UK Pork Outlook: how have slaughter levels played out so far?

Thursday, 29 April 2021

By Bethan Wilkins

In the January Pork Market Outlook, we forecast a sharp rise in UK pig meat production in the first half of this year. We expected this to translate into lower import volumes, especially while the foodservice industry remained closed. Exports were anticipated to be lower as well, with lower Chinese import demand and disruption exporting to the EU.

For the first quarter of the year, pig meat production volumes have indeed been higher and trade volumes have been lower than in 2020. However, the trends have been stronger than we expected. Here, we take a closer look at what happened and explore possible reasons why.

Clean pig slaughter

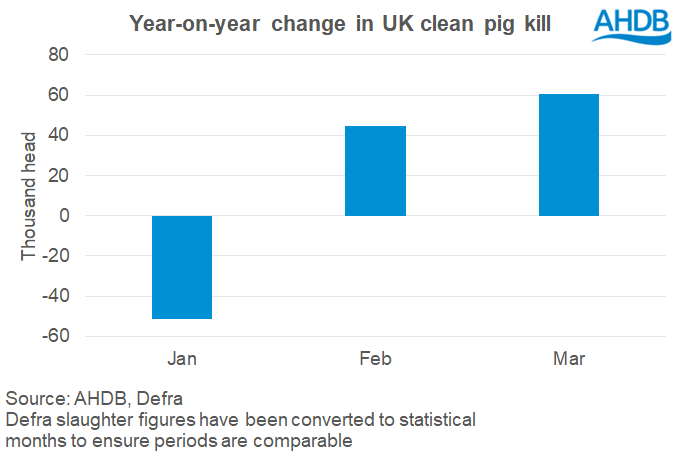

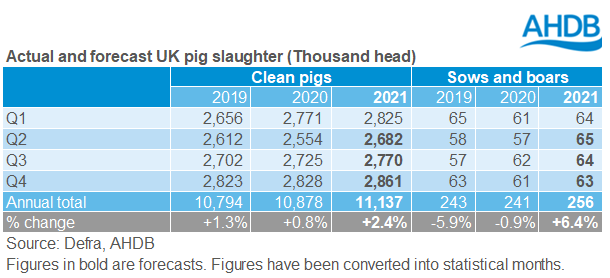

In the January forecast, we anticipated that UK clean pig slaughter for 2021 overall would rise by 3% from last year to stand at about 11.2 million head. This was largely due to expectations of high slaughter levels during Q2. Volumes at the start of 2020 were expected to be more similar to 2020, reflecting the fact we’d anticipated that processing capacity would remain a constraint early in the year.

Clean pig slaughter in Q1 was actually 1% higher than forecast, at 2.83 million head. This was 2% above year earlier levels.

The backlog of market-ready pigs waiting on farms that developed in late 2020 has influenced the higher pig slaughter levels. Many of these pigs have come through earlier than we previously expected. This means Q2 slaughter is likely to be lower than we previously forecast, as it now seems progress on the backlog was made in March. Rising pig prices also support this view.

It also seems that breeding herd performance was lower than expected in late 2020. The latest data from Agrosoft now indicates that the number of pigs weaned per sow per year in Q4 2020 was lower than Q4 2019. This would also have helped clear the backlog and again suggests finished pig supplies are likely to be tighter than we had expected in Q2.

Sow and boar slaughter

Adult pig slaughter was up by 4% on 2020 levels between January and March, at 64,000 head. Sow cullings were lower than expected last year due to some logistical challenges and so we expected an increase in 2021. Slaughter has not been quite has high as our expectations so far, primarily due to difficulties exporting the carcases to the continent in January, which supressed throughput. COVID-related difficulties may continue to limit demand for UK sows on the continent.

Pig meat production

We had forecast pig meat production in 2021 overall to rise by 4% to 1.02 million tonnes, reflecting higher kill levels and elevated carcase weights. It’s still early days, but so far both clean pig slaughter and carcase weights have run ahead of expectations. In Q1, pig meat production was 6% higher than last year at 263,000 tonnes, 2% higher than our original forecast for this quarter of 258,000 tonnes.

Trade

Imports

In the January forecast, imports were forecast to decline by 8% this year, driven by lower domestic demand as well as stronger domestic supply availability. The HMRC data suggests that imports have fallen by about 28% across January and February, totalling 108,000 tonnes (carcase weight equivalent).

The decline is clearly much larger than forecast. Although disruption related to leaving the EU likely affected shipments, this may also have affected reporting and so we urge caution over interpreting these figures for now. Nonetheless, export data from the EU27 for January also suggests a 26% decline in product being sent to the UK, so it does seem that a sharp drop in imports is reflective of reality, at least right at the start of the year. It seems that even though changes to import protocols from the EU have not been fully implemented yet, trade has still fallen, perhaps influenced by previous stockpiling efforts. This might mean the decline becomes less noticeable in the coming months, though there may be difficulties when import protocols change in several months’ time.

Exports

In recent years, the level of Asian demand has heavily influenced exports. In January, we anticipated a 7% decline in exports this year, with the level of global demand falling. We also thought the decline was likely to be sharper than this early in 2020, due to disruption in exporting to the EU. Across January and February, the HMRC data suggests that pig meat exports totalled only 26,300 tonnes (carcase weight equivalent- therefore excluding offal), a substantial 42% less than a year earlier.

The method of reporting exports to the EU has changed, so export figures from January 2021 onwards are not entirely comparable with previous numbers. Again, we also urge caution over interpreting the numbers, in case there are revisions in subsequent months. However, EU27 data for imports from the UK shows a similar decline to that seen in our export numbers during January. So, it does seem there was a real and noticeable drop in export volumes early this year. Considering the logistical changes and challenges supplying the EU that were widely reported at the time, this is not entirely surprising. It remains to be seen the extent to which these difficulties have subsequently been overcome.

Consumption

New supplies of pig meat available for consumption in the UK were 6% lower than year earlier levels across January and February, at 259,000 tonnes (carcase weight equivalent). We had expected volumes to be similar to 2020 in the January forecast. However, although production was a little higher than expected and exports were lower, this was more than counteracted by the lower imports.

Despite the drop in new supply availability, the latest estimates for retail and foodservice consumption suggest that the amount of pig meat sold in the 12 weeks to 21 March was similar to last year (AHDB estimates based on Kantar data). Volumes were actually above 2020 during January and February but dropped back in March, which last year saw large retail sales due to panic buying. This would mean that product has come out of storage to supply the market, which would make sense if there had been stockpiling before we left the EU customs union, which we think was the case.

Now the backlog of live pigs on farms has diminished, a tighter supply of both pigs and pork ought to be supportive for prices. Of course, this will depend on how demand holds up over the coming weeks. The reopening of eating-out outlets may well take some of the shine off demand for British pork, which is typically better represented in retail outlets.

What does this mean for the outlook?

With the backlog clearing earlier than expected and physical performance below anticipated levels, pigs are not expected to come forward at the rate we had previously forecast in Q2. This means pig slaughter will likely be below forecast levels in the coming weeks, though may well remain above 2020 levels as slaughter was particularly low at this time last year. In 2020, some pigs were pulled forward when the pandemic first escalated, which subsequently reduced supplies available later in the spring. Downside risks are also present for the second half of the year, depending on how herd performance has subsequently developed.

We have adjusted the Q2 slaughter forecast downward to take account of the actual developments in Q1:

There remains uncertainty around the outlook for international trade, especially considering the difficulties with interpreting the data at present. There is certainly the potential for exports to the EU to remain somewhat challenging, and if production volumes are lower than forecast this would also be a downside risk. On the other hand, import demand from Asia may be better than we had previously forecast, as African Swine Fever remains a significant challenge there. This could help support overall volumes in the coming months.

On the import side, it seems reasonable to expect some recovery in volumes relative to the first few months of the year, which may start to bring numbers back in line with the forecast. Demand levels in the UK will influence this trend, and recovering foodservice activity may support import volumes even if overall pig meat demand is unable to sustain the recent sales growth. In general, overall pork demand is still not expected to hold on to gains made in 2020, which were bolstered by panic buying early in the pandemic.

A full new forecast for UK pig meat production and trade will be released in July.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.