What will drive the rapeseed price for harvest 2023? Grain market daily

Wednesday, 21 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £277.50/t, gaining £3.00/t from Friday’s close. The Nov-23 contract closed at £265.60/t gaining £2.55/t over the same period.

- Domestic and global markets were supported by renewed concerns about grain leaving the Black Sea. This comes as referendums in four Ukrainian regions (with Russian installed leaders) will take place this week on whether they should be part of Russia or not.

- Paris rapeseed futures (Nov-22) closed at €574.75/t, gaining €3.25/t from Monday’s close. Rapeseed markets followed soyabeans higher as the US soyabean harvest is progressing slower-than-expected.

What will drive the rapeseed price for harvest 2023?

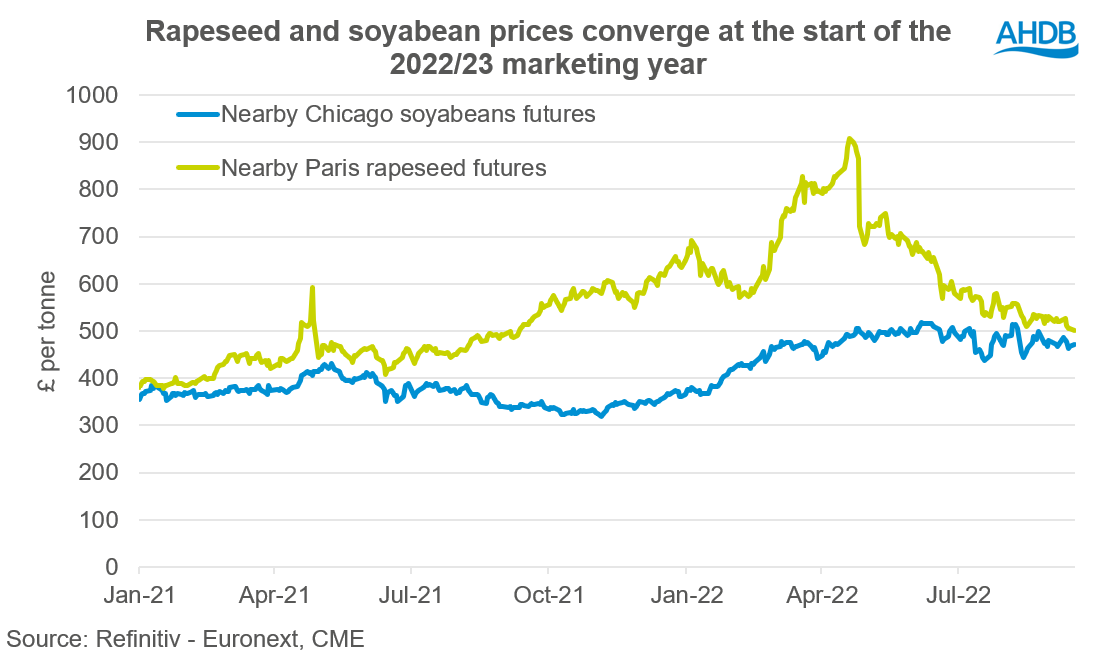

Last week Chicago soyabean futures (Nov-22) gained 2.6% (09 Sep to 16 Sep) due to a slight downward revision to global soyabean production in the latest USDA World Agricultural Supply and Demand Estimates, which tightened global ending stocks. Over this same period Paris Rapeseed futures (Nov-22) lost 3.4%, pressured by the on-going Canadian canola harvest. This divergence in price movements has led to further reductions to the premium of oilseed rape over soyabeans.

From June 2021 to May 2022, rapeseeds premium over soyabeans grew significantly. The premium started to grow in the summer of 2021, driven by drought across Canada impacting canola production. Canadian canola production in 2021/22 came in at 13.8Mt, down 29.4% year-on-year. The premium of oilseed rape grew further when Russia invaded Ukraine.

However, the premium started to come down from the end of May this year, as there were signs of a deal being negotiated to allow exports from Ukraine out of the Black Sea. Further to that, EU and Canadian respective rapeseed and canola crops did not encounter any major weather impacts this year. Last week, data released from Statistics Canada showed a rebound to the Canadian crop for 2022/23, up 38.8% on the year to 19.1Mt. Canola harvest in Canada started around a month ago and is on-going.

Over the 2021/22 marketing year the price ratio (rapeseed/soyabeans) between Chicago soyabeans and Paris rapeseed (in sterling terms) averaged 1.53. However, since the start of the 2022/23 marketing year, the convergence in the two oilseeds has meant the price ratio is now at 1.14 on average so far (01 Jul to 20 Sep).

So, what does this mean?

With ample global supply of rapeseed/canola this season and relatively in-elastic demand, ultimately the soyabean market will have a greater influence on rapeseed prices once again this season.

Key watchpoints that will influence soyabean (and rapeseed) prices over the next 6 months will be:

- US soyabean; although the crop is developed and matured, focus now turns towards harvest. As at 18 September, the USDA estimated that 3% of the US soyabean harvest was complete, behind last years and the five-year average pace of 5% by this point. Weather in the US Midwest over the next month will be a watchpoint, as rains could delay harvest. Currently, rains are expected over parts of this region in the next week.

- A record soyabean crop is expected from Brazil. In its first estimates for the new-crop, Conab currently peg production for Brazil at 150.4Mt, up from 125.6Mt in 2021/22. Other consultancies are around this figure too. According to Ag Rural, plantings of soyabeans is starting in the Mato Grosso region of Brazil, on irrigated soils. In the coming month, plantings will progress in Brazil and on-going rains will be welcomed – this will be a key watchpoint.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.