What does a weaker sterling mean for UK trade? Grain market daily

Thursday, 1 May 2025

Market commentary

- UK feed wheat futures (May-25) closed at £161.65/t yesterday, up £0.35/t from Tuesday’s close. The Nov-25 contract gained £0.40/t over the same period, to end the session at £183.00/t

- Domestic wheat prices followed global grain markets up yesterday, with Chicago wheat futures (May-25) up 1.4% over the same period. Support came from bargain buying and short covering with recent low prices leaving the market oversold (LSEG)

- Nov-25 Paris rapeseed futures ended yesterday’s session at €466.75/t, down €7.25/t from Tuesday’s close

- European rapeseed prices followed downwards pressure in the wider oilseeds complex yesterday. LSEG revised up its EU-27+UK rapeseed production estimate for 2025 yesterday by 1.8% to 20.2 Mt. Though drought risk remains for part of Europe

What does a weaker sterling mean for UK trade?

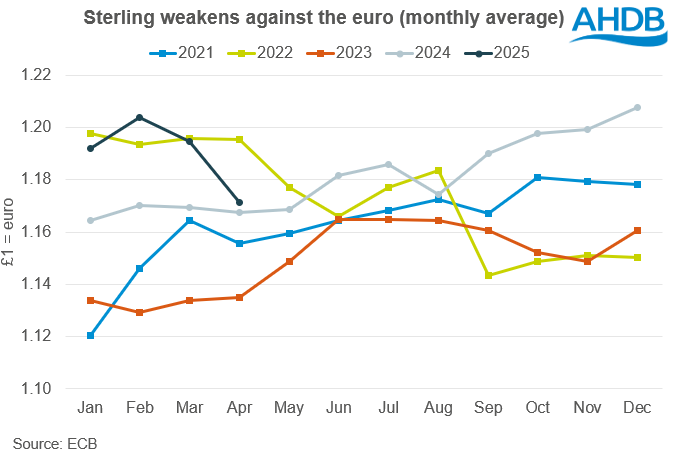

Despite reaching eight-year highs earlier this year, since February, sterling has continued to weaken against the euro. In mid-April, sterling fell to £1 = €1.151, the lowest point since December 2023. While the exchange rate has somewhat stabilised since then, sterling remains much weaker against the euro than earlier in the season.

On average, 65% of wheat imports, 51% of maize imports, 91% of wheat exports and 89% of barley exports have been to/from the EU over the last five years (2019/20 – 2023/24). As such, it’s important to consider what impact this fluctuation in exchange rate could mean for domestic trade.

Typically, when sterling strengthens, we see imports pricing more competitively, while exports become more expensive on global markets, as demonstrated earlier this marketing year. Equally, when sterling weakens, we would expect UK exports to become more price competitive, and imports to be less attractive for UK buyers.

According to the latest HMRC trade data, from July–February, UK imports of wheat (incl. durum) had reached 2.16 Mt, while maize imports totalled 1.99 Mt. While this is historically very high for both crops for that point of the season, pace is expected to slow significantly for the remainder of the season, with full season estimates at 2.70 Mt and 2.65 Mt respectively.

Season to date (Jul–Feb) wheat exports totalled 109 Kt, while barley exports reached 379 Kt. Full season estimates are currently at 250 Kt and 600 Kt respectively, suggesting an uptick in export pace for the rest of the season.

In summary, over the second half of the marketing year, a weaker sterling against the euro compared to earlier in the season is expected to support exports, while curbing the volume of imports coming into the UK. Of course, there are other factors to consider such as demand on the continent, and how price competitive imports from other origins may be.

Also, while exports are expected to pick up pace, they are still forecast well below average. However, the exchange rate will be a key factor in whether current estimates are met, and what that means for grain carried into next season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.