant to help cover fencing costs. Together with the income received from the farm’s participation in CS, the farm receives around £13,000 per year on average from both the SFI and CS.

Figure 4. Three-year projection of income received by 150 ha beef and sheep farm from Direct Payments, CS and SFI actions – option B

Source: AHDB

See a breakdown of ‘With SFI (Option B)’ actions.

Analysis of the 220 ha mixed farm

Two stacking combinations have been analysed

Our beef and sheep analysis using the 220 ha mixed farm considers two ways of stacking actions:

- Option A: SFI ‘lite’ – combination of SFI actions which do not require additional land

- Option B: SFI ‘ambitious’ – option A plus a combination of SFI actions which require additional land

The 220 ha mixed farm already has 22 ha of land entered into the CS option, SW6 (winter cover crops). The equivalent action to this in the SFI is SAM2 (multi-species winter cover crop). These equivalent actions both have a payment rate of £129/ha.

Table 4 shows the SFI actions included in options A and B, along with payment rate and the area of the 220 ha mixed farm selected for each action.

Table 4. SFI actions under options A and B with payment rates and area of land in 220 ha mixed farm

| Code | Action | Payment | Area or length | |

|---|---|---|---|---|

| Option A | SAM1 | Assess soil, test SOM, produce soil management plan | £6.00/ha plus £97 per agreement | 50 ha |

| HRW1 | Assess and record hedgerow condition | £5 per 100 m – one side | 10,000 m | |

| HRW2 | Manage hedgerows | £13 per 100 m – one side | 10,000 m | |

| HRW3 | Maintain or establish hedgerow trees | £10 per 100 m – both sides | 10,000 m | |

| IPM1 | Assess integrated pest management and make a plan | £1,129 per year | n/a | |

| IPM3 | Companion crop on arable and horticultural land | £55/ha | 10 ha | |

| IPM4 | No use of insecticide on arable crops and permanent crops | £45/ha | 22 ha | |

| NUM1 | Assess nutrient management and produce a plan | £652 per year | n/a | |

| NUM2 | Legumes on improved grassland | £102/ha | 10 ha | |

| Option B All actions listed for option A, plus: |

SAM3 | Herbal leys | £382/ha | 10 ha |

| IGL1 | Take improved grassland field corners or blocks out of management | £333/ha | 5 ha | |

| IGL2 | Winter bird food on improved grassland | £515/ha | 5 ha | |

| IGL3 | 4 m to 12 m buffer strip on improved grassland | £235/ha | 0.27 ha | |

| LIG1 | Manage grassland with very low nutrient inputs (outside SDAs) | £151/ha | 5 ha |

SOM: Soil organic matter

SDA: Severely disadvantaged area

Source: Defra, AHDB

An SFI management payment is also available, which is £20/ha up to the first 50 hectares of land entered into the relevant SFI actions. This has been factored into the analysis: the 220 ha mixed farm receives the maximum SFI management payment of £1,000 per year.

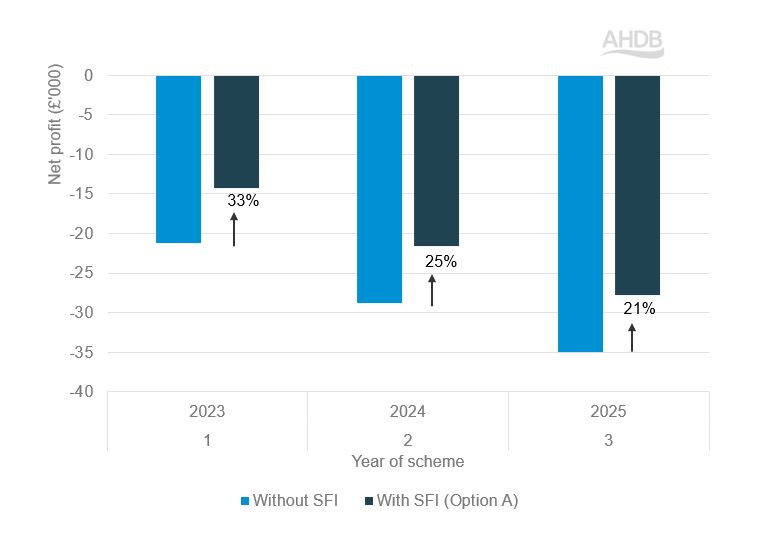

What’s the overall impact of option A on the 220 ha mixed farm’s net profit?

Figure 5 shows that the 220 ha mixed farm is making a loss regardless of participation in the SFI. The additional income from SFI option A reduces the overall loss made by the farm by 33% in year 1, 25% in year 2 and 21% in year 3.

Figure 5. Effect on 220 ha mixed farm’s net profit level – option A

Source: AHDB

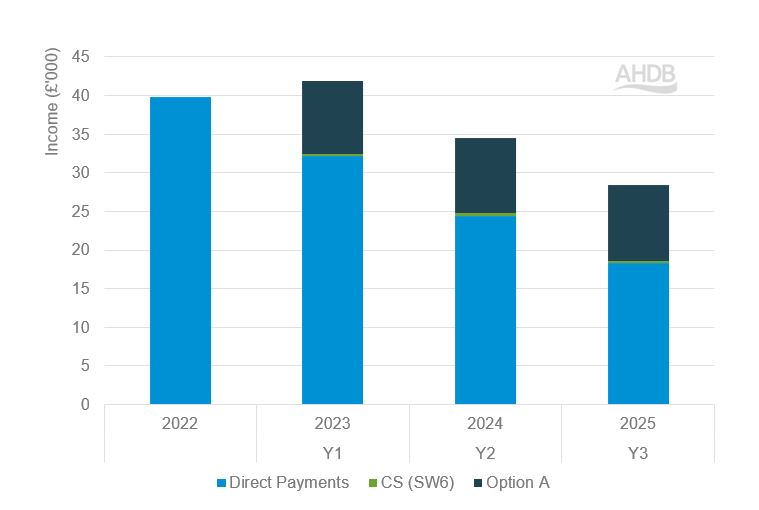

How much money can the 220 ha mixed farm make from option A (SFI ‘lite’)?

Figure 6 shows the income that would be received by AHDB’s 220 ha mixed virtual farm if option A was selected.

Figure 6. Three-year projection of income received by 220 ha mixed farm from Direct Payments, CS and SFI actions – option A

Source: AHDB

See a breakdown of ‘With SFI (Option A)’ actions for 220 ha mixed farm.

Assumptions:

- The three hedgerow actions (HRW1, HRW2 and HRW3), integrated pest management plan (IPM1) and nutrient management plan (NUM1) incur no additional cost as the farm already carries out these actions

- No additional cost is attributed to NUM2 (legumes on improved grassland), as clover is already present in the farm’s grassland

As a result of carrying out the actions under option A, the farm receives an extra £9,700 on average per year over the three-year duration of the SFI agreement. However, as shown in Figure 6, this is not enough to mitigate the loss of payments.

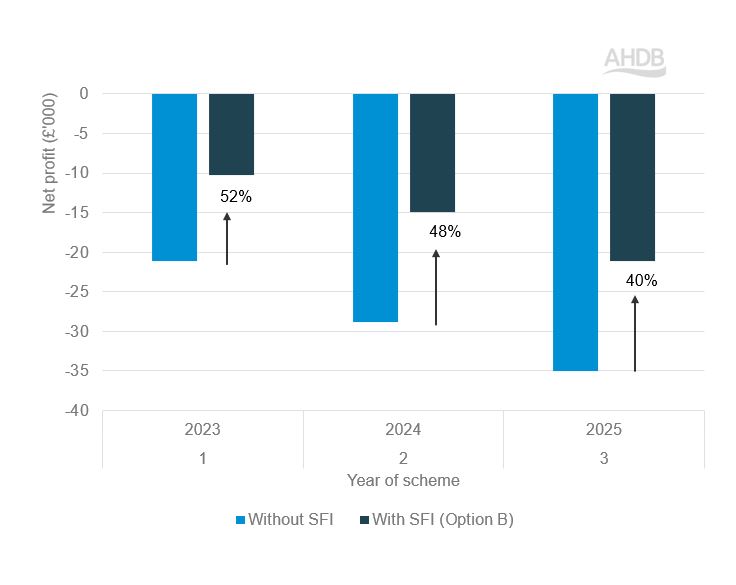

What’s the overall impact of option B on the 220 ha mixed farm’s net profit?

The more ambitious grassland actions in option B were carried out on 25 ha of the mixed farm’s land (11% of the total farmland area). Figure 7 shows that the mixed farm’s deficit reduced by up to 52% as a result of carrying out SFI actions under option B.

Figure 7. Effect on 220 ha mixed farm’s net profit level – option B

Source: AHDB

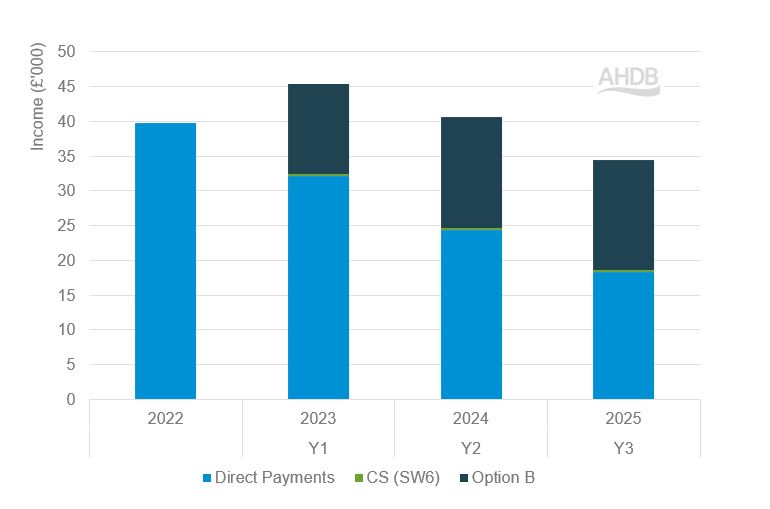

How much money can the 220 ha mixed farm make from option B (SFI ‘ambitious’)?

By selecting option B, the 220 ha mixed farm would receive £13,000 in year 1 and £15,900 in both years 2 and 3 (Figure 8).

Figure 8. Three-year projection of income received by 220 ha mixed farm from Direct Payments, CS and SFI actions – option B

Source: AHDB

See a breakdown of SFI (Option B) actions for 220 ha mixed farm.

Income from SFI in year 1 is lower than in years 2 and 3 for SAM3 (herbal ley) because there is an establishment cost in the first year.

The overall cost associated with managing grassland with very low nutrient inputs (LIG1) was greater than the payment rate after the cost associated with replacement silage for feed was factored in. However, the cost savings from the reduction in fertiliser usage outweighed this shortfall.

For IGL1 (take improved grassland field corners or blocks out of management), the farm is able to apply for a Countryside Stewardship capital grant to help cover fencing costs.

This highlights the advantage of option B over option A: higher payments are received for more ambitious environmental actions. However, these are still not enough to plug the gap left by Direct Payments.

Conclusions

The 2023 update of the SFI scheme offers farmers more flexibility in terms of choosing actions which suit their farms. However, only careful planning and selection will ensure each farmer benefits economically in their particular situation.

In this analysis, the 150 ha beef and sheep virtual farm benefited from taking part in the SFI to the tune of £9,400 per year in additional income for three years, topping up the existing £4,900 it was already receiving under CS. The 220 ha mixed farm was able to select both SFI arable and grassland actions and was £14,900 better off on average per year.

More ambitious actions require more land to be entered into the scheme, which may impact the forage potential of land entered, so there is a balance to be struck.

It is also worth considering what motivates you as a farmer: some actions may not give a good financial return straightaway but may provide benefits in future if it increases the productivity of your grassland.

Participation in the SFI alone is not enough to mitigate the loss of Direct Payments, but the right combination of actions could go a long way to make up some of the shortfall and act as a source of stabilisation for farm business incomes.

It is worth remembering that more SFI actions will be made available to farmers as the scheme progresses, providing more choice and sources of income. AHDB will continue to examine the details of the scheme as it develops and analyse its effects on levy payers.

With applications now open for SFI 2023, it is in farmers’ interest to investigate which options work for their farm to make the best-informed decision about their business.

Useful links

Environmental Land Management Schemes

Preparing for change: The characteristics of top performing farms

Farmbench: A business farm comparison tool