UK produced AN price fall slowed in April: Grain market daily

Thursday, 18 May 2023

Market commentary

- The Ukrainian export corridor, officially the Black Sea Initiative, was extended for 60 days yesterday. This strengthens the recent bearish sentiment in markets, which Millie covered yesterday.

- As a result, Nov-23 UK feed wheat futures fell £7.25/t over the session yesterday, to close at £190.10/t, its lowest price since February 2022. The Nov-24 contract fell £4.25/t to £195.75/t, the lowest price since the start of this month.

- Paris rapeseed futures also fell heavily. The Nov-23 contract lost €12.75/t to close at €404.50/t yesterday, the lowest level for the contract in nearly two years. Meanwhile, Nov-24 futures fell €5.00/t to €420.00/t, a new contract low.

UK produced AN price fall slowed in April

Spot prices for UK produced Ammonium Nitrate (AN) averaged £439/t in April, down 5% from March, according to latest AHDB data. This is a much smaller price fall than the 26% fall between February and March.

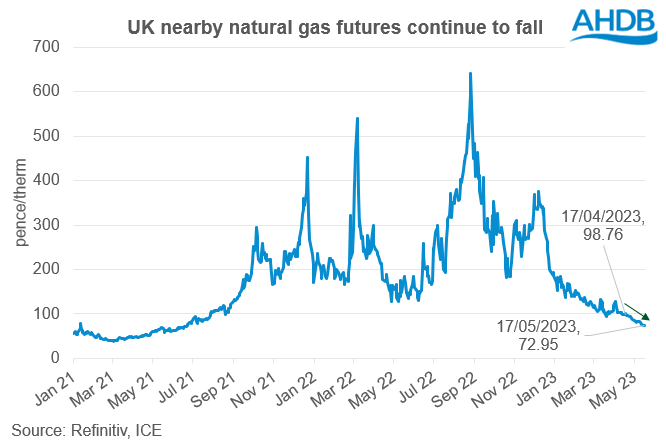

For several months now, fertiliser prices have followed the downward move in natural gas prices, which continue to fall.

Nearby UK natural gas futures prices are now around 73 pence per therm. This is down from last month and a long way down from the peak last August. But, natural gas prices are still above the levels from two years ago, when they were around 50-60 pence per therm.

Could prices fall further?

Warmer weather across Europe is reducing demand for natural gas for heating, which could help reduce prices further in the short term. Plus, natural gas stores are fuller than average for the time of year across Europe (Gas Infrastructure Europe).

But there’s an increasing number of reports questioning if natural gas prices could start to rise again in the months ahead. These are some of the reasons:

- Forecasts of a warmer than average summer in the US, which would mean more demand is needed for energy for cooling e.g. air conditioning. In turn, this would mean higher demand for natural gas and potentially higher US prices. The US is a major producer of natural gas so US gas prices by default affect European ones. However, the affect is now amplified as since the drop in Russian gas supplies, Europe is reliant on tankers of liquefied natural gas or LNG. The US is a key supplier of LNG.

- Also, the US gas ‘rig count’ has fallen to its lowest since April 2022 (Baker Hughes via Refinitiv). This follows recent price falls. The count is an early indicator of future production so could mean US natural gas production reduces in the months ahead, which could also push up prices.

- Europe is increasing its natural gas storage capacity and will want to fill these stores as we head towards autumn, meaning extra demand.

Against this, currently US stocks of natural gas are high after a mild winter. These will cushion any smaller increases in demand or falls in production.

Also, Asia is a big competitor for LNG supplies. Like here and in the US, demand is influenced by adverse weather, either hotter or colder than average, and economic growth. El Niño weather events can bring extreme weather to parts of the US and Asia and an EL Niño is forecast to develop later this year. Meanwhile, economic growth in China is currently unclear. But, either stronger economic growth in China or adverse weather, would mean higher competition for the LNG we now rely on.

In terms of what this means for fertiliser prices, it is likely that AN prices will continue to track the most recent downward movements in natural gas markets in the short term. However, with volatility likely to remain in natural gas markets, with the potential for increased global demand for LNG, this will likely have an impact on fertiliser prices going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.