Wheat prices and cash flows; what should you look out for: Grain Market Daily

Friday, 19 June 2020

Market commentary

- Nov-20 London feed wheat futures closed at £164.50/t, closing £0.30/t lower. In overnight trading CBOT wheat futures are lingering near 8-month lows, hit yesterday as the pressure of looming global harvests grows. Sept-20 CBOT wheat traded as low as $4.85 per bushel ($178/t / £143/t).

- Egypt’s state buyer GASC purchased 240kt of wheat from Black Sea origins yesterday. Suggestions that Russia’s crop could reach over 80Mt will pressure global markets amid aggressive sales into N. Africa.

- Tunisia purchased two 25kt barley cargoes for shipment Aug 25th-Sept 25th. Prices were $196.3/t CIF, equating to £157.50/t. Taking into account freight and costs, this would mean UK FOB prices for a 25kt vessel would need to be circa £139.50/t. Our FOB survey on Tuesday reported 4kt FOB at £135.50, so the UK is a viable option for this tender given our weakness against the US dollar in which global markets trade.

- French crop ratings stable on the week, with 83% of maize in good-excellent condition. Favourable EU maize conditions will pressure feed markets come harvest in late summer

Wheat prices and cash flows; what should you look out for

Here’s what we know so far for the 2020/21 growing season

- The UK wheat crop will be significantly lower in 2020 leading to larger imports.

- Cash flows will be impacted well into 2021.

- Global stocks outside of China are forecast to rise.

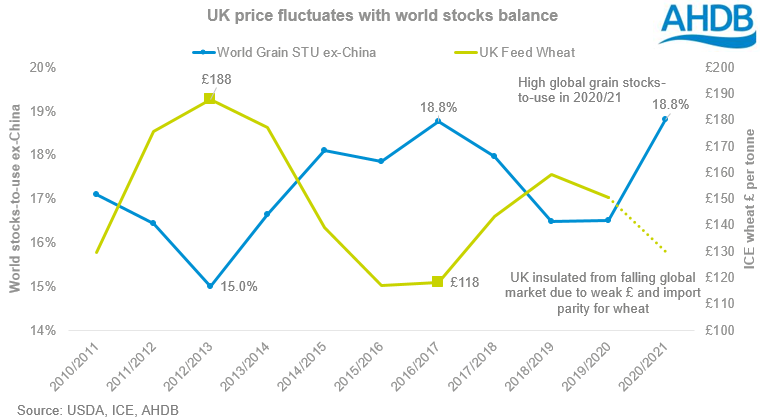

Let’s start with a global point of view. For 2020/21, USDA data suggests that the global grains stocks-to-use ratio excluding China (maize, wheat, barley, sorghum, oats) will be 18.81%. The last time the ratio reached this level in 2016/17 ICE feed wheat futures traded closer to £120/t.

So we could assume that UK wheat prices are going to come under pressure. However, pricing at import parity and weak sterling against the euro and US dollar is protecting UK values.

Despite prices being supported by weak sterling, we’re still likely to see tight cash flows from the smaller harvest.

In order to smooth the peaks and troughs of cash-flow, we need to think longer-term and combine cash flows and budgets for the 2020/21 and 2021/22 seasons.

So what does the 2021/22 price look like?

Once harvest is over, and the UK deficit is known, there’ll be a rush to plant every possible acre with wheat in the UK (assuming weather allows this time!). So despite 2020/21 being a tight crop year, sentiment will soon shift to the longer-term view of markets.

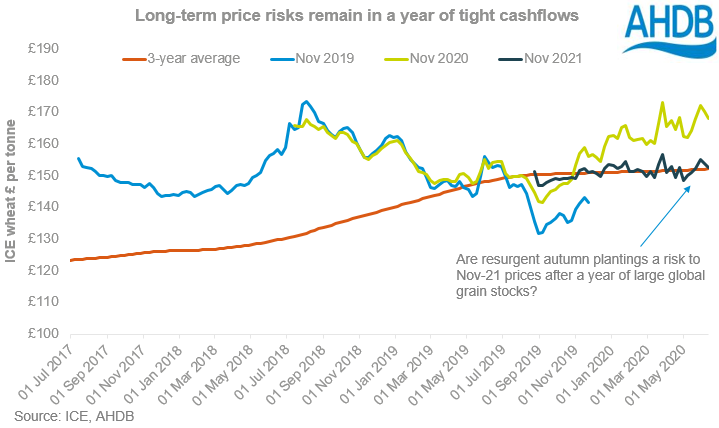

Looking against the 3-year average, November 2021 prices in the early months of its life have been tracking the average closely.

Resurgent plantings in late summer could push the Nov-21 prices to large discounts to Nov-20 as Helen went into in more detail last week.

So if we’re heading into 18 months of variable cash flows, there are three key risks to look out for:

- Sterling strengthens against the US dollar, reducing import parity prices and barley export competitiveness.

- Larger world stocks outside of China adds negative sentiment to market.

- Rebound of production in 2021 and Nov-21 futures move below 3-year average.

Have you factored these risks into your marketing plan, cash flow and business plan for the next 2 seasons?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.