What will happen to rapeseed prices next year? Grain market daily

Tuesday, 10 May 2022

Market commentary

- Old crop UK feed wheat futures (May-22) closed yesterday at £335.30/t, gaining £0.30/t on Friday’s close. New crop futures (Nov-22) closed at £318.05/t, down £0.70/t over the same period.

- New crop domestic market followed Paris wheat futures (Dec-22) down, after dry weather in France fuelled the market at the end of last week.

- New crop Chicago wheat futures also dropped, pressured by recent rainfall in parts of the U.S. Great Plains. On Monday, the U.S Department of Agriculture rated 29% of winter wheat good to excellent condition, up 2% from the previous week.

What will happen to rapeseed prices next year?

Throughout this marketing year, rapeseed prices have been extremely high. Although rapeseed’s trading relationship with other oilseeds has been increasingly disconnected this season, it’s position as the top priced oilseed has been further supported by price increases in other parts of the complex.

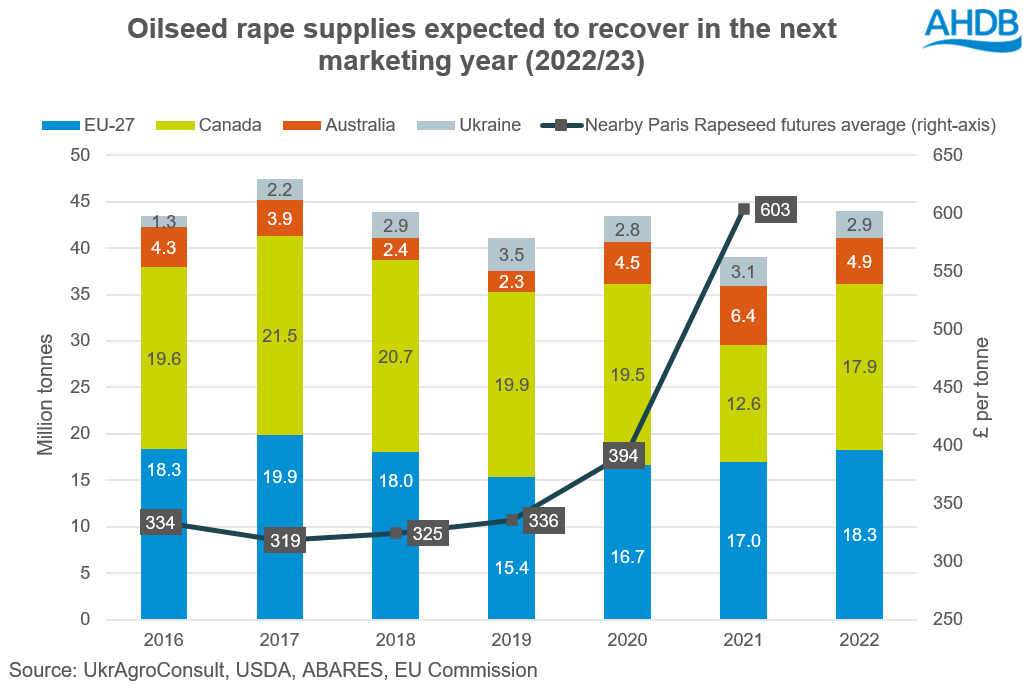

In 2021/22, rapeseed prices were supported by tight global supply, in part driven by the reduced, drought hit Canadian canola (rapeseed) crop. This was back 35% on the year, at 12.6Mt.

This marketing year, inelastic demand for rape oil drove prices as rape oil had unique tastes in food products. The Ukraine war has meant rape oil demand, as a substitute for sun oil, has soared.

The old crop Paris rapeseed futures (May-22) contract expired on 28 April 2022 at £864.80/t. The bullish news (mentioned above) meant that Paris rapeseed prices have averaged £603.00/t in this marketing year (2021/22). This is significantly above 2020/21, which averaged £394.00/t.

With new crop Paris rapeseed futures (Nov-22) closing yesterday at £708.94/t, what does the preliminary supply of rapeseed look like for the 2022/23 marketing year?

A better supply of rapeseed for the next marketing year

So far, planting intentions show the globe is set to be better supplied for rapeseed next year, but this is on paper (please note weather can change this).

Some key supply factors in setting EU continental prices are (which inherently drives domestic growers’ prices):

1) EU-27 production and imports – production in Europe is set to increase next year. Preliminary estimates peg the crop at 18.3Mt, up 8% on last year. Therefore, imports are forecast to reduce to 4.0Mt, down from 4.9Mt last year, easing demand a touch from the EU’s import origins.

2) Canadian production – after last year’s drought-riddled crop, StatsCan estimate seeded area at 8.5Mha for 2022/23, down 7% year-on-year. However, if 5-year-average crop loss (harvested area – seeded area) and yields are taken, this Canadian crop could recover to around 17.9Mt for 2022/23.

3) Ukraine production and exports – UkrAgroConsult predict Ukrainian production at 2.9Mt, down 6% from last year and exports at 2.7Mt, down 1% from last year. In light of current events, there are a lot of unknowns around whether this crop will be exported, particularly in the tonnage and times required by the EU (front loaded in the season).

4) Australian production & exports – Although this crop will not be online till the end of 2022, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) estimate production and exports for 2022/23 at 4.9Mt and 4.0Mt, down 22% and 17% respectively on 2021/22.

All this information mentioned above means that these key areas of the globe are currently estimated to produce 44.0Mt of rapeseed for the 2022/23, up 13% year-on-year. This will be the highest amount of rapeseed produced (by these countries) since 2018.

As the graph shows in years of deficits (such as 2021/22) the average price of Paris rapeseed futures is significantly higher, this increase in production could very well temper recent highs going forward. However, a floor of support could be given if demand remains strong, particularly while sun oil continues to be harder to source,

Conclusion

This increase in production does not necessarily mean prices are going to fall significantly. But, it’s is another macro indicator forecasting that rapeseed supplies are going to increase from last year.

There are a lot of parameters that could change this, such as the weather, Ukraine’s ability to export, a drought-hit Indian crop potentially increasing their import requirements, and other oilseed supplies.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.