What are the impacts of coronavirus on domestic markets? -podcast: Grain Market Daily

Friday, 27 March 2020

Market commentary

Currency and financial markets

- The value of sterling has continued to rally since my last GMD (Wednesday). At yesterday’s close £1=$1.220 and £1=€1.106. Sterling has continued to gain strength today. Dollar weakness is likely a key driver of the recent strength, with US data released yesterday showing a record number of citizens claiming for unemployment support.

Grain and Oilseed prices

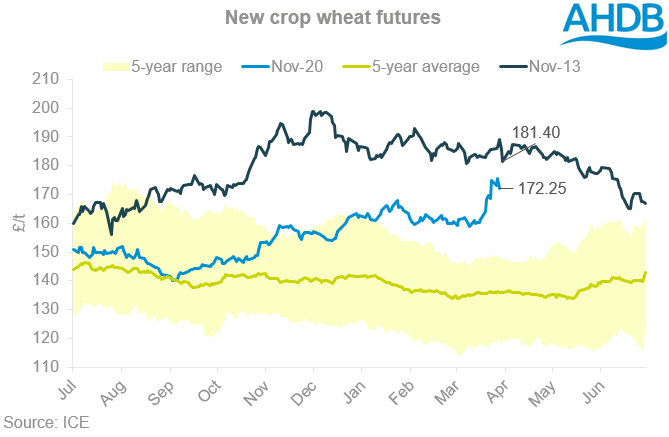

- UK feed wheat futures have been increasingly volatile in the past week, but lost significant ground on sterling strength yesterday. Old crop futures (May-20) closed at £162.25/t, a fall of £3.45/t on the day. Meanwhile, new crop (Nov-20) futures closed at £172.25/t, a fall of £3.25/t.

- Both old and new crop markets have gained strength today, although sterling has limited the greater gains seen in Paris markets from filtering into UK prices.

- Even with the large declines seen yesterday, November futures continue to represent good value. New crop futures are at their highest point for this time in the season since March 2013.

Supply and Demand

- David, Peter and I recorded a podcast covering some of the important fundamental issues created by coronavirus and the implications for this in the domestic market, this is now available here.

- Another key question for grain markets has stemmed from uncertainty over Russian export supplies, and challenges in obtaining phytosanitary certificates. In response to this and the weaker Rouble we have seen the value of Russian cash prices climb.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.