What could our wheat production be this harvest? Grain Market Daily

Tuesday, 7 June 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £317.50/t, gaining £20.00/t on last Wednesday’s close (01 Jun). May-23 gained £19.70/t over the same period, closing yesterday at £323.25/t.

- Our domestic market followed the Chicago and Paris markets higher yesterday. This bullish spur comes as fresh news from the Black Sea suggests disruptions to shipments out of Ukraine look to continue, as the conflict intensifies in the country.

- Paris Rapeseed futures (Nov-22) closed yesterday at €799.25/t, gaining €28.50/t on Friday’s close. Rain in parts of the Canadian prairies over the coming week could potentially leave some canola fields unsown. This is a watchpoint, not a major cause for concern, as large parts of their crop will have been sown already.

What could our wheat production be this harvest?

Time seems to come around fast, but next month, parts of England could start harvesting 2022 crops weather allowing.

After a dry April, the wetter May that we have had in parts of GB over the last month could possibly bring plenty of corn and hay this harvest. Sunshine hours this month too are critical for UK grains to take advantage of recent welcomed rains.

The latest crop development report to the 24 May, can give us an insight into the size of GB’s wheat crop this harvest. In the article, I use the latest winter wheat crop condition figures and apply them to yields scenarios, using the DEFRA June Survey, to give us an indicative production for harvest 22.

The scenarios are as follows:

- Excellent – five year maximum yields.

- Good – five year average yields plus 5%.

- Fair – five year average yields.

- Poor – five year average yields less 5%.

- Very poor – five year minimum yields.

I use these yield scenarios and apply them to our Early Bird Survey to estimate regional figures.

Please note that the latest planting figures will be out in our Planting & Variety Survey which is set to be published in July. We are entering the final stages of data collection. 5 minutes of your time to compete the survey can provide a great help to our industry.

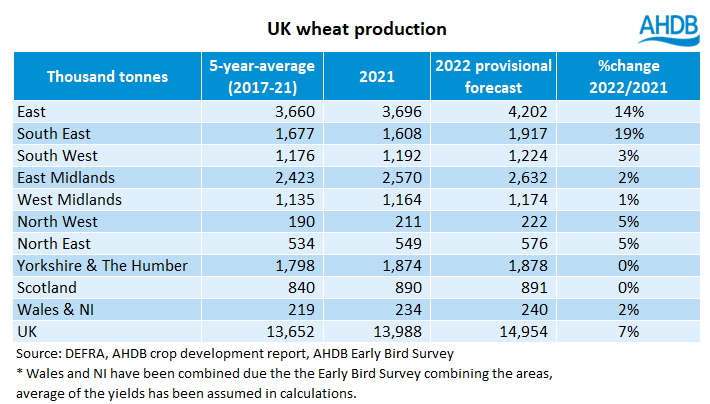

UK production estimate

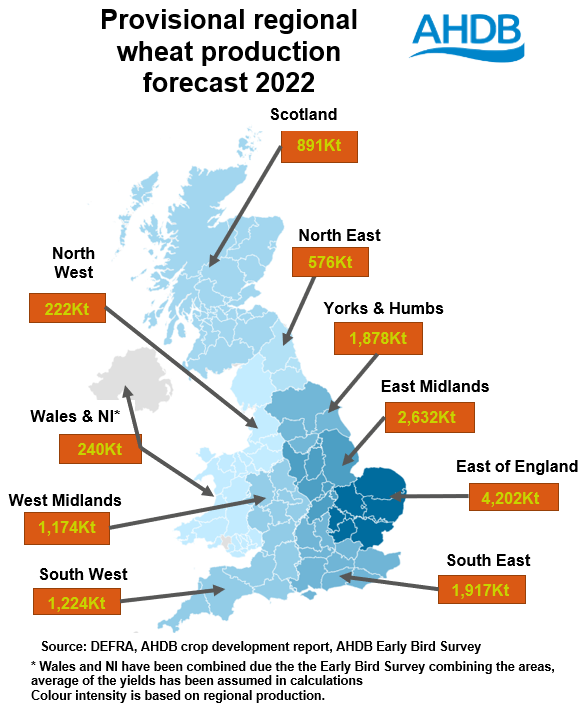

Using the method outlined above, the UK’s 2022 wheat production is estimated to be 14.95Mt. This is up 7% on last year’s crop of 13.99Mt, and 10% up on the 5-year-average.

Every region is estimated to rise in production. In GB, the largest year-on-year rise being in the Eastern and South East region, where production out of the two regions could collectively increase by 815Kt. This is a 15% increase year-on-year.

Marginal increases are only recorded in Yorkshire & the Humber and Scotland, where production increases are estimated at 3.9Kt and 0.6Kt, respectively. In Yorkshire though its worth noting that production out of this region is still 4% above the five-year-average, which could potentially temper feed wheat premiums, into the 2022/23 marketing year. Though bioethanol demand will be something to watch in this region.

Conclusion

To conclude this production is just an indicative figure for the coming harvest and there may be significant regional differences based on the GB crop condition scores. This analysis is assuming these conditions proportionally represent every region.

Comparing these conditions against yields, the UK production for this coming harvest could increase year-on-year. This may decrease our reliance on large imports for the 2022/23 marketing year should no other factors change and requirements be met by domestic grain.

Further to that, fertiliser adjustments may also impact UK production this coming harvest. Read more information in Vikki’s article analysing production impacts from reduced nitrogen fertiliser strategies.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.