Analyst Insight: UK wheat balance on a knife edge for 2020/21

Friday, 23 October 2020

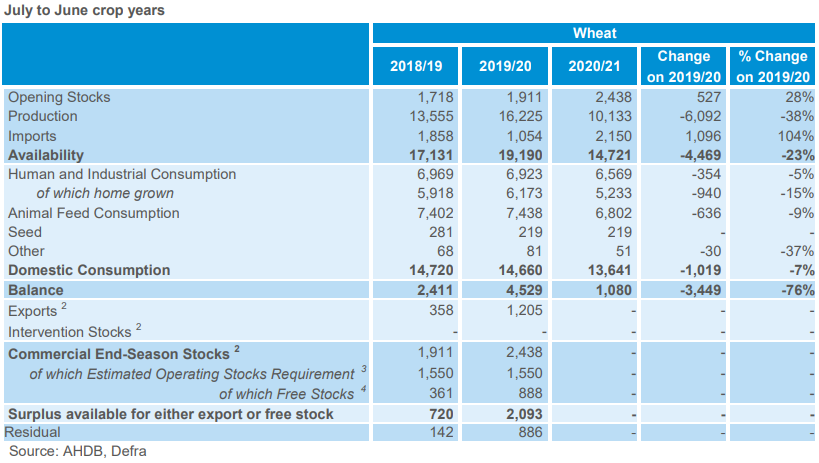

The 2020/21 AHDB early balance sheets were published this morning providing the first look of wheat and barley supply and demand for the season. The wheat balance sheet is set to be the tightest in a number of decades due to a significant drop in total availability outweighing a contraction in usage.

The main driver being the fall in total availability is unquestionably the large drop in wheat output. Defra have provisionally pegged wheat production for 2020 at 6.1Mt down year on year at the lowest level in nearly 40 years at 10.1Mt. Total availability is forecast at 14.7Mt, a substantial 23% decrease on the year.

In terms of usage, the latest estimates show a reduction in total domestic consumption of over 1Mt at 13.6Mt, on the back of reduced bioethanol, starch, distilling and animal feed demand.

This leaves a balance of supply and demand of 1.1Mt, which is nearly 3.5Mt lower year on year. Due to the size of the balance and the nature of this season, an operating stocks or surplus figure have not been estimated for wheat in the early balance sheet. As the current estimates stand, and if an operating stock requirement was estimated, then the balance sheet would show the surplus available for either export or free stock as a deficit.

Imports are already forecast to be more than double that of 2019/20 and if we upped them further to avoid a deficit it would go against industry expectations and the market. Given the substantially lower domestic production and heightened uncertainty in global markets at the moment from the influence of weather and international demand, we do not want to be reporting figures that would cause undue volatility for all businesses in the domestic supply chain.

With such a tight balance sheet, questions start to arise around the validity of the official data used in the estimates. We know that the production figure is provisional at this stage, with opinions in the industry split around whether the figure is too high, too low or about right.

An area which does have a large question mark around in our opinion is the opening stocks forecast. While it is forecast to increase by over 500Kt on the year, it could be argued that there is room for a further rise. As we investigated when the final 2019/20 balance sheet estimates were released at end-September, some of the large residual that was identified for wheat at the end of the season could well be attributed to on-farm stocks, due to the fact the on-farm stocks data has such a large confidence interval.

The first official UK supply and demand estimate is provisionally scheduled to be published on 26 November, which will give estimates for all cereals.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.