Arable Market Report - 23 May 2022

Monday, 23 May 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

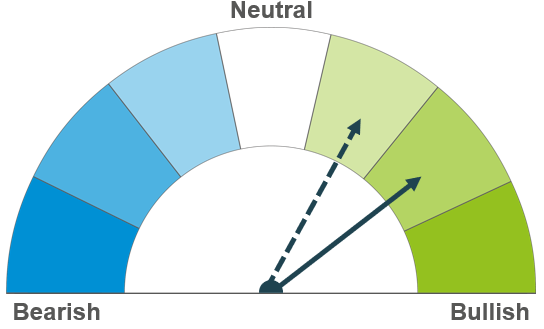

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Fundamental support remains from a tight supply and demand outlook. Prices remain volatile short term, reacting to new news. Longer term, weather remains a watchpoint for harvest 22.

Global maize supply remains tight. Though drier weather has aided US planting progress for harvest 22. Competitiveness to other feed grains, as well as bioethanol margins, will be demand watchpoints going forward.

The global and domestic barley market remains tight. Prices remain supported further by firm wheat and maize prices.

Global grain markets

Global grain futures

Global grains saw another week of high volatility last week. Though prices began to pull back as we headed towards the end of the week, on some profit-taking. A bull market needs new news to keep climbing, especially at such high levels.

Last week, we reported that India had placed a ban on wheat exports to dampen domestic prices. This saw global grain prices rally at the start of the week. Though towards the end of the week, the market understood India may relax these rules to export the 1.8Mt of grain remaining at port.

Also taking the heat out of prices at the end of last week was the news the UN are trying to negotiate sea corridors for shipments of Ukrainian grain. Plus, the outlook for a large Russian harvest 22 wheat crop of 85.0Mt, of which IKAR consultancy forecast 39.0Mt to be exported next season (2022/23).

Last Monday, US winter wheat conditions ‘good’ to ‘excellent’ fell by 2 percentage points (pp) for the week ending 15 May, to 27%. This was back 2 percentage points on the week, falling below trade expectations. Maize planting in this same period jumped up 27pp to 49%. Behind the 5-year average (2017-2021) of 67%. Updated figures are due from the USDA this evening.

French soft wheat conditions were downgraded last week after a hot spell in recent weeks. In conditions to 16 May, FranceAgriMer said 73% of French soft wheat was in ‘good’ or ‘excellent’ condition. Down from 82% the week before. There were also falls to winter barley (-8pp) and spring barley (-7pp) ’good’ to ‘excellent’ crop conditions, to 71% and 69% respectively. Rain is now needed in early June to manage the damage to crops.

Fundamental support remains for global grain prices, though volatility will likely continue as news readjusts the balance of next season’s supply (harvest 22) and demand.

UK focus

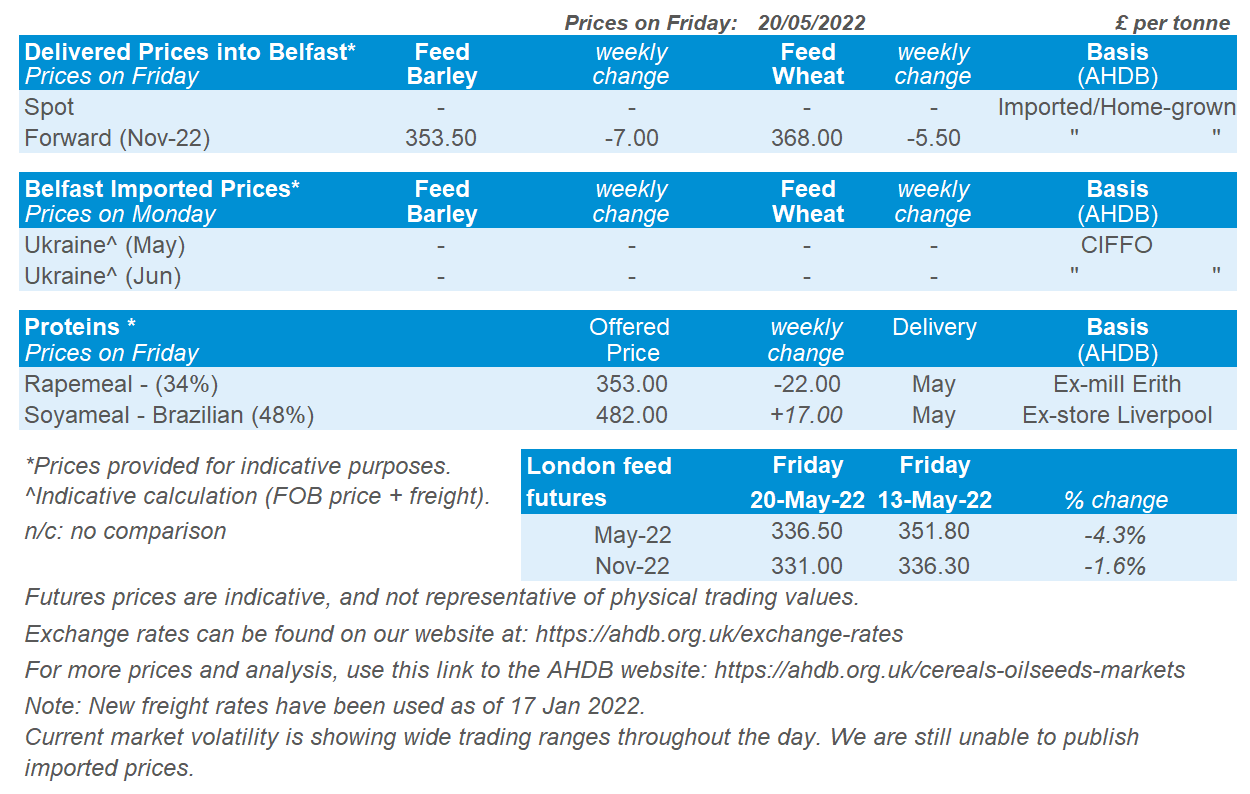

Delivered cereals

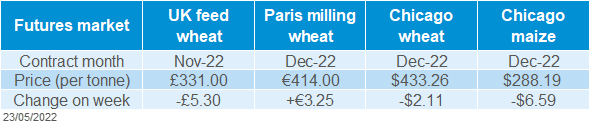

UK feed wheat futures (May-22) closed on Friday at £336.50/t. This is down £15.30/t from last Friday. The new-crop futures (Nov-22) closed on Friday at £331.00/t, down £5.30/t. Though both contracts reached record highs on Monday following the Indian export ban.

New-crop futures have narrowed closely to old-crop prices, falling less week-on-week. The fundamental support remains for next season, considering the war between Russia and Ukraine, and weather issues causing concern to global harvest 22 crop sizes.

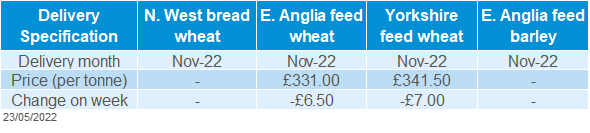

UK delivered prices continue to follow global market movements. East Anglia feed wheat, for Nov-22 delivery, fell £6.50/t last week (Thurs-Thurs) to be quoted at £331.00/t on Thursday.

Bread wheat prices for Nov-22 to London/Essex were quoted at £374.00/t on Thursday.

Last week, two key analysis pieces were produced. The first looking at gross margins for harvests’ 22 and 23. The second piece explored the impact on harvest 2023 from high input costs.

Oilseeds

Rapeseed

Soyabeans

Short-term, old crop rapeseed prices will remain supported until this coming European harvest. Longer-term, the outlook looks better supplied. However, market direction depends on the Ukraine-Russia war and whether this will impact rapeseed/sunflower oil exports out of the Black Sea.

Strong demand for old-crop US soyabeans combined with tightening US ending stocks is supporting the market. Longer-term sizable crops are expected in South America and the US. Focus is currently on US new crop plantings. The latest progress from the USDA is out later today.

Global oilseed markets

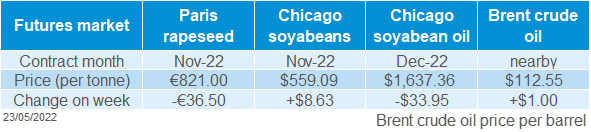

Global oilseed futures

Chicago soyabeans futures (Nov-22) gained 1.57% across the week to close Friday at $559.09/t. Furthermore, across the week commodity funds were net-buyers of Chicago soyabean futures contracts.

Support remains for soyabeans as there is currently strong US export demand for old-crop. In the week ending 12 May, net sales of 752.7Kt of US soyabeans were recorded (USDA). This exceeded trades expectations of 150.0Kt - 500.0Kt (Refinitiv). This is despite US ending stocks for 2021/22 marketing year forecasted to drop to 6.4Mt, the lowest since 2015/16 marketing year. New-crop soyabean sales were above trade expectations, pegged at 149.5Kt.

In other oil related news, Indonesia removed their export ban on palm oil last week. As a result, Malaysian palm oil futures (Aug-22) were pressured by 4.1% (down 260MYR) across the week. Although expected, this has implications for vegetable oil markets which were pressured in line with palm oil. Chicago soy oil futures (Dec-22) were down 2% across the week.

However, since the lift on the ban, Indonesia have imposed a domestic market sales requirement on palm oil to secure a supply of cooking oil. Currently traders and companies are awaiting details on these rules which will aim to control Indonesian domestic cooking oil prices.

Rapeseed focus

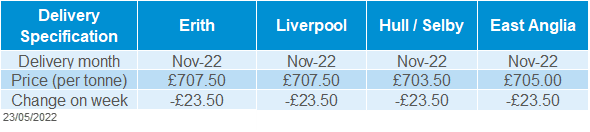

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) closed Friday at €821.00/t, down €36.50/t across the week. Domestically, delivered rapeseed (Into Erith, Hvst-22) was quoted Friday at £701.50/t, down £23.00/t across the week. For the same delivery, November was quoted at £707.50/t, down £23.50/t across the week.

Currently there isn’t any major weather concerns in the Canadian Prairies where canola (rapeseed) plantings are on-going. Forecasts show that in the next week that mean temperatures remain stable, with light rains forecast over the next 7 days in the Canadian prairies.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.