US pig prices similar to Germany as ASF developments shape Chinese trade

Wednesday, 28 October 2020

By Bethan Wilkins

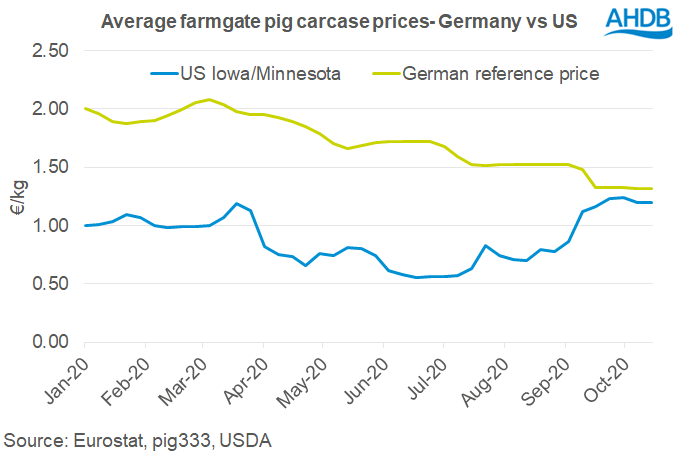

US pig prices have risen sharply since the summer. Since mid-September, the US Iowa/Minnesota carcase price has hovered around $1.40-$1.45/kg, the highest prices for this time of year since 2015. In contrast, back in June prices were little over $0.60/kg.

Meanwhile in Germany, prices have declined sharply over the same timeframe. The German reference price has been about €1.32/kg for over a month. Prices fell from €1.52/kg in early September, following the discovery of African Swine Fever (ASF) in the wild boar herd close to the Polish border. In the summer, prices had been over €1.70/kg.

In euro terms, the US pig prices are currently around €1.20/kg, remarkably close to the latest German averages of €1.32/kg. Prices are generally not entirely comparable between countries; on a like-for-like basis the two quotes would probably be even closer together as German producers typically face larger deductions (e.g. for transport costs) according to data from Interpig.

Many key export markets, most notably China, closed to German pork following the ASF discovery. Germany is a large exporter, so these restrictions on pork marketing have understandably dampened the value of German pigs. However, this also created an opportunity for other rival exporting nations, such as the US. ASF in Germany has therefore helped support the US pig market.

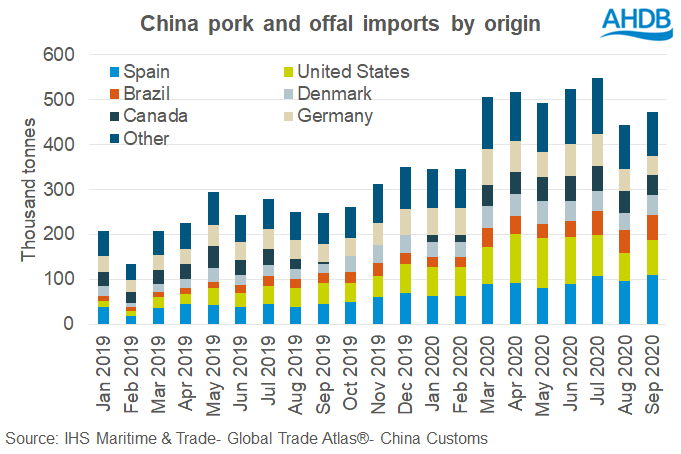

Germany’s presence on the Chinese import market had already been weakening this year, with US pork gaining market share. In 2019, Germany supplied 16% of Chinese pig meat (and offal) imports by volume. This had fallen to 11% by August this year and drops to 9% in September. Even before German pork was banned in mid-September, some plants had voluntarily suspended shipments due to COVID-19 outbreaks. The suspension of shipments from a variety of plants due to difficulties with coronavirus outbreaks has likely influenced the lower Chinese import volumes in August and September, compared to earlier in the year.

At the moment it is difficult to see any potential upside for German pig prices, unless a regionalisation agreement is reached with China that allows pork to be shipped again. Germany is also facing a situation where reduced slaughter capacity has led to a backlog of slaughter-ready pigs developing. This is clearly challenging for prices at farmgate level, but does limit excess meat supplies further up the supply chain. When these extra pigs do eventually come through, German meat prices may be further pressured, unless demand can rise to match this extra supply. COVID-19 means the outlook for all these factors is very uncertain.

The UK is a net importer of pig meat, of which over 20% comes from Germany. Monitoring how German prices are developing is important for the British pork industry. US prices may also become important in the future, if a trade deal is agreed that allows improved access for US pork. Usually, US pork is considerably cheaper than EU product, but the current developments mean that right now, the most competitively priced pork is probably much closer to home.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.