UK wheat premiums remaining firm: Grain Market Daily

Friday, 20 November 2020

Market commentary

- Yesterday, May-21 UK feed wheat futures closed at £192.35/t, a gain of just £0.05/t. Weaker sterling helped to support the domestic market, while global (Paris and Chicago) futures fell.

- The Nov-20 contract is still on the board (just!) but both the traded volume and open interest are exceedingly low. As a result, we are seeing some particularly erratic movements. The final trading day for the contract is on Monday.

- Pressure for global wheat markets may start to be seen as the Australian wheat harvest progresses.

UK wheat premiums remaining firm

Over the course of this season the UK market wheat market has been understandably firm. Low production, coupled with global support from the maize market, has resulted in UK feed wheat prices (May-21) continuing to set contract highs.

The support for physical premiums at the moment is seen for both feed wheat over futures and for milling wheat over feed wheat.

Support from rising maize prices

At present, the rally in domestic wheat markets is showing no real sign of slowing down to a material degree. The domestic market has been finely poised and the expectation was that we would have a strong reliance on maize through the first half of the season. Here in lies the first driver of recent price rises.

When maize vessels were booked in the summer months, prices were very competitive. On 28 July, maize priced at £168.53/t delivered to compounders in October.

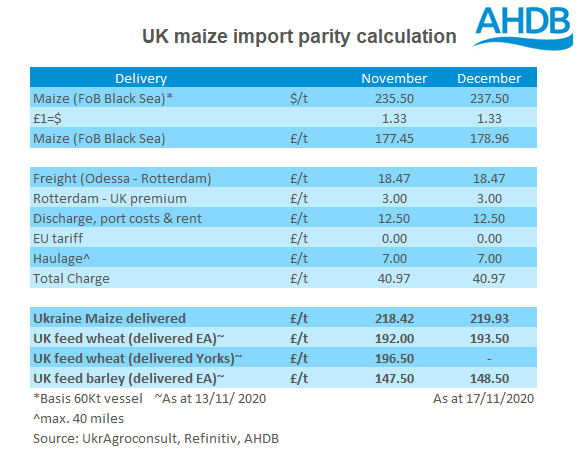

Since then however, maize prices, particularly in the Black Sea, have rallied considerably. The latest import parity calculation suggests Ukrainian maize, delivered in December, is worth £220.00/t. As a result, we have heard anecdotal comments of maize vessels not being loaded / being cash settled.

This changes the demand dynamic for the UK, and has increased short-term demand for feed wheat. With maize prices likely to stay firm until confirmation of South American maize crop sizes, the support for wheat prices looks set to remain.

With challenges for wheat and maize availability, it is likely that UK wheat prices will need to remain firm to attract imports, at least until the end of December. Beyond December the market becomes harder to call, due to the looming Brexit tariffs.

Tight availability of milling wheat

The second driver of firm premiums in the physical market is the availability of milling wheat. While quality this season is “manageable”, overall availability is low again owing to the small domestic wheat crop.

Add into this picture the potential tariff on wheat below 14.6% protein after 31 December 2020, and the carry has extended in the market from pre to post-December. The carry for North West group 1 bread wheat from December to January was quoted at £4.00/t as at 12 November.

One factor to watch as we move through the next couple of weeks is the progress in the Australian wheat harvest. This could remove some support for the underlying futures price.

Look out for our UK delivered wheat prices, published this afternoon, which will give the next indication into direction of the UK physical market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.