Will biodiesel imports ease tightness in EU rapeseed markets? Grain market Daily

Wednesday, 6 November 2019

Market Commentary

- UK feed wheat futures (May-20) rose yesterday to £148.50/t, up £2.15/t from Monday. New crop futures (Nov-20) gained £2.45/t, to close at £156.00/t.

- UK FoB wheat is offered at £145.00/t for November shipment (basis 4Kt vessel), bids are currently below this value.

- China has announced today the resumption of imports of Canadian beef and pork, the ban had been in place since June. Canadian canola producers hope this positive step will extend to a resumption of canola imports.

Will biodiesel imports ease tightness in EU rapeseed markets?

The EU is forecast to import 6.0Mt of rapeseed this season. So far this season, EU imports of rapeseed to 03 November have totalled 2.68Mt. Ukraine origin accounts for 2.12Mt of this supply. However, this supply is expected to cease in the New Year as Ukrainian record rapeseed export schedules near completion.

However, as mentioned , alternative origins will have to make up the remaining deficit, which could prove difficult with the GM nature of the Canadian supply, and weather challenges in Australia. One alternative is an increase in the volume of EU imports of biodiesel towards the second half of this season.

What about biodiesel imports?

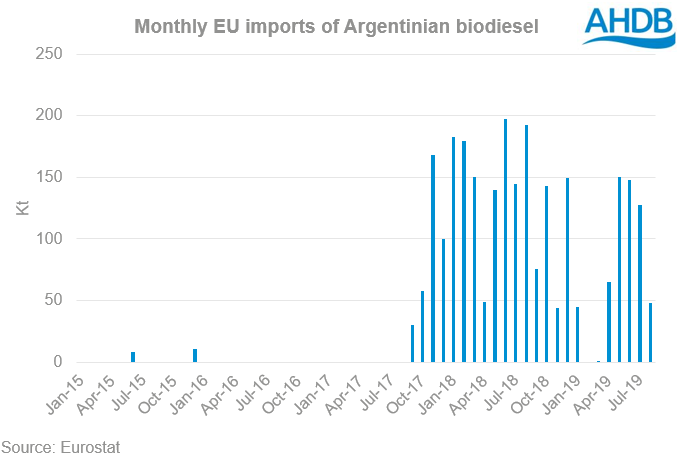

EU imports of biodiesel have been on a large rise since the effective removal of the EU imports ban in 2015. In February 2019, the EU announced the implementation of a 1.36BL duty-free quota on imports of Argentinian biodiesel.

Throughout October, the price of FoB Argentinian biodiesel has remained at its lowest point of $780.00/t since early February this year. Prices have largely fallen with the continued US anti-dumping duties on Argentina, impeding exports of biodiesel to the US.

EU imports of Argentinian biodiesel increased from 355.7Kt in 2017 to 1.64Mt in 2018 as Argentina seeks to find an alternative markets. So far this year to August, imports have totalled 582.9Kt, this is below volumes last year which totalled 1.23Mt by August.

With a large deficit of rapeseed in the EU this season, biodiesel production is likely to be affected. Whilst imports of Argentinian biodiesel have been slow so far this year, there is the potential of increased imports into 2020.

This could suppress demand for rapeseed oil and rapeseed in the latter winter period, before biodiesel producer’s switch to cheaper veg oils, like palm oil and soyabean oil, for summer production months.

So, as we head into the spring period, less demand for rapeseed oil in the face of biodiesel imports could ease the tightening EU rapeseed supply and demand balance.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.