Unpicking the UK-Canada continuity agreement: Grain Market Daily

Tuesday, 15 December 2020

Market Commentary

-

UK feed wheat futures (May-21) lost £4.50/t yesterday in a large correction from Friday’s Russia and sterling led rally. Despite the fall the May-21 contract still closed at £194.60/t.

-

Sterling closed yesterday at £1=€1.0974, despite trading as high as £1=€1.1055. Movements against the dollar have understandably been less erratic in the past couple of days. With just 17 days left before the end of the EU exit transition, sterling is likely to continue to be volatile, while uncertainty persists.

Unpicking the UK-Canada continuity agreement

With the end of the EU exit transition period looming ever closer, the situation for wheat trade is a concern for many. Under the proposed UK general tariff structure, UK importers would be faced with a tariff of £79/t to import wheat below a 14.6% protein.

We have already seen one continuity trade agreement introduce a tariff rate quota (TRQ) for wheat. The Ukrainian continuity trade agreement allows for 136Kt of wheat to be imported with no tariff. You can read more on that deal here.

Last Thursday, the details of the UK-Canada continuity trade agreement were published. Once again this made provision for wheat imports. Under the agreement the UK can import 51.6Kt of low/medium quality wheat from Canada per year from 2021-2023 with zero tariffs. Further to this, the UK-Canada trade deal also allows for a reduction of tariffs on volumes outside the TRQ mentioned above. This is in line with what is agreed in the EU-Canada (CETA) trade deal. As a result, UK tariffs on low/medium quality Canadian wheat will be scaled back by 12.5% per year from 2017 to 2024. This means that there will be no tariff on low/medium Canadian wheat imports by 2024.

With this in mind, from 1 January 2021 the import tariff for Canadian low/medium quality wheat will be equivalent to 37.5% of the UK general tariff of £79/t. This means that volumes of Canadian wheat outside of the new TRQ can effectively be imported through 2021 with an import tariff of £29.63/t. To understand what this truly means we can look at an import parity for Canadian wheat.

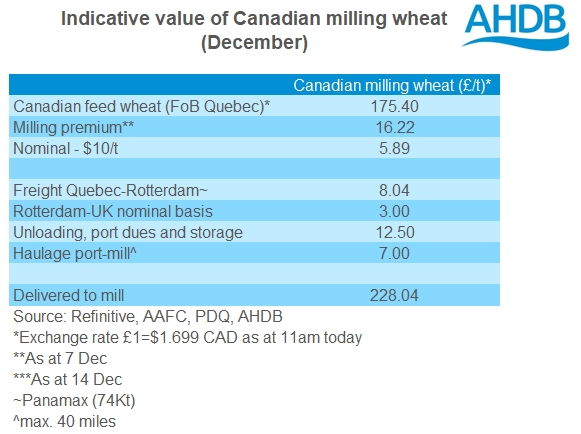

Data is limited for Canadian grain prices. However, for the sake of this analysis, I have calculated an indicative milling wheat price. Using a FoB feed wheat price for Quebec. The Alberta Wheat Commission give the average spread between a 13.5% grade 1 milling wheat and 11.0% grade 2 milling wheat as £16.22/t. With this spread still representing milling wheat grades, I have assumed a further £5.89/t (CAD$10/t) to represent the premium of grade 1 milling wheat over feed wheat. Combining these values with the FoB feed wheat price, would give a Canadian 13.5% Western Red Spring wheat FoB value of £197.50/t.

Taking this a step further and including a freight rate from Sept-Îles in Quebec to Rotterdam of £8/t (Refinitiv), as well as unloading and domestic haulage costs, suggests an indicative value of £228/t delivered to the mill, before a tariff is applied.

This is broadly in line with German milling wheat using a similar calculation method.

So far this season (July-October) the UK has imported 205Kt of Canadian wheat. In the full season last year, the UK imported 440Kt of Canadian origin wheat. While it remains to be seen how much wheat the UK will/can import this season, the calculation of imported Canadian wheat is one that needs watching.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.