UK trade, shifting the balance of domestic S&D? Grain market daily

Wednesday, 25 May 2022

Market commentary

- New crop UK feed wheat futures (Nov-22) closed at £331.20/t yesterday, down £5.00/t on Monday’s close.

- Forecasts of Ukraine’s new crop grain harvest has been raised by APK-Inform. 2022/23 grain exports could reach 39.4Mt, up from 33.2Mt in the previous outlook (APK-Inform). This is down to winter harvest being better-than-expected.

- New crop Chicago maize futures (Dec-22) closed at $285.53/t, down $5.41/t on Monday’s close.

- As outlined in yesterday’s market commentary, maize plantings have progressed by 23 percentage points (pp) last week. The improved planting conditions in the US, along with the news that China will be allowing Brazilian maize imports, poses a potential threat to US exports (Refinitiv).

- New crop Paris rapeseed futures (Nov-22) closed down €4.00/t from Monday’s close at €810.00/t.

UK trade, shifting the balance of domestic S&D?

Tomorrow, the latest 2021/22 UK cereals supply and demand estimates will be published.

Ahead of this, I will be looking at HMRC trade data season-to-date headline figures. With tight domestic grain supply and demand, can an updated view of trade alter this balance?

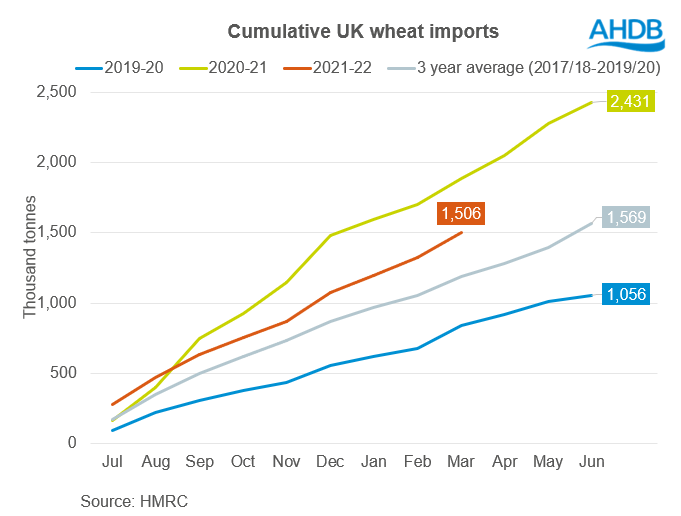

Wheat imports strong

Wheat (including durum) imported season-to-date (July to March) totals 1.51Mt. In March, the HMRC recorded 88.2Kt of wheat arriving from Canada. This brings total Canadian imported wheat this season to 385.2Kt. Consistent imports from the EU continue also.

In the March cereals supply and demand estimates, full season wheat imports were estimated at 1.50Mt. However, since then, global and domestic trading dynamics have changed. As a result, and considering wheat imports have now reached 1.51Mt as explained above, this forecast will likely see an increase.

An outlook for higher wheat imports than originally forecasted could be surprising, considering the tight global supply we find ourselves in.

However, it is important to look at the domestic supply balance. Domestic supply and demand has been tight, with the market understood to be lacking liquidity in domestic wheat selling.

Be sure to look tomorrow at the revised import number and how this may impact on the balance heading into next season.

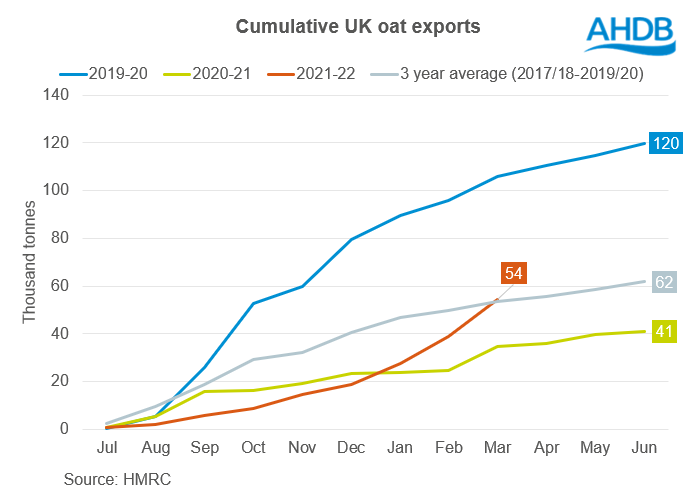

Oat exports, stronger?

Another area I wanted to discuss today is oat exports. In the last forecast, we set oat exports at 100.0Kt due to the price competitiveness of UK oats. Season-to-date HMRC data has recorded that the UK have exported 54.4Kt (July to March), with a pickup in March recording 15.4Kt.

However, according to customs surveillance data, the EU Commission record that they have imported 112.5Kt from the UK up to 23 May.

Therefore, we may see a change in the oat trade forecasts too as a result in tomorrow’s balance sheet release.

Feed grain balance - maize on for a comeback?

Finally, maize imports will be a watchpoint in tomorrow’s update. Considering the current prices for feed wheat and feed barley, maize imports are looking more attractive.

The domestic barley market continues to remain tight, and with wheat and barley at record high prices, maize may look to fulfil some demand.

To conclude

A lot has changed to alter the global supply and demand balance in the past few months, with the outbreak of the war between Russia and Ukraine. As a result, we have seen record prices recorded for global and domestic grain.

As such, we have seen changes in trade dynamics whether this be competitive UK grains being exported or imported grains looking to ease the tight supply picture.

Be sure to look at the UK cereals supply and demand estimates, due to be released tomorrow.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.