Upwards market moves as political tensions rise: Grain market daily

Tuesday, 22 February 2022

Market commentary

- The May-22 UK feed wheat futures contract closed yesterday at £223.00/t. This is up £0.50/t from Friday’s close. The Nov-22 contract gained £1.00/t from Friday to close yesterday at £205.00/t.

- Paris rapeseed futures (May-22) gained €12.25/t (1.74%) yesterday, to close at €716.00/t. The Nov-22 contract gained at a slower pace (+€6.50/t) but closed the day at another record high for the contract (€626.50/t).

- US markets were closed yesterday due to Presidents Day. The latest commitment of trader’s report showed soyabean net long positions (as at 15 Feb) were the highest since May-21, indicating a bullish market.

Upwards market moves as political tensions rise

News of Russian troops moving into separatist areas of Ukraine will dominate trading direction today.

If further incursions occur, global grain, oilseed, and oil markets will likely jump up today. This is on concerns of disrupted supply from the key producing Black Sea region.

Oil markets are particularly driven by Russian-Ukrainian tensions. Crude oil has moved as high as $99.50/barrel so far this morning, the highest price since September 2014.

Malaysian palm oil (nearby) jumped $42.51/1 (2.8%) to close yesterday at $1478.46/t (6,177MYR/t). This is an all-time high for the contract. Since the start of January 2022, the price of palm oil (nearby) has gained 17.3% and continues to move higher today.

On the back of rising oil markets, Paris rapeseed futures will also be supported.

For both grains and rapeseed prices, the UK will track global movements. So far today, May-22 UK feed wheat futures has traded as high as £5.50/t above yesterdays close.

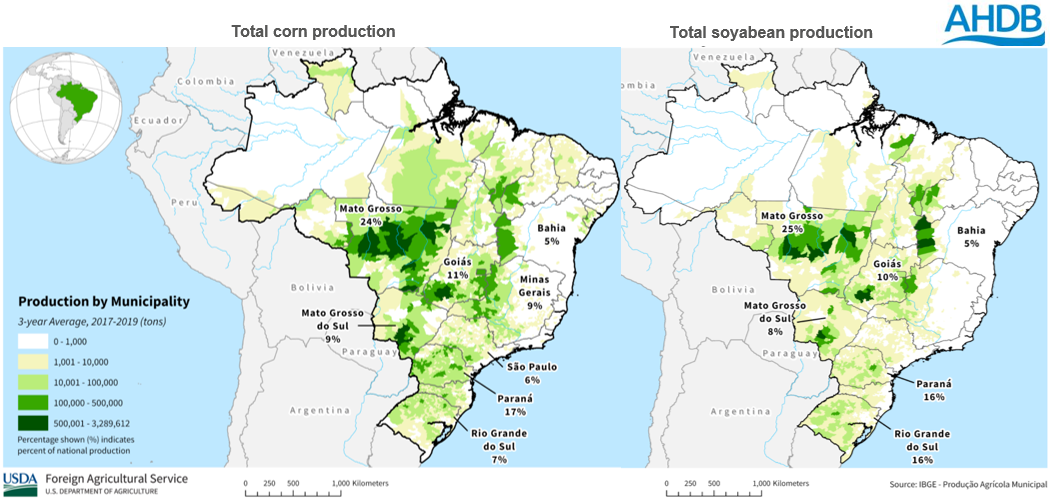

Meanwhile, South America continues to be affected by adverse weather. Parts of Brazil, particularly the key grain producing state of Mato Grosso, have received excessive rainfall. At the same time, southern states remain dry. There were already concerns surrounding yield and quality of soyabeans, but this will likely exacerbate the matter. Also, excessive rain will likely hold up planting of the second maize crop. The second maize crop is estimated to account for 77% of Brazilian maize production in 2021/22 (Conab). The current rainfall could offer decent soil moistures for the second maize crop. However, this is only providing it doesn’t delay soyabean harvest too much and prevent planting.

Also, the State Statistics Service in Ukraine preliminary forecast pegs winter wheat plantings at 6.54Mha. This is down 5.3% from 2021 and sits well below the Ag Ministry’s forecast of 6.66Mha in late November.

Ukraine is an important player in global wheat markets, estimated to make up 12% of global exports in 2021/22 (USDA). Sentiment could add support to markets but even if total production fell 5.3% year-on-year, it would still be near record highs.

As previously mentioned, any movement or support to global wheat prices would in turn support domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.