What’s ahead for global markets this week? Grain market daily

Tuesday, 3 November 2020

Market commentary

- There were mixed movements in grain markets yesterday, mainly driven by weather and economic / political uncertainty. May-21 UK feed wheat futures closed at £187.30/t, down £0.50/t.

- Weather forecasts look favourable to the ongoing US maize harvest and improved for developing crops in South America. However, the week on week improvement in US winter wheat crop conditions was less than a poll by Refinitiv showed the market had expected.

- Oilseed prices declined again yesterday as dry weather in the US allowed the soyabean harvest to near completion. Paris rapeseed (May-21) closed at €383.25/t, down €2.75/t from Friday.

- After the US markets closed, the USDA reported that the US soyabean and maize harvests had progressed less the market expected. This could offer some support to prices today.

What’s ahead for global markets this week?

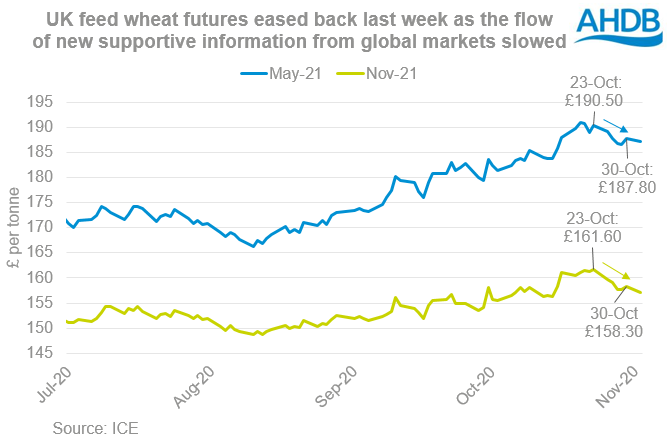

UK wheat futures prices eased back a bit last week after generally rising since mid-August. The main drivers of the rise were strong purchases of US maize by China and concerns about planting winter wheat for harvest 2021 in Russia, Ukraine and the US. Worries about weather conditions in South America have also been a factor.

A rising (bull) market needs new supportive information each day to keep it rising. In the absence of new supportive information and some improvements to weather forecasts (more in yesterday’s Market Report) prices have eased.

The below factors look set to influence prices over the coming week:

- Currency – There’s a strong likelihood of currency volatility in the coming days as the main voting period for the US election gets underway later today. Results are usually expected around breakfast time in the UK on the Wednesday. A stronger US dollar would pressure US prices and given the influence of US exports on markets currently, such pressure would be more likely to filter through to UK prices. Conversely, a weaker US dollar would support US prices and potentially global values too.

- Speculative risk – Selling by speculative traders likely contributed to the recent falls in global grain and oilseed markets. However, given the size of the long positions held last Tuesday (27 Oct), they’re still likely to hold sizeable positions in Chicago maize, wheat and soyabean futures. Any further falls in price could trigger more selling activity and in turn accelerate the fall.

- Changing weather forecasts – Currently weather forecasts look a bit more favourable for Brazil with rainfall expected, which could help newly planted soyabean crops. However, drier weather is expected to return to Argentina, which will not be beneficial. Heavy but patchy showers are expected in the Black Sea region. Temperatures and rainfall over the next few weeks in Black Sea region will be key to the winter crops emergence and early development ahead of winter. If crops go into winter in poor condition, there’s a greater risk of winter damage. On Thursday, the AMIS report on global crop conditions may offer some more insight, along with weekly reports from the Rosario and Buenos Aries grain exchanges.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.