Where matters for wheat this year? Grain Market Daily

Tuesday, 7 July 2020

Market Commentary

- Maize and soyabean futures both added to last week’s gains yesterday amid forecasts for hotter than normal weather in the US Midwest this week. Hot, dry conditions can be particularly damaging to the yields of crops going through their reproductive stages as they are currently, so this is important to monitor.

- As at 5 July, the percentage of soyabeans rated as in a good/excellent condition was unchanged from the previous week, while maize recorded a 2% point decline.

- Nov-20 UK feed wheat futures only gained £0.30/t to £167.00/t yesterday. The gains in US prices were largely offset as sterling crept higher again against the US dollar.

- Paris rapeseed futures (Nov-20) closed at €380.00/t yesterday, up €1.50/t from Friday’s close, likely following the wider gains in oilseed markets.

Where matters for wheat this year?

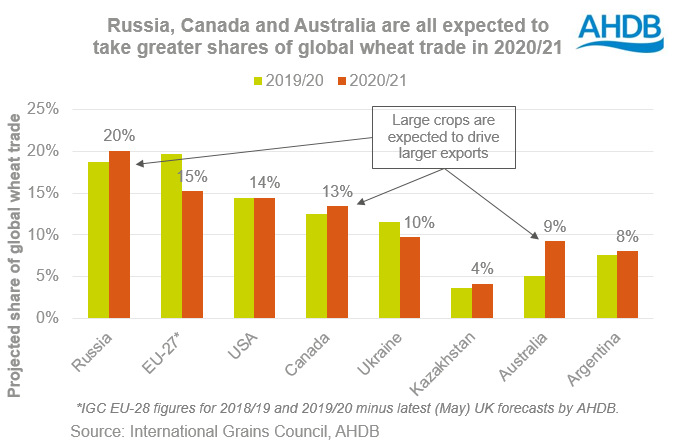

Expected larger crops in Australia, Russia, Canada, Kazakhstan and Argentina mean that they are all expected to supply a larger share of the world’s wheat trade in 2020/21. This means news relating to these countries, whether around crop sizes or exports will be more important than normal to markets.

The current view of the global wheat market is that it’s looking well supplied in 2020/21 but there’s still potential for greater pressure or more support if crops come in larger or smaller.

My take would be particularly to watch the Russian crop forecasts given the uncertainty over the estimates with poorer than expected yields from early harvest.

Northern Hemisphere

As the harvests gather pace, here are a few things to look out for in the next couple of weeks:

- USDA’s monthly World Supply and Demand Estimates are out on Friday (10 July). Crop forecasts for all the major exporters will be worth a look, plus the July report usually includes the first supply and demand forecasts by class for US wheat.

- There’s uncertainty over the size of the Russian crop due to contrasting conditions in northern and southern European Russia (AMIS). As often one of the lowest price supplies of wheat onto the global market, a swing in the size of the Russian crop could see markets react.

- French harvest is underway and FranceAgriMer will release its first forecasts of supply and demand in 2020/21 tomorrow (8 July).

- In the UK, AHDB will release the results of its Planting and Variety Survey tomorrow at 2pm. Trade data for May will also be released by HMRC on 10 July.

Southern Hemisphere

- Conversely, dry weather is hampering planting in Argentina and last week the Buenos Aries Grain Exchange reduced its area forecast. Monthly crop estimates from the Rosario Grain Exchange are due out on Wednesday (8 July).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.