What falling global dairy exports could mean for the UK

Wednesday, 5 August 2020

By Kat Jack

Global exports in dairy products are forecast to fall by 4.1%* in 2020, according to the UN Food and Agriculture Organisation (FAO). This would be the steepest contraction in around 30 years if realised, as import demand drops in multiple countries. Imports are generally anticipated to decline due to COVID-19-related market disruptions and widespread economic slowdowns. The steepest declines in imports are expected to come from China, Algeria, Saudi Arabia, United Arab Emirates, Vietnam and Mexico. On the upside, this would be slightly offset by increased imports from countries like Canada, Indonesia and the Republic of Korea. But what does this mean for the UK?

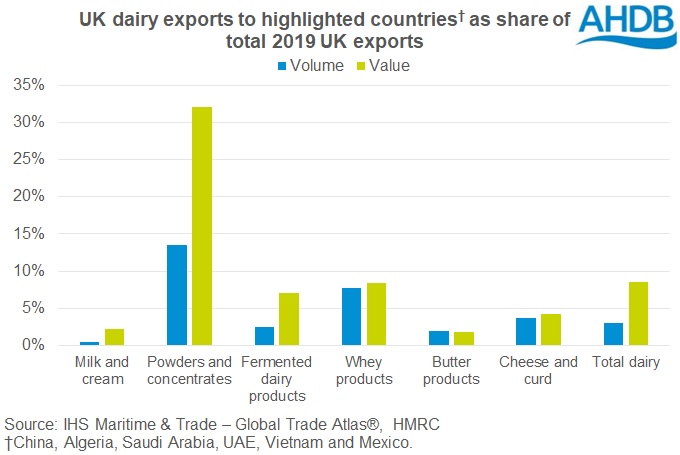

In the grand scheme of things, reductions in demand from this particular group of countries won’t have a large impact on overall UK dairy export** volumes, as the vast majority of our exports are destined for the EU (91% in 2019). The six countries expected to have the most severe import reductions accounted for 3.1% of UK dairy export volumes in 2019. The three countries highlighted for growth accounted for just 0.2% of volumes.

However, the losses will be more noticeable for specific markets, and for individual companies. For example, China and Algeria are big importers of milk powders, and are relatively important markets for UK exporters. In 2019, the UK exported around 8,000 tonnes of milk powders and concentrates to each of these countries, together accounting for 10% of annual volumes and 27% of the total value.

On the growth side of the FAO expectations, Canada is notable as a destination for premium UK cheese. The 1,800 tonnes of cheese exported to Canada in 2019 was only 1% of the UK’s cheese exports that year, but with an average price of £7,700/tonne it is likely a valuable market for those supplying it.

Although a relatively small amount of UK dairy gets exported outside the EU, UK markets may still feel the influence of changing global import levels on pricing. If world export supplies are not balanced to match the loss in demand, this could limit the volumes the UK is able to export, and put downward pressure on prices.

*In milk equivalent (note subsequent figures are not milk equivalent)

**Products in HS codes 0401-0406. Note that this includes approximately 800k tonnes of raw milk crossing the border into Ireland for processing.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.