Will strong global dairy markets protect domestic milk prices?

Thursday, 4 March 2021

By Patty Clayton

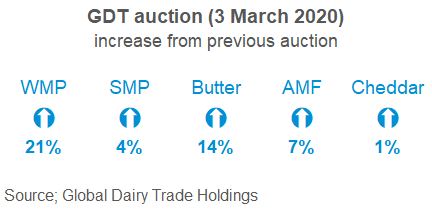

The 15% increase in prices at the Global Dairy Trade (GDT) auction has taken markets by surprise, with whole milk powder (WMP) prices rising 21% to a 7-year high. While these sort of increases aren’t expected to become the norm, GDT prices have been on an upward trend over the past 8 auctions.

The upward pressure is said to be the result of seasonally declining supplies in New Zealand combined with strong demand from China. Difficulties in securing shipping containers, and good consumer demand, is fuelling concerns over food security, leading to the flurry in buying activity.

These are positive signs for the global dairy markets, but to what extent will they impact on farmgate prices closer to home, where very little WMP is produced?

While the UK will not benefit directly from the higher WMP returns, they will encourage more milk to be directed into WMP leaving less available for other products. This will, in turn, provide support to the value of both fat and protein, pushing up prices of other dairy products.

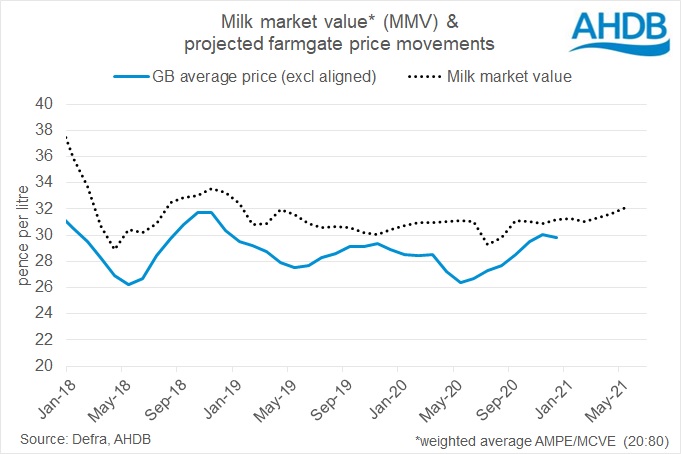

As farmgate milk prices[1] are essentially determined by returns available from the market, positive trends in global pricing will, in time, flow through into market-related farmgate prices. However, the extent to which domestic manufacturers will benefit from these higher prices will depend on their ability to access these markets, and the degree to which the additional costs of trade will dampen the overall returns.

A crucial element in how prices develop over the spring flush will be the extent to which excess milk supplies, particularly in the form of bulk cream and skim concentrate, can find a home. Trade with the EU has become more costly (and in some cases unviable) under the new trading conditions. As a result, we may not be able to take full advantage of the rising global prices, and may find domestic prices fail to reflect the higher global values.

Look out for our assessment of what is expected over the peak, both in terms of milk deliveries and our processing capabilities off the back of the recent Milk Forecasting Forum.

[1] excludes prices on retail aligned contracts which are linked to costs of production

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.