Can US old crop soyabeans take more demand? Grain market daily

Tuesday, 24 May 2022

Market commentary

- New crop UK feed wheat futures (Nov-22) closed at £332.50/t, gaining £1.50/t on Friday’s close.

- In its latest MARS report released yesterday, the EU has lowered its forecast of the EU average soft wheat yield to 5.89t/ha, from 5.95t/ha. The report cited that significant rain is required to avoid further losses.

- Exports of palm oil resumed out of Indonesia yesterday. However, Indonesia policy uncertainty means caution is being taken when resuming exports. Further details need to be clarified on how much oil must be reserved for domestic use.

- US planting of maize as at 22 May 2022 is estimated at 72%, up 23 percentage points (pp) from last week, now only 7pp behind the 5-year-average. Soyabean plantings have progressed at pace and are now estimated at 50% complete. This is up 20pp from last week and only 5pp down from the 5-year-average.

- US winter wheat crop condition scores improved slightly on the week with 28% rated good-to-excellent, up 1pp from last week.

Can US old crop soyabeans take more demand?

Since the war between Russia and Ukraine started, oilseed markets have been shaken considerably. From constrained supplies from the Black Sea to a palm oil export ban in Indonesia. This has caused changes in consumption of oilseeds and led to increased demand for other sources such as soyabeans.

Soyabeans are a large market sentiment setter for the oilseed complex. For 2021/22 soyabeans account for 70% of total production of oilseeds (palm kernel, rapeseed, soyabean and sunflower).

Demand for US origin soyabeans has been strong. For this marketing year (Sep 21 – Aug 22) the USDA are estimating that the US will export 58.2Mt of soyabeans, with ending stocks dropping to 6.4Mt, the lowest since 2015/16.

However, the US has currently committed to export 59.2Mt of soyabeans, meaning that their ending stocks could tighten further. China is set to purchase 30.4Mt of this. Up until 12 May 2022 28.1Mt have been exported to China (USDA).

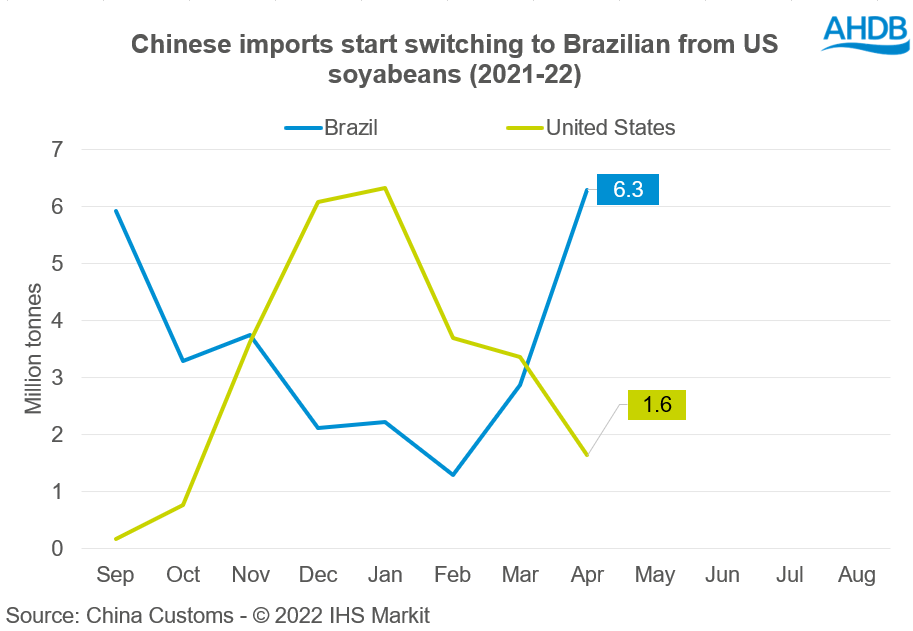

We are approaching the time of year when Chinese demand will switch from US to Brazilian origin. As the chart above shows, in April, China imported 6.3Mt of Brazilian soyabeans, while only 1.6Mt came from the US (IHS Markit).

However, the Brazilian crop coming to market at the moment is estimated at 125Mt, down 10% year-on-year. This crop was initially estimated at a record, but drought over the festive period compromised production estimates. As detailed in yesterday market report, Chinese demand was above expectation for US origin, despite Brazilian supplies coming to market.

This is something to monitor going forward as further demand for US soyabeans could support the oilseed complex, which in turn could support domestic rapeseed prices. Additionally, details of Indonesia’s domestic sales policy need to be realised. A sizable policy could constrain exports of palm oil and lead to increased demand for other oilseeds, such as soyabeans.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.