January UK sheep outlook - review

Wednesday, 4 May 2022

In January we published an outlook for the UK sheep sector. Let’s now take another look at it, to see how it’s fairing against more recently available information.

The main points from the outlook were:

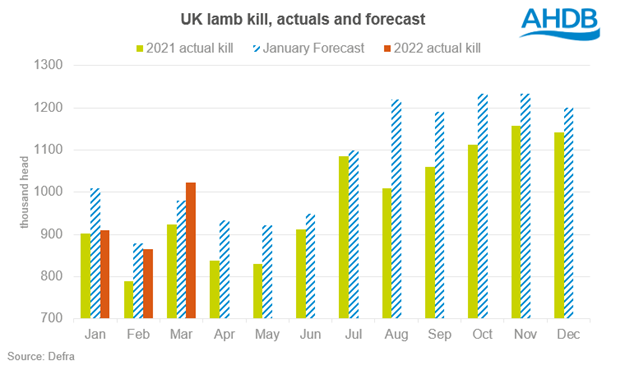

- Increase in number of available lambs to kill in 2022 as we shift away from a pre-Brexit kill pattern. We expect the finished lamb kill to end 2022 11% higher than Defra’s 2021 figures.

- Lamb imports forecast to remain lower as New Zealand continues to pivot towards China, and shipping costs remain high. Imports fall 6% while exports could grow by 5%

- Demand expected to fall 3%, as restrictions ease, and Easter demand improves, but environmental concerns play a role and lamb has lost some ”menu share”

Production

In January we wrote “The number of lambs recorded in the Defra June survey at 1 June 2021 was 16.4 million head, similar to June 2020. Between then and the end of December, 7.5 million of them have been recorded in Defra slaughter statistics, around 600,000 fewer than we would usually expect based upon that size of lamb crop and seasonal kill patterns. It is expected that actual kill was higher than published by Defra, based upon other data sources, market dynamics and industry reports.

Taking all this into account, we forecast the carry-over from 2021 into 2022 to be around 3.9 million head. In addition to this, around 1.8 million new season lambs are forecast to come forwards over the first six-months of the year.”

In the year to 23 April 2022, estimated clean sheep slaughter is 3.40 million head, up 7% from 3.17m at the same point in 2021.

Trade

We only have two months of trade data, showing that total import volumes stood at 9,100 tonnes in the first two months, up 2,300 tonnes (34%) compared to year earlier levels, and exports totalled 10,400 tonnes, up 2,200 tonnes (27%). Much of the increase can be attributed to recovery from last year’s post-Brexit lows. The higher imports largely came from Ireland, which could even be a data error, as that level of increased trade is probably unsustainable. In the first two months, imports from New Zealand were steady on 2021 levels.

Demand

The foodservice market continues to open up, and so consumer demand is shifting towards that, and so away from retail. Retail data for the 12 weeks ending 20 March 2022 compares with a year ago, when more restrictions were in place. As such, primary lamb sales declined by 27% year on year during this period.

However, for the 52 weeks ending 20 March 2022, retail demand was only down 5% compared to 2019. Taking foodservice and retail demand together, in the 52 weeks ending 20 March, demand is likely to be down by around 8% compared to 2021.

Lambing

Indications are that lambing has gone relatively well so far, with many being able to take advantage of the clement weather and turn animals out. Recent widespread rain has been lacking, so while some in the west of the country have already been able to take a first cut of silage, others are hoping for rain to boost grass availability. Having said that, Ruminant Health and Welfare has identified a phase of heightened Schmallenberg Virus (SBV) risk in the UK, launching an online survey to track its development. A report will be produced and shared with the wider industry in early summer, hopefully in time to inform an update to this outlook. On balance, at the moment any material deviation from the forecast UK lamb crop would come as a surprise.

Inputs

The biggest difference in the market compared to when the forecast was made in January, is the price of inputs, already high then, and further pushed up in price by Russia’s invasion of Ukraine. As one of the lower input sectors, it is possible that the impact on sheep meat production will be relatively limited. However, it could affect retention rates of adults later in the year, and the typical profile of lamb slaughter might be advanced too, if forage availability becomes tight.

AHDB has produced a calculator to help graziers decide if the inflated price of fertilizer is worth paying, given the inflated price of bought feed.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.