US winter wheat condition – does it matter right now? Grain market daily

Wednesday, 30 November 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £252.75/t, up £0.15/t on Monday’s close. The Nov-23 contract closed at £236.65/t, down £0.35/t over the same period.

- Minimal movement on the domestic market. However, Paris wheat futures (May-23) were down yesterday as competition from cheaper Black Sea supplies capped prices. Record Russian harvest combined with the continuation of the export corridor is creating competition for EU origin.

- Chicago soyabeans gained on Tuesday as investors optimistically hoped that China will ease COVID-19 measures after rare protests unsettled markets on Monday. Paris rapeseed futures (May-23) were also supported closing at €589.25/t yesterday, gaining €3.50/t on Monday’s close.

US winter wheat condition – does it matter right now?

Although there has been a lot volatility in cereals and oilseeds markets, apart from South American crops the global supply for the most part is set for this marketing year.

As we enter the midst of the Northern Hemisphere winter, focus will now start to turn towards winter crop conditions for 2023 harvest, and this is something that could impact forward prices and market sentiment.

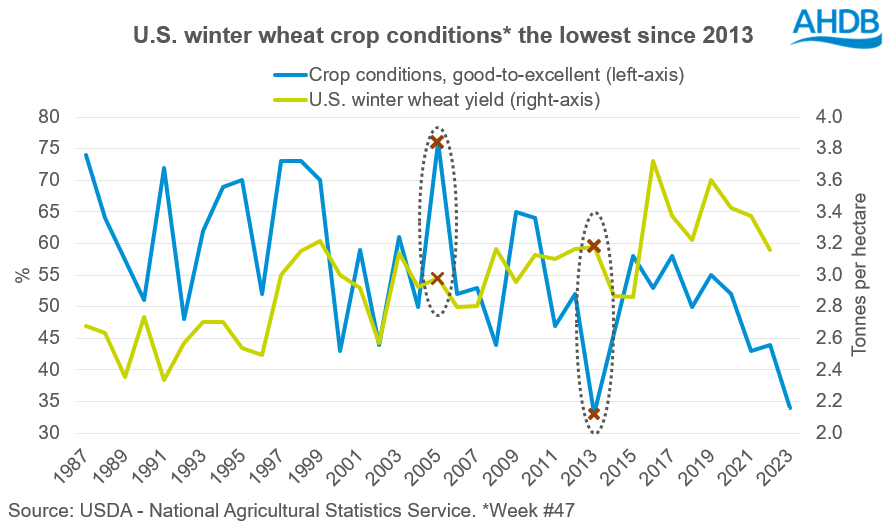

In yesterday’s crop progress report, the USDA pegged U.S. ‘good-to-excellent’ winter wheat conditions at 34%, slight improving on last week’s report by 2 percentage points. For this respective week (week #47) this is the second worse crop condition score going back to 1987.

Based off 5-year-averages, the U.S. account for 6% of global wheat production and 12% of global exports, therefore this makes them a key player in setting global market sentiment. Since the last update just over a month ago, the drought conditions in key winter wheat states have not improved. However, does this really matter for the moment?

Based on historic data there is a not an absolute positive link between winter wheat crop condition scores and final winter wheat yields.

For example, in this same point in November 2012 good-to-excellent crop condition scores were at 33%, the worse ever recorded, but U.S. winter wheat yields for harvest 2013 remained relative stable at 3.2t/ha. In November 2004, the same week’s ratings were pegged at 76%, the best-ever recorded; however, winter wheat yields were estimated at 2.98t/ha.

Although these reports are good at providing an insight into the current crop conditions, it’s not the end of the world if conditions are not the best, as there is a lot of weather to play out in springtime that will ultimately drive yields.

Does this uncertainty create support for a market that will dissipate as we head out of winter and hence present an opportunity to take advantage of a price being supported by a theoretical rather than actual supply and demand question?

The first insight into GB crop conditions score is provisionally expected to be released this Friday (02 Dec 2022). Full analysis and insight will be on our crop development page and released in our grain market daily publication.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.