Market Report - 02 November 2020

Monday, 2 November 2020

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

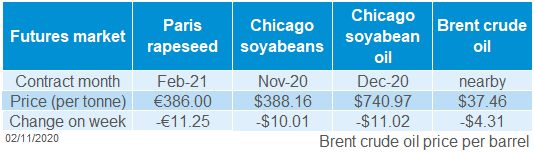

Paris rapeseed futures (Feb-21) closed Friday at €386.00/t (£347.40/t), losing €9.75/t over the week (Mon-Fri). Rapeseed markets were pressured by wider declines in both oilseed and crude oil markets. This morning, as of 11.00AM GMT, the contract had lost a further €3.50/t to be at €382.50/t (£344.80/t).

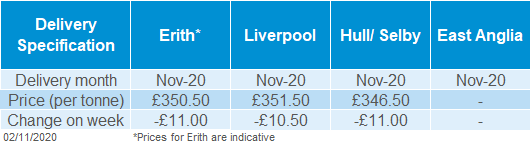

UK delivered rapeseed (Nov - into Liverpool) was quoted at £351.50/t on Friday, losing £10.50/t from the week previous.

EU+UK customs surveillance data highlighted rapeseed imports from non-EU origins totalled 2.06Mt as of 25 Oct, down 22% versus the same point last season. Ukraine accounted for 67.6% of the imports so far this season, with Canada at 28.0% and Serbia at 2.0% in second and third place respectively.

Wheat

Global grain markets

Maize

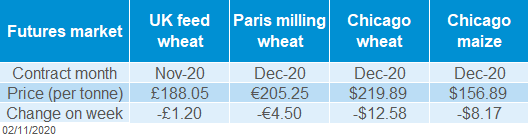

Global grain futures

Barley

The global wheat rally ran out of steam last week due to rain reducing drought worries in key production areas. However, more rain is needed in many parts and therefore prices remain supported.

Recent rainfall across parts of the US and Brazil led to maize prices also moving lower last week. However, import demand by China and reduce crop size forecasts continue to support the market longer-term.

UK focus

Barley is still pricing at a huge discount to wheat in order to remain export competitive. It is also reportedly pretty much maxed out in domestic animal feed rations currently.

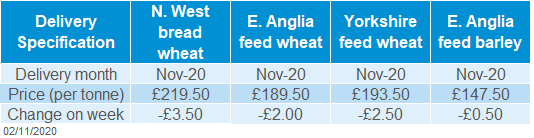

Delivered cereals

Global grain markets took a breather last week, losing some of their recent gains. This follows long awaited rains in the US, South America and the Black Sea easing some production concerns for new crops in these key wheat producing regions.

There is also some nervousness in the markets regarding the ongoing coronavirus pandemic and the economic impact that further lockdown restricts could have on markets.

The latest US crop progress report had maize harvested at 72% as at 25 Oct, up from 60% the previous week and 38% at this time last year. Winter wheat conditions were also reported for the first time this season. With 41% good to excellent and 19% poor or very poor, this is the second worst ratings at the start of the season since 1995.

On Thursday, the International Grains Council (IGC) cut global maize production for 2020/21 by 4Mt, to 1.156 billion tonnes. This was to reflect dry conditions in the US, Ukraine and EU. Global wheat production for 2020/21 was marginally increased by 1Mt to 746Mt.

The key message from the MARS EU crop report last week was that rains across Europe in late September and early October provided mixed blessings. In some parts they eased drought concerns, however in other areas it put a stop to the maize harvest or delayed the beginning of the autumn drilling campaign. This said, there is still a chance for the timely completion of autumn drilling, should we see favourable conditions in the coming weeks.

Oilseeds

Despite sustained losses throughout the week, May-21 London wheat futures found support on Friday, closing at £187.80, up £1.20/t from Thursday’s close. New crop (Nov-21) wheat futures also firmed on Friday, closing up £0.70/t at £158.30/t.

With England set to move into another lockdown for at least 4 weeks on Thursday, it will be interesting to see how this affects the market. We know from the lockdown in spring that demand for flour and baked goods through retail was strong, which largely counteracted reduced demand from food service. However, pubs and restaurants closing will likely further reduce demand for malting barley during this lockdown period, which was already expected to be down this season.

Global oilseed markets

Global oilseed futures

Rapeseed

Fears over rising global coronavirus infection rates offered pressure to oilseed markets last week, though Chinese demand for soyabeans remains a longer-term bullish factor. Markets also await the results of the US election tomorrow which could bring elevated levels of volatility.

Soyabeans

Rapeseed markets tracked the losses in oilseed markets last week, with uncertainty in currency markets impacting too.

Rapeseed focus

UK delivered oilseed prices

Oilseed markets saw large declines over the week. Losses in crude oil markets were a large factor in the drops following expectations of reduced demand because of stricter lockdown measures in countries with surging coronavirus infection rates. Brent crude (nearby) fell 10.3% ($4.31) in the week to close at $37.46/barrel on Friday.

A long run of frequent Chinese purchases of US soyabeans over the last couple months saw soyabean prices reach the highest level since July 2016 last Monday. However, as bearish news followed in the week, the Chicago soyabeans Jan-21 contract fell 2.5% ($10.0/t) from Monday to Friday to close at $388.10/t on Friday. The US election tomorrow (3 Nov) brings volatility to commodity markets, with dollar currency markets most likely to be affected in the immediate future.

One vein of support for oilseed markets was a slow start to Brazilian soyabean planting following dryness concerns disrupting schedules. However, a return of some rainfall to fields across Brazil recently curbed the bullish sentiment. Planting pace increased 15% in the week to 23% planted by 25 Oct. Data released tomorrow should give updated figures on planting completion.

Reportedly some Brazilian states have made significant progress and are back to average planting levels – if confirmed could provide further bearish sentiment. Rainfall levels will be an important watch point over the next few months, especially given the occurrence of a La Niña weather event.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.