Southern Hemisphere weather watch for wheat market sentiment: Grain Market Daily

Friday, 28 August 2020

Market Commentary

- Following recent increases in the value of US maize, the European Union yesterday (27 Aug) removed the tariffs on Maize imports into the EU. The previous tariff, was reduced to €0.28/t on Wednesday (26 Aug), having been set at €5.48/t since 12 August. The EU operates a floating tariff system for maize which responds to changes in market value.

- CBOT soybean markets (Nov-20) reached the highest levels since January yesterday. This increase in prices is being driven by continued demand from China and the potential for reduced production levels in the US as a result of an extreme weather front.

- UK wheat prices (Nov-20) closed at £168.75/t yesterday, a rise of £2.00/t. Firm Chicago futures have been one of the main drivers. This continues a steady period of price growth since 11 August.

Southern Hemisphere weather watch for wheat market sentiment

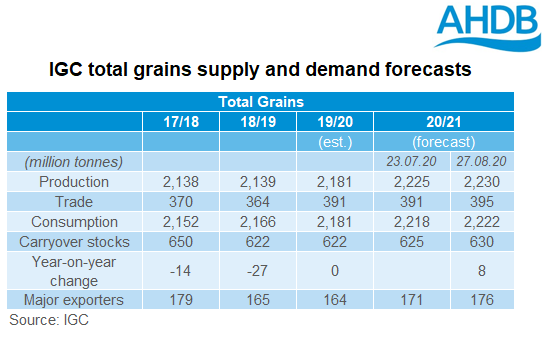

The International grain council (IGC) released their most recent global forecasts for 2020/21 yesterday (27 August). The new estimates now forecast total grain production at 2230Mt, an increase of 5Mt on the previous estimate. Increases in both wheat and coarse grain production led an overall increase in ending stocks.

Despite these signs of growth on a global scale, this sentiment is not necessarily being felt in all regions. Recent market sentiment has been dictated by adverse weather in the US. Furthermore, there are several factors to consider which could impact global wheat production in the coming months.

Firstly, the UK and EU are still anticipating low production figures after considerably adverse weather conditions throughout both the planting and harvest seasons. The EU commission has now reduced its common wheat production estimate to 113.5Mt, a decrease of 3.2Mt on their previous estimate from July.

Secondly, the risk of La Niña has now increased in both Argentina and Australia. The impacts of La Niña vary between regions, in Argentina a La Niña event leads to drier conditions which would likely have a detrimental effect on crop conditions

Crop conditions in Argentina are already suffering after a drought and a higher percentage of wheat is now being classed as ‘fair’ or ‘poor’.

Australia’s risk of La Niña has now been upgraded from ‘La Niña watch’ to ‘La Niña alert’ according to the Australian Bureau of Meteorology. The impact for Australia is likely to be a high-pressure system, which often leads to increased rainfall. This may be beneficial to their yields, but has the potential to cause issues for crop quality if rains persist later in the season.

So despite, the overall bearish nature of the IGC crop report, current and future climatic drivers need watching closely for future market sentiment and price direction.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.