What does the US stimulus package mean for arable markets? Grain Market Daily

Wednesday, 25 March 2020

Market Commentary

Currency & financial markets

- The US government and senate have agreed a new stimulus package to try and reduce the impact of the coronavirus outbreak on the US economy. The $2 trillion dollar package which includes a raft of measures aimed at supporting the US economy still needs to go through congress but is viewed as a step in the right direction.

- In response to the US stimulus the value of the US dollar fell back, reaching £1=$1.1903 at 9.30am, compared to yesterday’s close of £1=$1.1757. The Dow Jones Index has also gained strength, increasing by 11.37% yesterday.

Grain & oilseed price impact

- The weakness in the dollar supports the value of US priced commodities. With the subsequent strength in the value of the euro and sterling pressuring domestic prices.

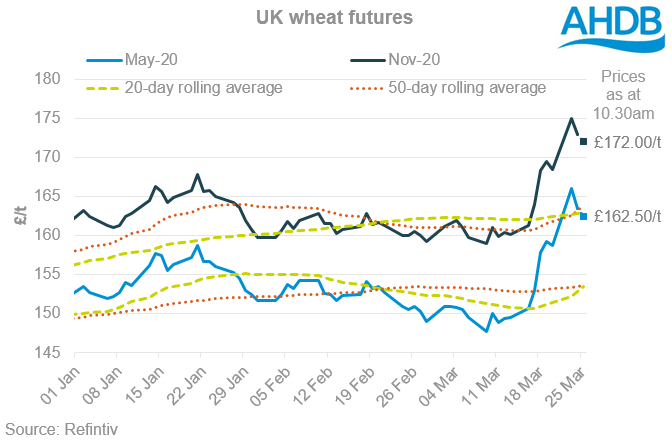

- UK feed wheat futures (May-20) closed £2.50/t lower yesterday, £163.50/t. While, new crop (Nov-20) futures closed at £173.00/t, a fall of £1.95/t on the day. Values have fallen back further again in early trading this morning, if the dollar continues to weaken today we could see further losses for domestic grains.

- Both May-20 and Nov-20 futures currently sit well above their respective 20 and 50-day rolling averages.

Supply and demand

- There has been fundamental support for vegetable oils in recent days, with some Malaysian palm oil plantations ordered to close to try and stem the spread of coronavirus. Nearby Malaysian palm oil prices reached their lowest point since late-October last Thursday (19 March), but have gained 6.2% to yesterday’s close, and increasing further this morning.

- Soyabeans have also seen support of late, driven by a number of factors, including increased US export demand and potential increases in US animal feed demand following reduced ethanol production. The latest support comes from proposed grain movement restrictions in parts of Mato Grosso, Brazil. The Mato Grosso region produces 30% of the countries soyabeans.

- The support from soya and palm hasn’t filtered into EU rapeseed prices. The stronger euro relative to the dollar has curtailed any price rises.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.