What could happen to delivered premiums going forward? Grain market daily

Thursday, 9 June 2022

Market Commentary

- UK feed wheat futures (Nov-22) closed at £302.50/t yesterday, down £2.50/t from Tuesday’s close. The May-23 contract closed at £308.70/t, dropping £1.30/t over the same period.

- Whilst domestic prices were down slightly, global wheat prices continue climbing as significant exports from Ukraine are looking more unlikely.

- Chicago wheat futures (Dec-22) closed at $404.78/t yesterday, up $1.83/t, from the previous day’s close.

- Nov-22 Paris rapeseed futures saw a rise of €7.75/t from Tuesday’s close, settling at €785.75/t. This increase is again a likely result of the doubtful export potential of Ukraine.

What could happen to delivered premiums going forward?

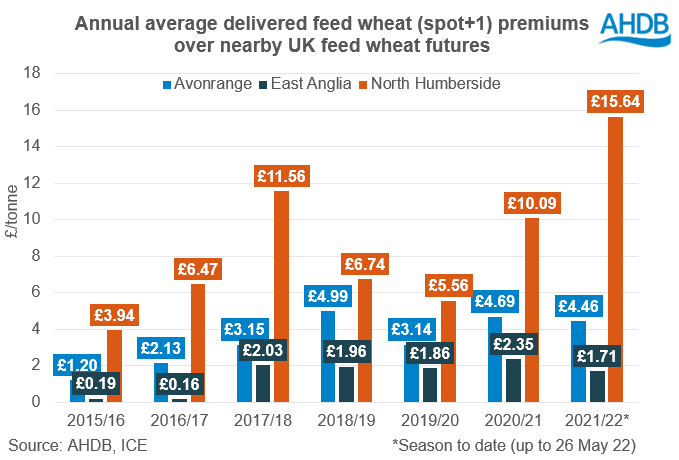

Throughout this marketing year, delivered premiums in the North on average have been at their highest in comparison to the previous few years. At the beginning of February, wheat for spot+1 delivery into North Humberside reached a £24.25/t premium over nearby UK feed wheat futures.

Demand in the North has been supported by the increased production of bioethanol in the area. Further south, the premium of wheat delivered in to Avonrange and East Anglia has been lower than last season, due to higher supply.

New crop premiums (Nov-22) are looking much lower than in 2021/22. Using the latest delivered prices (26 May), wheat delivered into North Humberside for November is estimated to be at a £9.00/t premium over futures. However, wheat delivered in November into East Anglia is currently at a discount of £0.50/t.

Northern demand

It’s clear looking at the North Humberside delivered prices that there is a strong correlation between UK bioethanol production and higher premiums. Following the announcement that Vivergo planned to cease production in September 2018, the premium of delivered feed wheat over futures dropped in the area. North Humberside feed wheat premiums fell from an average of £11.56/t in 2017/18 to £5.56/t in 2019/20. So far this marketing year, now that both bioethanol plants are operating again in some form of capacity, spot+1 prices for North Humberside delivered feed wheat have risen to an average of £15.64/t over futures.

Rising domestic demand to soften premiums

With robust demand for wheat in the area, it may indicate that the premium over futures will remain strong. However, as explored in Tuesday’s Grain Market Daily, wheat production in the Yorkshire and Humber area is likely to be higher next season, in line with a rise in total UK output. In turn this could contribute to the smaller delivered premium as mentioned above.

As well as a rise in production for 2022/23, wheat carry in stocks are expected to be higher than previous seasons at 1.893Mt. Taking into account a minimum import requirement, this will lead to a higher availability of wheat domestically next season.

Conclusion

If both bioethanol plants remain operational, demand for feed wheat in the North will continue to be strong. However, it’s important to note that an increase in production in the area could weaken the higher delivered premiums we’ve seen of late. Further south and in East Anglia, with higher domestic availability expected for 2022/23, going forward the discount of delivered wheat to futures may increase.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.