What could the impact be on harvest 2023 from high input costs? Grain market daily

Friday, 20 May 2022

Market commentary

- UK May-22 wheat futures ticked up slightly yesterday, gaining £3.20/t on the day to close at £336.30/t. Meanwhile, new crop (Nov-22) futures moved in the opposite direction, down £9.30/t over the same period, closing at £330.80/t. New crop contracts followed downward moves from profit taking on Chicago contracts, and news that a pocket of wheat exports could still be available from India.

- FranceAgriMer today reported worsening crop conditions for French wheat and barley. Record May temperatures and drying conditions have seen French wheat conditions downgraded to 73% good excellent by 16 May, down 9 percentage points from the week before. Winter barley also fell 8 percentage points over the period, to 71% good to excellent. Significant rain will be needed in early June to stave off losses, stated the agency.

- After imposing a wheat export ban at the weekend, India is considering allowing the 1.8Mt of wheat stuck at its ports to be shipped. This is after announcing on Tuesday that wheat currently going through customs will be permitted for export.

What could the impact be on harvest 2023 from high input costs?

Last week I took you through the impact Mark’s nitrogen fertiliser application scenarios could have for harvest 2022. But what about harvest 2023?

Megan looked at gross margin calculations yesterday for harvest 2023, the reality showing that, unsurprisingly, margins could well be squeezed to a greater degree next season due to the higher input costs. These higher input costs could see some either reduce their nitrogen applications, reduce their cropping areas, or both. These adjustments could be necessary for businesses to optimise their margins, or because of a less liquid cash flow. So, for harvest 2023, there are a couple of variables we need to consider. Firstly, there are the adjustments in nitrogen fertiliser application. Secondly, there are potential reductions in area of certain crops. The scenarios below outline the potential implications of these variables on production for the 2023/24 marketing year.

Introducing the different scenarios

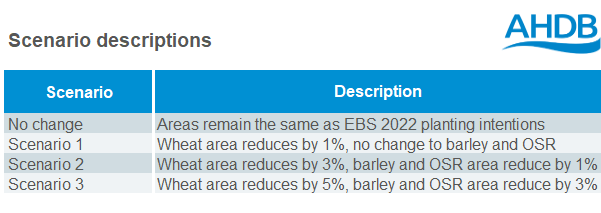

Four different options have been considered for this modelling work. The first would be a benchmark i.e. assuming there is no difference in area for harvest 2023 than that estimated by the Early Bird Survey for harvest 2022.

The following three scenarios all see key cropping areas reduce by a set percentage. Wheat is assumed to see the greater area reduction, due to the higher input costs. Area reductions are taken against the area forecast in the Early Bird Survey for harvest 2022.

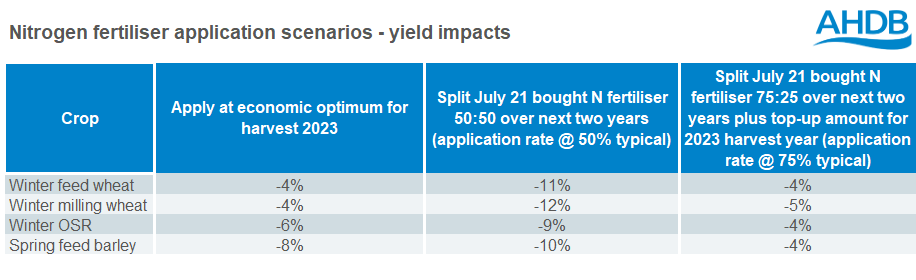

Against these different area scenarios, the following nitrogen fertiliser application strategies are overlayed.

These options, originally explained by Mark’s analysis, would see fertiliser either applied at the economic optimum, 50% of typical application rates or 75% of typical application rates. A point to note here is that the higher input costs for next season would see a yield reduction in all three cases.

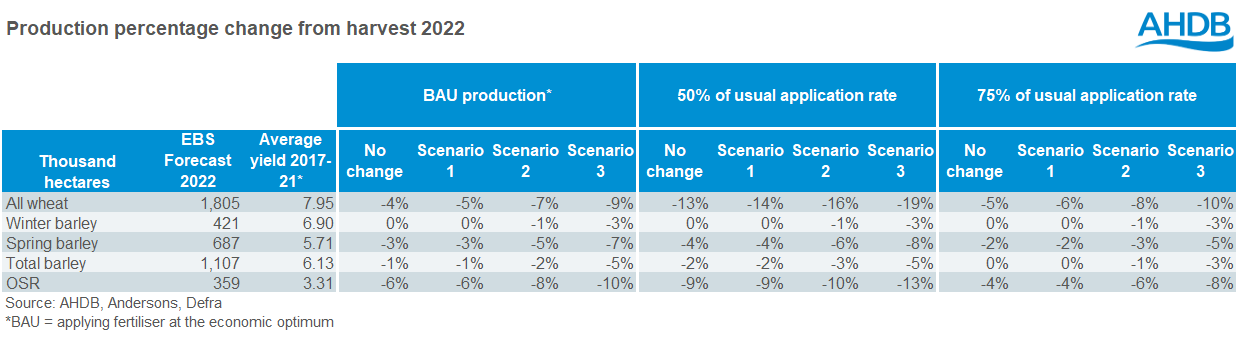

If we take a no change in area to be based upon the planting intentions for 2022 outlined in the Early Bird Survey this year, the rise in input costs mean that if fertiliser is applied at the economic optimum, a reduction in production is seen across all crops.

So, what could the impact be on production for harvest 2023?

The table below highlights that, in all circumstances, we could see a production decline in wheat, barley and oilseed rape (OSR) for harvest 2023. The most minimal impact would, unsurprisingly, be felt if no area change is seen on the year and fertiliser is applied at the economic optimum.

Moving down the scenarios, the greatest impact is felt with the largest area reductions and at 50% application rate of fertiliser.

However, there are several key points and caveats that need to be taken into consideration with this modelling work. Firstly, these production figures are assuming average yields. Obviously, there is a lot of time and weather between now and harvest 2023 that can affect growing conditions. Secondly, there is the fluctuation of fertiliser price and availability, particular over the coming months when it will be being purchased. The most recent anecdotal quotes for nitrogen fertiliser are around £705/t, a fall from the £839/t being quoted in March. However, availability remains challenging and further price volatility is not off the table, especially considering the current natural gas forward prices. Thirdly, there is the price of grain itself, and the potential margin it could offer for growers. UK Nov-23 futures closed yesterday at £270.65/t. This is a rise of £96.60/t since the contract opened last July and £106.15/t more than where the Nov-22 contract sat at this point last season. And fourthly, if farmers cut area in the light of higher input/fertiliser costs, they will normally cut least-productive land first. This could mitigate the yield impact from fertiliser application reduction to some extent.

What could this all mean?

All the while the global supply shocks continue, driven by the conflict in Ukraine and weather worries in global exporters, volatility in both input and output costs will remain. As ever, margin is a key element when considering planting intentions. However, the availability of cash flow could be a hurdle for some when looking to optimise crop potential.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.