Australian wheat woes worsen: Grain Market Daily

Friday, 18 October 2019

Market Commentary

- UK feed wheat futures climbed yesterday on the back of Australian crop woes (read more below), prices have subsequently fallen this morning.

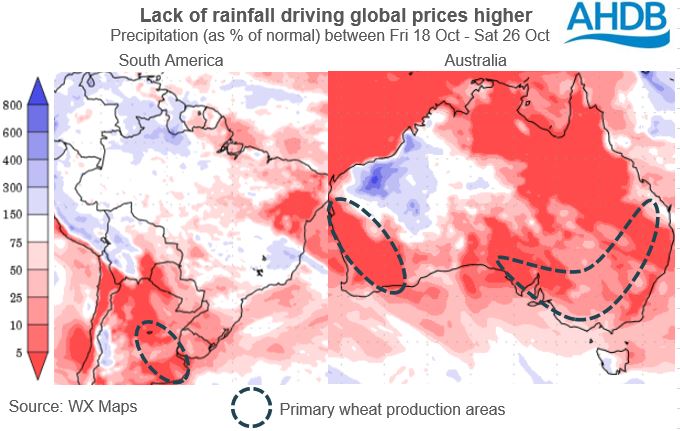

- Globally concerns over southern hemisphere wheat will continue to be a key driver of price.

- Following yesterday’s GASC tender, the Saudi Arabian state grain buyer (SAGO) has tendered for the purchase of 595Kt of milling wheat for delivery between February and March 2020.

Australian wheat woes worsen

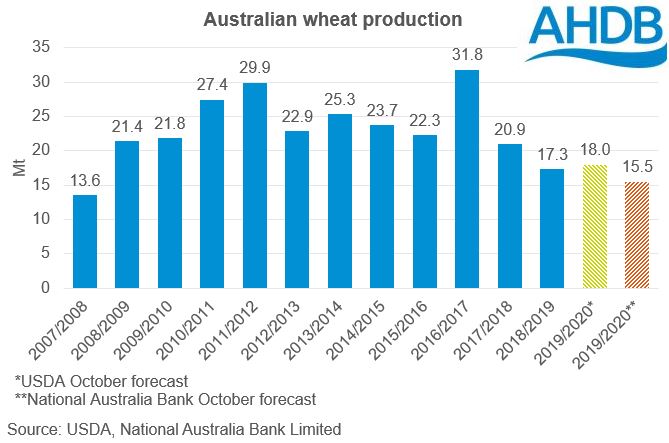

UK feed wheat futures have gained £2.50/t this morning as Australian weather woes reach new levels. A forecast of Australian wheat production from National Australia Bank limited has pegged output at 15.5Mt, the latest forecast is 4.5Mt below the bank’s forecast from last month, and 2.5Mt below the latest USDA estimate.

The reduction in Australian production follows the ongoing drought conditions which have hampered crop development through the Australian spring. The outlook for rainfall in Australia remains stunted and the continued trend for dryness will be a key influencer of global grain markets for the coming months.

If the NAB forecast is realised, Australian exports of wheat could be limited to their lowest level since 2007/08 at 7.5Mt.

Will currency limit the impact for UK markets?

While the Australian woes have caused UK feed wheat futures (Nov-19) to spike yesterday, going forward the impact of Southern Hemisphere concerns on UK markets will be heavily dependent on developments in the House of Commons.

Parliament is due to sit tomorrow to debate and vote on the latest Brexit deal proposed by Johnson. Although there is still a long way to go with Brexit – recent developments have been view positively by foreign exchange markets with sterling at its highest point against the dollar since 13 May.

If a deal is agreed in Parliament this weekend sterling will appreciate further. As sterling rises the impact of movements in international markets on domestic markets is lessened and may represent a large risk for domestic grain and oilseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.