Will grain prices have a second wind? Grain market daily

Wednesday, 19 May 2021

Market commentary

- Nov-21 UK feed wheat futures made a small gain yesterday, closing at £178.75/t, up £0.20/t. As at 11.10 this morning, futures had continued to lose ground, down £2.25/t at 176.50/t.

- Paris milling wheat futures (Dec-21) have shown a very similar pattern, closing up €0.25/t yesterday, before losing €1.50/t so far this morning.

- Both sterling and the euro continue to make gains against the dollar. This is exacerbating declines in domestic grain pricing. The dollar has moved lower on weak economic data from the US and signals of support from the US Federal Reserve.

Will grain prices have a second wind?

Since the release of last week’s USDA world supply and demand estimates, both old and new crop global grain markets have lost a lot of ground. Part of this drop has been driven by larger than expected estimates for both old and new crop maize.

However, in spite of the latest estimates there is still a high volume of uncertainty. This is driven, in part, by weather concerns in Brazil. As such, we could yet see the old crop get smaller. This would impact the size of ending stocks and restrict supply both this season and next, all other things being equal.

The safrinha maize crop continues to be an area of concern, and as a result potential support, for markets. The crop was planted late, and has continued to develop in less than ideal conditions. According to Conab, 45.0% of the crop was flowering in the week ending 8 May. Further, 15.7% was emerging and 35.7% in a stage of yield development.

There was some brief respite for crops in Brazil with rainfall coming into the forecast for key regions (click here to see where key safrinha regions are). However, beyond next week Brazil looks dry once more.

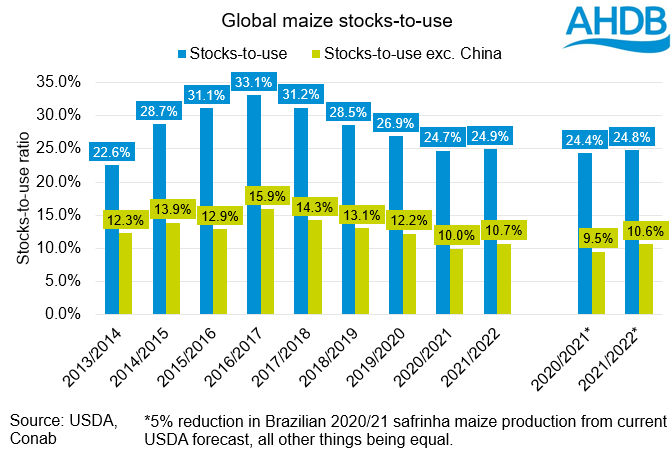

In the latest WASDE, the USDA estimated total maize production at 102Mt for Brazil. Using the USDA data alongside Conab data, we can look at the impact of potential reductions in Brazilian crops. All other things being equal a 5% reduction in Safrinha crop output from current forecasts would reduce the global maize stocks-to-use (STU) ratio for 2020/21 from 24.7% to 24.0%.

Doing the same calculation, excluding China, would push 2020/21 STU from 10.0% to 9.5%. Furthermore, the potential impact of a fall in old crop output by 5% would leave STU next season at 24.8%, compared to the current forecast of 24.9%.

The impact of any further tightening will largely depend on the stocks figure currently being traded. But, we can expect further dryness in Brazil to add fresh support to prices.

Of course there are many other factors which could influence the global stock level. We need to watch the development of the US crop closely, as well as Chinese demand for feed grains.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.