Where next for wheat prices? Grain Market Daily

Wednesday, 2 September 2020

Market Commentary

- Global wheat and maize markets have continued to rally, in spite of recent bearish supply and demand reports. In the last 15 days, UK feed wheat futures (Nov-20) have gained £8.10/t, to close yesterday at £169.35/t.

- UK feed wheat values continue to be heading for a retest of £170.00/t, a level last hit in June at the height of the concerns around Russian drought and global supplies.

- Sterling is a key driver of UK prices at present, and has rallied considerably against the dollar over the last two months, closing yesterday at £1=$1.3383. This is the highest point since December.

Where next for wheat prices?

UK futures are not moving independently, and the recent surge in UK and Paris futures has been heavily dictated by movements in US markets. Exports from the US of wheat, maize and soyabeans to China and the rest of the world have been strong in recent weeks, with the demand drive outweighing the supply picture.

How is the technical picture looking?

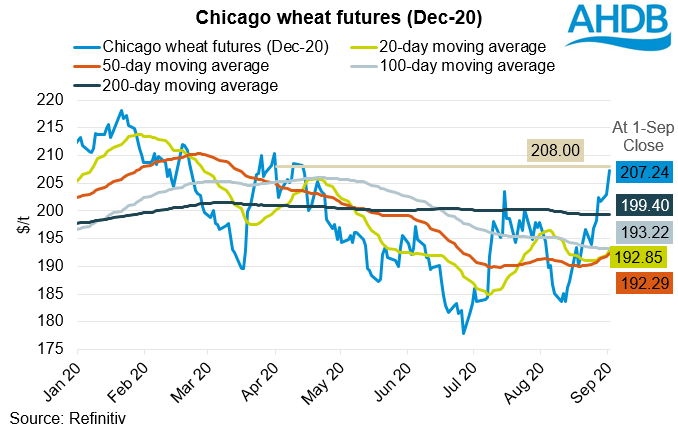

Looking at the more technical picture for US wheat, the Dec-20 contract at yesterdays close was heading towards being technically overbought. Prices have fallen back in early trading today, but there are still a number of bullish signals. The 20-day moving average has crossed over the 100-day moving average, and the 50-day average is heading in a similar direction. Prices in Chicago futures are likely to retest $208.00/t, a level not hit since 13 April 2020.

What are the drivers going forward?

If Chicago wheat pushes back up towards the $208.00/t level, the ability for this to be sustained will be dependent on continued demand for US grains and oilseeds. In the week ending 20 August, net sales of 1.45Mt of corn and 776Kt of wheat were recorded for the current and next marketing year.

Aside from demand drivers, supply drivers also need watching closely. Weather has continued to be a key talking point throughout this season, and as Charlie highlighted on Friday will continue to be watched closely. Dry conditions have reduced crop conditions across the US for corn and soyabeans. Furthermore, dryness is also a concern in Argentina and the Russian spring crop regions.

Additionally, we need to be aware of the impact of global availability of wheat. Anecdotal comments from Refinitiv suggest that grain origination may be slow, this in turn may support values.

What does this mean for UK values?

With the UK set to import large volumes of grain this season, be that maize or wheat, prices of UK grain will continue to track the global sentiment. If prices continue to rally globally, we could well see continued support for UK futures. However, the extent of the support will be impacted by the value of sterling against the dollar.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.