Ukraine’s rapeseed key for global market: Grain market daily

Wednesday, 18 May 2022

Market commentary

- UK feed wheat futures (May-22) closed yesterday at £358.50/t, down £2.50/t on Monday’s close. New crop futures (Nov-22) closed yesterday at £351.50/t, down £0.50/t over the same period.

- The domestic new-crop market followed Paris wheat futures (Dec-22) down yesterday. Small losses were likely made on profit taking at such high price levels.

- However, worries about global supplies remain, even though India has announced it would allow overseas wheat shipments awaiting customs clearance.

- Further to that, conditions of the winter wheat crop in the US remain, as Vikki discussed yesterday.

Ukraine’s rapeseed key for global market

In my article last week, I discussed how rapeseed for the next marketing year (2022/23), withstanding any extreme weather events, will likely be in better global supplies. In turn, depending on other oilseeds, this could mean prices may not be as elevated as they have been for the 2021/22 marketing year. Though demand is set to remain strong.

Last week, the USDA released their first new crop (2022/23) World Agricultural Supply and Demand Estimates (WASDE). For rapeseed, this report confirmed that global production will increase 9.1Mt to 80.3Mt. Global consumption too will be up year-on-year (+5.4Mt) to 78.4Mt, and ending stocks are expected to slightly increase (+1.3Mt) to 5.6Mt. Please note ending stocks are still down from the 5-year-average (2017/18-2021/22) at 7.2Mt and the second smallest since 2016/17.

Looking now to Ukraine. Surprisingly, according to the USDA, Ukrainian rapeseed is their only major grain or oilseed that will both A) increase in production and B) increase in exports year-on-year (for 2022/23). Sunflower seed exports are forecast to increase (+400kt) too but their production forested to reduce (-6.5Mt). Barley (-66%), maize (-61%), and wheat (-47%) exports are on average expected to reduce year-on-year by 58%.

Scenario planning for Ukrainian rapeseed

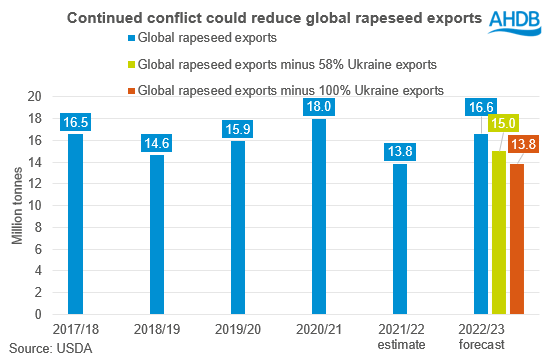

As we know over the last few years a lot in global markets can change in a very short space of time. So, what could happen in different scenarios that part or all of Ukraine’s rapeseed exports are removed from the global market. Important to consider given recent destruction to Ukrainian’s export infrastructure.

Scenario 1 – No further disruption, Ukraine exports all of the intended 2.75Mt to the global market.

Scenario 2 – Ukrainian rapeseed exports reduce by 58% year-on-year, meaning 1.6Mt of rapeseed is removed from global rapeseed exports.

Scenario 3 – An unlikely, but important to understand scenario, 100% of 2.75Mt of rapeseed is removed from global exports for the 2022/23 marketing year.

As the graph above shows, Ukraine’s exports are key to global exports of rapeseed. If all of their rapeseed is removed from global exports, we could see exports drop to 13.8Mt. This would be similar to this year which were down due to major loss to the drought impacted Canadian canola crop.

Although this is hypothetical, it is not impossible. On paper now rapeseed stocks are expected to recover, which in turn may take some steam out of rapeseed prices on harvest. However, Ukraine-Russia news going forward as to how much can be exported from the region, will impact what price you get at the farm gate for your rapeseed.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.